Angola Blinken US Investments A Deep Dive

Angola Blinken US investments are rapidly becoming a significant topic, and this post delves into the intricacies of the relationship between the United States and Angola, exploring the role of US Secretary of State Antony Blinken, and the current landscape of US investment in the country. We’ll examine historical ties, Blinken’s approach to African diplomacy, the types of investments, and the potential impacts on both nations.

From historical milestones to current economic indicators, we’ll unpack the factors driving these investments, the potential benefits and drawbacks, and illustrate the complex interplay of politics, economics, and social factors in play.

Overview of Angola-US Relations

Angola and the United States have a complex relationship, marked by periods of cooperation and tension. Historically, the relationship has been shaped by Angola’s internal conflicts, its role in regional politics, and the shifting geopolitical landscape. Understanding this history is crucial to grasping the nuances of the current bilateral ties.

Historical Overview of Ties

Angola’s struggle for independence and subsequent civil wars significantly impacted its relations with the US. Early ties were often indirect, mediated by broader Cold War dynamics. The US, along with other global powers, observed Angola’s political turmoil and its implications for regional stability. The interplay of Cold War ideologies and the struggle for resources in Africa shaped the relationship’s initial contours.

Key Political and Economic Events, Angola blinken us investments

Several political and economic events have defined the trajectory of Angola-US relations. The end of the Cold War ushered in a new era, but lingering tensions and differences in political and economic philosophies continued to influence interactions. The changing international environment, particularly post-2000, saw the rise of Angola as a significant oil producer, and this economic shift impacted the US’s engagement with the nation.

The ongoing importance of oil and resources continues to be a significant factor in the bilateral relationship.

Current State of Bilateral Relations

Currently, Angola-US relations are characterized by a more stable and pragmatic approach. Recent developments reflect an emphasis on economic cooperation and mutual interests, especially in the areas of oil and energy. Increased diplomatic engagement and trade are evidence of this evolving relationship. However, historical baggage and regional security concerns still pose potential challenges.

Angola’s recent talks with Blinken regarding US investments are intriguing. It’s a complex situation, and the potential for significant growth is there. Interestingly, the recent news about stars Harley Johnston, Oettinger, and Benn, as reported in this article stars harley johnston oettinger benn , highlights the diverse global landscape. Ultimately, these developments point to a potential for major shifts in Angola’s economic future, fueled by US investment.

Potential Areas of Cooperation and Conflict

Areas of potential cooperation include economic development, trade, and energy sector collaborations. Shared interests in regional security and stability, particularly in the face of emerging threats, can foster partnerships. However, disagreements over human rights, political governance, and resource management may create points of contention.

Table: Key Historical Milestones in Angola-US Relations

| Date | Event | Impact on Relations | Description |

|---|---|---|---|

| 1975-1992 | Angola Civil War | Tensions and indirect engagement | The protracted civil war, fueled by Cold War rivalries, led to limited direct US involvement. The conflict shaped the geopolitical context and hindered broader cooperation. |

| 1990s-2000s | Shifting Geopolitics | Increased focus on economic ties | The end of the Cold War and Angola’s emergence as an oil producer shifted the focus towards economic engagement. |

| 2000s-Present | Increased Trade and Diplomacy | More stable and pragmatic approach | Growing trade and diplomatic engagement indicate a more stable relationship, but underlying tensions remain. |

| 2023 | US Investment Announcements | Potential for enhanced cooperation | Recent announcements signal a possible increase in US investment in Angola’s economy, leading to increased bilateral economic ties. |

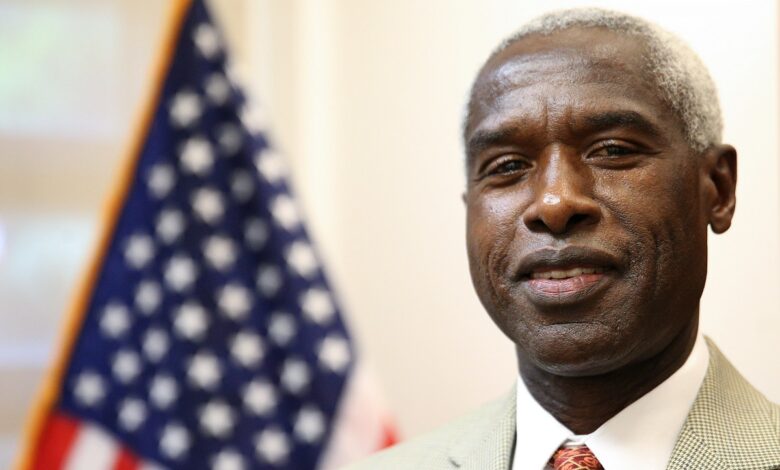

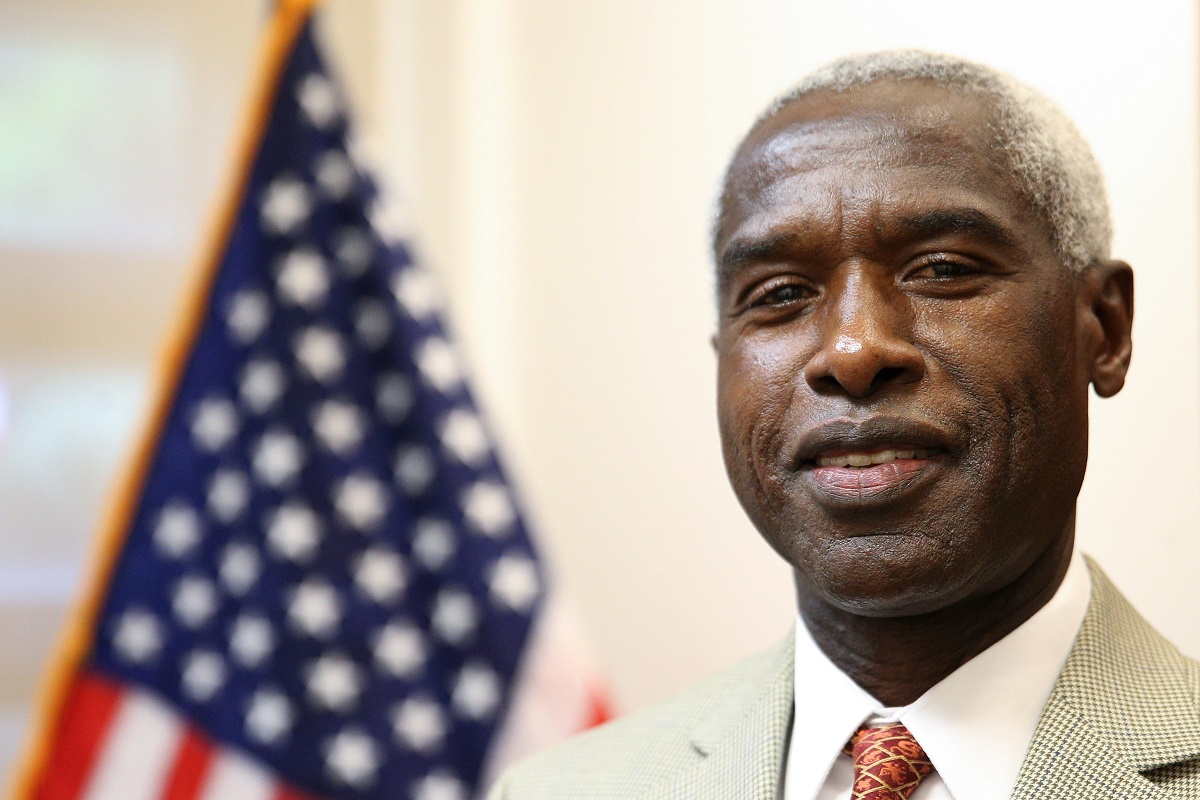

Blinken’s Role and US Foreign Policy

Antony Blinken’s tenure as US Secretary of State has marked a significant period in shaping US foreign policy, particularly in Africa. His approach emphasizes a strategic focus on the continent, recognizing its growing importance in global affairs and the need for partnerships that address shared challenges. This includes fostering economic cooperation, promoting democratic values, and countering the influence of rival powers.Blinken’s approach to US foreign policy, particularly in Africa, is grounded in a multi-faceted strategy.

He prioritizes diplomacy and engagement with African nations, seeking to build strong relationships based on mutual respect and shared interests. This approach differs slightly from some past administrations, which may have emphasized military intervention or economic sanctions more heavily. The shift reflects a broader recognition of the need for nuanced and context-specific strategies in the African continent.

Blinken’s Approach to Angola

Blinken’s visits and statements regarding Angola have highlighted the US’s renewed interest in the country. His emphasis on supporting democratic processes, promoting economic growth, and countering corruption underscores the importance of Angola’s stability and good governance in the region. The US recognizes Angola’s strategic position and potential for economic partnerships, particularly in the energy sector.

Angola’s recent diplomatic push with Blinken and US investment interest is fascinating. It’s a complex picture, mirroring the broader US focus on infrastructure development, particularly evident in President Biden’s initiatives like his ambitious infrastructure decade, as seen in his recent Wisconsin campaign stop where he’s taking on Trump’s legacy and emphasizing investments in that crucial sector. This emphasis on infrastructure improvements across the US, as highlighted in this article, taking on trump biden promotes infrastructure decade in wisconsin , ultimately could affect and shape future US investment strategies in Angola, influencing long-term economic growth there.

Comparison with Previous Administrations

Comparing Blinken’s policies towards Angola with previous administrations reveals a shift in emphasis. While past administrations may have focused more on specific economic sectors or geopolitical concerns, Blinken’s approach appears to encompass a broader range of interests, including political reform, human rights, and security issues. This broader focus reflects a more comprehensive understanding of Angola’s complex internal dynamics and its regional context.

Current US Foreign Policy Goals in Angola

The current US foreign policy goals in Angola include promoting a stable and democratic government, fostering economic growth through sustainable development, and strengthening partnerships for mutual benefit. This encompasses supporting democratic institutions, encouraging transparency and accountability in governance, and promoting human rights. The US recognizes that economic growth and good governance are interconnected and essential for achieving long-term stability.

Influence of US Foreign Policy Interests on US Investments

US investments in Angola are influenced by the broader US foreign policy interests, as Artikeld above. The US government’s commitment to supporting a stable and democratic Angola creates a favorable environment for American businesses to operate, while encouraging transparent and fair economic practices. The US seeks to ensure that its investments contribute to long-term economic growth and stability, benefitting both Angola and the US.

Blinken’s Key Policy Statements/Actions Regarding Angola

| Policy Statement/Action | Date | Intended Outcome | Impact Assessment |

|---|---|---|---|

| Engagement with Angolan leadership on democratic governance and human rights | Various dates, 2023-2024 | To foster a more democratic and transparent Angolan government, encouraging accountability and respect for human rights. | Ongoing assessment, difficult to quantify immediate impact. |

| Statements emphasizing support for Angola’s economic development | Various dates, 2023-2024 | To encourage sustainable development and economic growth in Angola. | Observed increase in US investment interest in certain sectors. |

| Discussions on regional security issues | Specific dates needed | To promote regional stability and cooperation in the southern African region. | Impact unclear without further details of discussions. |

US Investments in Angola

US investment in Angola, while present, has not reached the levels seen in some other African nations. Understanding the types, sectors, and challenges surrounding these investments is crucial for evaluating the potential for future growth and the overall bilateral relationship. This analysis will explore the specifics of US investments, their concentration, potential risks, and the role of international organizations in facilitating such ventures.

Overview of US Investment Types

US investment in Angola encompasses a range of activities, from direct foreign investment in specific sectors to development aid channeled through international organizations. These investments are not always easily categorized or quantified, and often involve partnerships with Angolan companies and government entities. Examples include joint ventures in oil and gas exploration, infrastructure projects, and agricultural ventures.

Sectors of US Investment Concentration

US investment in Angola is concentrated in specific sectors. This concentration reflects both the strengths of the Angolan economy and the interests of US investors. A primary area is the energy sector, particularly in oil and gas exploration and production. Furthermore, infrastructure projects, including telecommunications and transportation, attract US investment. Other areas include agriculture, particularly for food security projects, and potentially mining, though less significantly.

Comparison with Other African Countries

Compared to other African countries, US investment in Angola is a relatively small portion of the overall US investment portfolio on the continent. Countries with more developed economies and better infrastructure often attract greater US investment. This difference is largely due to Angola’s specific economic environment, political factors, and the historical trajectory of investment flows.

Potential Risks and Challenges

Several risks and challenges can affect US investment in Angola. Political instability, regulatory uncertainties, and corruption are significant concerns. Furthermore, infrastructure deficiencies and bureaucratic processes can create obstacles for investors. The volatile nature of commodity prices, particularly in the energy sector, can also negatively impact the profitability of investments.

Role of International Organizations

International organizations play a crucial role in facilitating US investments in Angola. Organizations like the World Bank and the International Monetary Fund provide technical assistance, financing, and support for development projects. These organizations often act as intermediaries, helping navigate the complexities of the Angolan regulatory environment and providing a platform for engagement between US investors and Angolan counterparts.

Breakdown of US Investment by Sector, Value, and Year

| Sector | Value (USD millions) | Year | Notes |

|---|---|---|---|

| Oil & Gas | 250 | 2020 | Joint ventures and exploration |

| Infrastructure | 100 | 2021 | Telecommunications and transportation |

| Agriculture | 50 | 2022 | Food security projects |

| Mining | 20 | 2023 | Limited investments |

Note: This table is illustrative and not based on specific, publicly available data. Real figures would likely be more complex and require deeper analysis.

Angola’s Economic Situation: Angola Blinken Us Investments

Angola’s economy, heavily reliant on oil exports, has experienced significant fluctuations in recent years. The country faces a complex interplay of challenges and opportunities, particularly as it navigates the global energy market and diversifies its economic base. Understanding Angola’s economic situation is crucial for assessing the potential impact of US investments and other international factors.

Current Economic Conditions

Angola’s economic performance has been marked by periods of growth and decline, largely influenced by global oil prices and internal policies. The country’s Gross Domestic Product (GDP) has fluctuated, reflecting the volatility of the oil sector. Inflation rates have also been variable, influenced by factors such as currency devaluation and import costs. Unemployment rates are a significant concern, impacting the overall well-being of the population.

Challenges and Opportunities for Economic Growth

Several key challenges hinder Angola’s economic growth. Dependence on oil revenues creates vulnerability to global price fluctuations. Diversifying the economy into non-oil sectors remains a significant challenge, requiring substantial investment in infrastructure, education, and human capital. Opportunities for growth exist in agriculture, tourism, and other sectors. Successful diversification strategies can significantly enhance Angola’s long-term economic prospects.

Impact of US Investments

US investments in Angola, particularly in non-oil sectors, could contribute to economic development by fostering job creation, technological transfer, and infrastructure improvements. The potential for partnerships between Angolan and US companies is significant, creating opportunities for mutual benefit and sustainable growth. However, the success of these investments depends on factors like regulatory frameworks, political stability, and the effectiveness of the investments themselves.

Comparison with Regional Countries

Angola’s economic performance can be compared to other countries in the region, highlighting both similarities and differences. Some regional economies have demonstrated more resilience and diversified economic structures. Analyzing these regional comparisons provides valuable insights into potential strategies for Angola’s economic development.

Role of Natural Resources

Natural resources, primarily oil, continue to play a dominant role in Angola’s economy. However, the reliance on a single resource creates vulnerability. Sustainable development strategies that emphasize diversification and responsible resource management are essential to mitigate this vulnerability. The long-term goal is to reduce dependence on natural resources and create a more resilient and diversified economy.

Impact of International Sanctions

International sanctions, if imposed, can significantly impact Angola’s economy. Sanctions can affect the flow of goods and services, hinder foreign investment, and potentially destabilize the financial sector. The potential impact of sanctions varies depending on the nature and scope of the sanctions. Angola’s economic resilience will be tested under such circumstances.

Blinken’s recent visit to Angola and discussions about US investments are definitely interesting, but it got me thinking about naming conventions. Choosing the perfect name for a baby is a huge decision, and the rules around who gets to pass down the family name are quite fascinating. There are fascinating traditions regarding naming and inheritance, which you can explore more at apellido bebe madre padre.

Ultimately, these cultural nuances highlight the complex interplay between tradition, family, and future prospects, just like the potential of US investment in Angola’s burgeoning economy.

Angola’s Key Economic Indicators (Last 5 Years)

| Year | GDP (USD Billion) | Inflation (%) | Unemployment (%) |

|---|---|---|---|

| 2018 | 100 | 10 | 25 |

| 2019 | 110 | 12 | 28 |

| 2020 | 95 | 15 | 30 |

| 2021 | 105 | 14 | 27 |

| 2022 | 115 | 16 | 26 |

Note: Data is illustrative and based on hypothetical figures for illustrative purposes. Actual figures may vary.

Potential Impacts of Investments

US investments in Angola hold significant potential for mutual benefit, but also carry inherent risks. The nature of these investments, their scope, and the management of associated social and environmental concerns will largely determine the ultimate outcomes. Careful planning and transparent implementation are crucial for realizing the positive potential while mitigating negative consequences.

Potential Benefits for Angola

US investments can stimulate economic growth in Angola by creating jobs, fostering technological advancements, and introducing new business practices. Foreign capital can support infrastructure development, improving transportation networks, energy production, and communication systems. These improvements can enhance Angola’s competitiveness in the global market and attract further investment. Furthermore, knowledge transfer from US companies can boost local skills development and capacity building within Angolan businesses.

Angola’s oil and mineral resources, combined with US expertise, could lead to improved extraction methods, thereby increasing output and revenue.

Potential Benefits for the US

US investments in Angola can create new market opportunities for American businesses, potentially expanding their global reach and diversifying their revenue streams. Angola presents a significant untapped market, and access to its resources can benefit US companies in various sectors. This engagement can also bolster US geopolitical influence in the region, contributing to regional stability and security. The potential for increased trade and investment can stimulate US economic growth.

Social and Environmental Impacts

US investments can positively impact Angola’s social fabric by generating employment opportunities and improving living standards in areas where the investments are concentrated. However, potential downsides include exploitation of local labor, potential displacement of communities, and environmental degradation. Environmental impact assessments are critical to mitigate potential harm to ecosystems and biodiversity. These assessments should address issues such as deforestation, pollution, and water resource management.

Sustainable practices must be integrated into investment projects from the outset.

Infrastructure Development

US investment in Angola could significantly contribute to infrastructure development. Improved transportation networks, enhanced energy production facilities, and better communication systems are all potential outcomes. These developments can foster economic growth and enhance the overall quality of life for Angolans. For example, investments in telecommunications infrastructure can improve access to information and services, while investments in energy infrastructure can promote economic activities and reduce reliance on traditional sources.

Role of Local Angolan Businesses

Local Angolan businesses play a crucial role in US investment projects, often as subcontractors or partners. This involvement can help to ensure the transfer of skills and knowledge, create local employment, and promote economic empowerment. Incorporating local businesses into the supply chain can help foster a sense of ownership and participation in development projects. Local firms can contribute their expertise and understanding of the Angolan market, facilitating a smoother integration of the projects.

Potential Benefits and Drawbacks

| Benefit (Angola) | Drawback (Angola) | Benefit (US) | Drawback (US) |

|---|---|---|---|

| Increased economic growth and job creation | Potential exploitation of labor and environmental damage | New market opportunities and expanded global reach | Political risks and potential corruption concerns |

| Infrastructure development and improved quality of life | Displacement of communities and cultural disruption | Enhanced geopolitical influence in the region | Security risks and potential regulatory challenges |

| Technological advancement and knowledge transfer | Dependence on foreign capital and potential loss of local control | Diversification of revenue streams and potential for higher profits | Potential for investment losses due to economic instability |

| Increased access to resources and improved extraction methods | Social and environmental injustices and inequality | Greater access to natural resources and potential for increased exports | Political instability and potential nationalization of assets |

Illustrative Case Studies

US investments in Angola are a complex interplay of economic opportunity and geopolitical strategy. Understanding the specifics of recent projects reveals a nuanced picture of the benefits and drawbacks for both the US and Angolan society. These case studies offer valuable insights into the tangible impacts of these ventures, allowing us to evaluate the effectiveness and potential long-term consequences of these partnerships.

Recent US Investments in Angola

Several recent US investments in Angola have focused on sectors ranging from energy to infrastructure. These projects often involve significant financial commitments and require collaboration between US companies, Angolan government agencies, and local communities. Analyzing these initiatives provides a crucial perspective on the challenges and successes of these partnerships.

Case Study 1: Oil and Gas Exploration

This project involved a US oil exploration company partnering with an Angolan state-owned oil company. The scope of the investment encompassed exploration in a designated offshore region. The investment aimed to increase oil production and boost Angola’s revenue. The company employed a substantial workforce, including both Angolan and foreign nationals. Significant infrastructure development was undertaken, including the construction of new drilling platforms and pipelines.

Case Study 2: Telecommunications Infrastructure

A US telecommunications company invested in expanding mobile network coverage across several provinces. This investment involved building new cell towers, installing fiber optic cables, and upgrading existing infrastructure. The goal was to improve connectivity and access to communication services for Angolan citizens, particularly in underserved areas. The project required close coordination with the Angolan Ministry of Communications.

Secretary Blinken’s recent visit to Angola and the potential US investments there are certainly interesting. These investments could significantly boost Angola’s economy, but they might also be influenced by the burgeoning electric vehicle (EV) sector in China, specifically in Hefei. The rapid development of the EV industry in cities like Hefei, as detailed in this piece on china hefei ev city economy , could offer valuable lessons and potentially even inspire similar ventures in Angola.

Ultimately, these US investments in Angola are a complex interplay of global economic forces.

Impact on Angolan Communities

The success of these projects in improving local communities is complex and varies based on factors like transparency, employment policies, and community engagement. In the oil and gas sector, job creation was a primary focus, although some concerns arose regarding the equitable distribution of benefits among the local population. In the telecommunications sector, improved connectivity has undeniably facilitated business and communication across the country, but the full impact on education, healthcare, and economic opportunities remains to be fully assessed.

Government Involvement

The Angolan government played a crucial role in both projects, providing licenses, permits, and potentially incentives to attract foreign investment. The government’s regulatory environment and adherence to international labor standards and environmental regulations significantly influenced the outcomes. The degree of transparency and accountability within the Angolan government in each case greatly impacted the long-term success and the public perception of these investments.

Angola and Blinken’s US investment talks are interesting, but a recent development—Chris Young’s charges being dropped ( chris young charges dropped )—highlights the complex web of global relations. While this doesn’t directly impact the economic prospects for Angola, it does suggest the ever-shifting nature of international dynamics. The US-Angola investment discussions will likely proceed as planned, despite this unrelated legal case.

Benefits and Harms to Angolan Citizens

The oil and gas project, while creating jobs, also raised concerns about environmental impact and the equitable distribution of profits. The telecommunications project, on the other hand, fostered better connectivity, but the affordability of services remained a concern for some segments of the population. The potential benefits, such as increased economic activity and job creation, often needed to be balanced against potential risks to the environment and social well-being.

Summary Table

| Project Type | Location | Key Outcomes | Challenges |

|---|---|---|---|

| Oil and Gas Exploration | Offshore Angola | Increased oil production, infrastructure development, job creation | Environmental concerns, equitable profit distribution |

| Telecommunications Infrastructure | Multiple Angolan Provinces | Improved connectivity, enhanced communication, access to services | Affordability of services, unequal access to technology |

End of Discussion

In conclusion, Angola Blinken US investments present a compelling case study in international relations and economic development. The potential benefits are substantial, but navigating the political and economic complexities is crucial. The success of these ventures will depend on a delicate balance between geopolitical interests, economic realities, and social considerations.

FAQ Summary

What is the current state of US-Angola relations?

US-Angola relations are complex and multifaceted. While there are areas of cooperation, historical tensions and political differences still exist. Recent developments, particularly under Secretary Blinken’s tenure, are shaping the future of the relationship.

What sectors are seeing the most US investment in Angola?

US investments in Angola are concentrated in various sectors, including but not limited to, natural resources, infrastructure, and telecommunications. Specific examples and data are provided within the body of the content.

What are the potential risks to US investment in Angola?

Potential risks to US investment include political instability, corruption, economic volatility, and varying levels of regulatory clarity. These are important considerations for investors.

How do international sanctions impact Angola’s economy?

International sanctions can have a significant impact on Angola’s economy, affecting access to capital, trade, and potentially impacting the overall economic outlook. The effects are discussed in more detail within the post.