Quotation of the Day Water Tax on California Farmers

Quotation of the day what if farmers were taxed on water in california some are – Quotation of the day: What if farmers were taxed on water in California? Some are. This complex issue touches on vital aspects of California’s agricultural economy, its water resources, and the well-being of rural communities. California’s water management has a long history, and the state faces significant challenges in balancing agricultural needs with the growing demands of urban areas and environmental concerns.

Different perspectives exist on how best to address water scarcity and its impact on agriculture.

The potential implications of taxing water usage on California farms are multifaceted. From the economic effects on farmers’ profitability and potential impacts on food prices to the environmental concerns surrounding water quality and availability, the debate is complex and warrants careful consideration. This article will delve into the various facets of this discussion, exploring the potential benefits and drawbacks of such a policy.

Introduction to the Concept

The idea of taxing water usage for farmers in California, while seemingly straightforward, is deeply rooted in the complex history of water management in the state. California’s agricultural sector, renowned for its vast production, has historically relied heavily on abundant water resources. However, the state is now facing significant water scarcity, prompting the need for innovative and potentially controversial solutions.This concept, although not entirely new, is gaining traction as a potential tool to address water sustainability and encourage responsible water usage within the agricultural industry.

The debate surrounding this tax often centers on its potential impact on farmers’ profitability, the overall health of the agricultural economy, and the long-term viability of California’s agricultural production. The challenge lies in striking a balance between supporting agriculture and ensuring the sustainable management of this vital resource.

Today’s quote about taxing farmers’ water use in California is intriguing, but it’s interesting to consider how water scarcity affects other regions. For example, China’s Hefei, a city heavily invested in electric vehicle production, is facing unique economic challenges, which china hefei ev city economy highlights. Ultimately, the question of water taxation in California still needs a lot of consideration, especially given the potential ripple effects.

Historical Context of Water Management in California

California’s water management has a long and evolving history, marked by periods of abundance and scarcity. Early policies focused on developing infrastructure to bring water to arid regions, supporting agricultural expansion. However, these historical approaches haven’t always considered long-term environmental impacts or the potential for overuse. Today, the state faces significant challenges in balancing agricultural needs with environmental protection and the needs of urban communities.

Water rights disputes, changing climate patterns, and population growth all contribute to the complexity of the current situation.

Different Perspectives on Water Scarcity and its Impact on Agriculture

Different stakeholders hold diverse perspectives on water scarcity and its impact on agriculture. Environmental groups often emphasize the importance of protecting ecosystems and preserving water for wildlife. Agricultural interests highlight the economic consequences of water restrictions and the potential for reduced agricultural production. Urban residents frequently prioritize access to reliable water supplies for their daily needs. These varied perspectives underscore the intricate web of interests involved in the water debate.

Comparison of Water Usage by Agricultural Sectors

The following table illustrates the diverse water usage patterns across various agricultural sectors in California. This data underscores the significant water demands placed on the state’s resources by different crops and practices.

| Agricultural Sector | Estimated Water Usage (in billions of gallons per year) | Description |

|---|---|---|

| Almonds | ~1.5 | High water-intensive crop, requiring significant irrigation. |

| Rice | ~1.0 | One of the most water-intensive crops, often requiring flooded fields. |

| Cotton | ~0.8 | Water-intensive crop, particularly in drier climates. |

| Dairy | ~0.7 | Significant water usage for animal feed production and livestock needs. |

| Vegetables | ~0.6 | Varied water needs depending on the specific vegetable type. |

Note: Estimates are approximate and can vary based on specific conditions and practices. Further research is needed to refine these figures.

Economic Implications: Quotation Of The Day What If Farmers Were Taxed On Water In California Some Are

A water tax on California farmers presents a complex web of economic consequences. The potential impacts on crop yields, farm profitability, food prices, and consumer costs require careful consideration. Understanding these interconnected effects is crucial for evaluating the overall societal impact of such a policy.The introduction of a water tax will inevitably alter the economic landscape of California agriculture.

Farmers will face increased operational costs, potentially affecting their bottom lines and impacting the long-term viability of their businesses. The extent of these consequences depends on the specific tax structure, the availability of alternative water sources, and the overall economic climate.

Potential Effects on Crop Yields and Farm Profitability

The availability and cost of water directly influence crop yields and farm profitability. A water tax will likely increase production costs, potentially leading to reduced profit margins for farmers. This could manifest in various ways, from reduced irrigation frequency to the choice of crops grown. Some farmers might be incentivized to adopt water-efficient irrigation technologies, while others might be forced to abandon less profitable crops or even exit the industry entirely.

Potential Impacts on Food Prices and Consumer Costs

Increased production costs, driven by the water tax, will likely translate into higher food prices. Consumers will bear the brunt of these increased costs, potentially leading to inflation and impacting their purchasing power. The extent of the price increase will depend on factors such as the tax rate, the ability of farmers to pass on costs, and the overall market demand for agricultural products.

Potential Revenue Generated from Water Taxes and Potential Uses

A water tax could generate substantial revenue for the state. This revenue can be used to fund various initiatives, including water conservation projects, infrastructure improvements, and drought relief measures.

| Potential Revenue Generated | Potential Uses |

|---|---|

| $1 billion annually | Funding water conservation research and development. |

| $500 million annually | Investing in drought-resistant crops and irrigation technologies. |

| $250 million annually | Supporting agricultural diversification and the development of alternative water sources. |

Potential Shift in Agricultural Practices

A water tax could incentivize a shift in agricultural practices. Farmers might be compelled to adopt water-efficient irrigation techniques, explore drought-resistant crops, or diversify their farming operations to reduce reliance on water-intensive crops. This could lead to a more sustainable agricultural sector in the long run.

| Current Agricultural Practices | Potential Shift |

|---|---|

| Intensive irrigation of water-demanding crops (e.g., alfalfa, rice). | Transition to drought-resistant crops and more efficient irrigation techniques. |

| Limited crop diversification. | Increased focus on diverse crops to reduce water consumption. |

| High reliance on groundwater. | Exploring alternative water sources and water management strategies. |

Environmental Considerations

A water tax on California agriculture, while potentially addressing water scarcity, presents a complex interplay of environmental benefits and drawbacks. The delicate balance between human needs and the health of ecosystems hinges on careful consideration of the ecological impacts. This section explores the potential environmental ramifications, considering current water usage patterns, and contrasting them with alternative conservation strategies.The impact of a water tax on California’s agricultural water usage will ripple through the state’s ecosystems, affecting everything from river flows to wildlife populations.

Understanding these intricate connections is crucial for crafting a policy that fosters sustainable water management while minimizing harm.

Potential Environmental Benefits

Implementing a water tax could incentivize water-efficient irrigation techniques and practices. Farmers might adopt more sophisticated irrigation systems, such as drip irrigation, reducing water waste. This could lead to improved water quality downstream, as less water is being used to wash away pollutants. Increased efficiency could also free up water for other uses, such as urban consumption and maintaining healthy ecosystems.

A reduced demand for water could lessen the strain on already stressed aquifers and rivers.

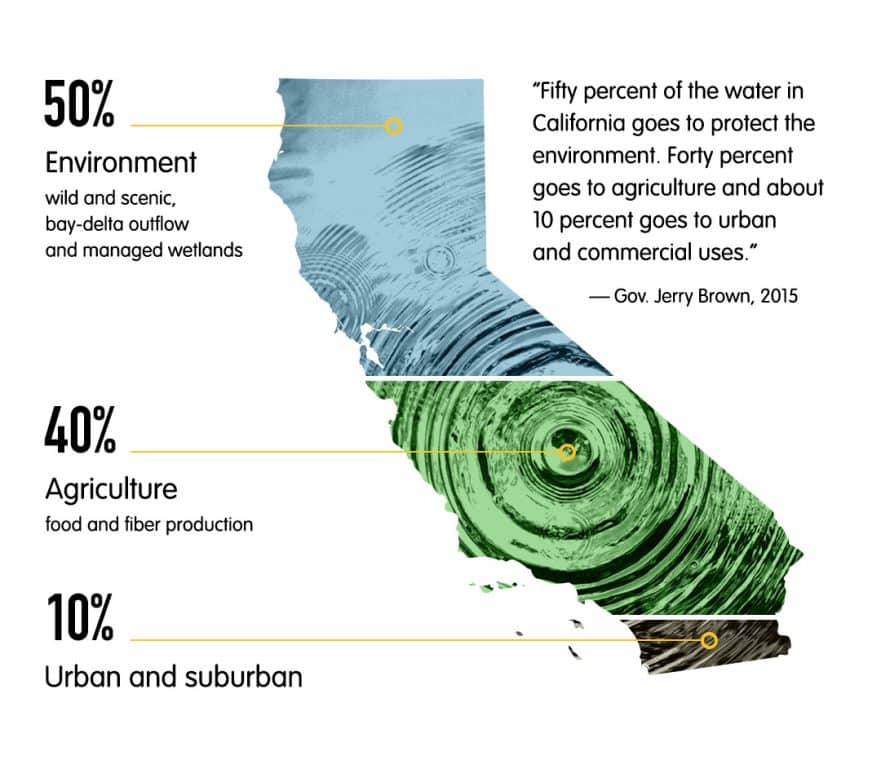

Current Water Usage Patterns in California Agriculture

California’s agricultural sector, a major consumer of water, faces significant water use challenges. Current data illustrates that agriculture consumes a substantial portion of the state’s water supply. For example, a report by the California Department of Water Resources (CDWR) reveals that agriculture accounts for approximately 80% of the state’s water use. This heavy reliance on water underscores the urgent need for change.

This water usage pattern often involves unsustainable practices, and a water tax might be a crucial tool for encouraging change.

Potential Impacts on Water Quality and Availability for Other Users

A water tax, while potentially increasing water efficiency in agriculture, could have unforeseen consequences on water quality and availability for other users. If not carefully implemented, it could lead to reduced water availability for urban areas, impacting public health and daily life. Furthermore, a sudden shift in agricultural practices could lead to the concentration of pollutants in the remaining water, affecting water quality for all users.

Effects on Ecosystems Dependent on Water Resources

California’s diverse ecosystems, including rivers, wetlands, and riparian zones, are highly dependent on water resources. Changes in water availability and quality could negatively impact these delicate environments. For example, reduced water flow in rivers could harm fish populations and disrupt the delicate balance of the aquatic ecosystem. The effects on wildlife that rely on these resources would be significant and potentially irreversible.

That thought-provoking quote about taxing farmers on water in California is definitely something to ponder. Some farmers are already facing these issues, and it makes you wonder about the broader implications. It’s a stark reminder of the complex issues facing agriculture in the Golden State. Meanwhile, stories like the tragic tale of lovers in Auschwitz, Keren Blankfeld and József Debreczeni, found in the cold crematorium , highlight the devastating impact of human cruelty and remind us of the importance of water access for life itself, and how easily resources can be threatened.

Ultimately, it all comes back to the initial question: what if farmers were taxed on water in California? Some are, and it’s a serious issue.

Alternative Water Conservation Strategies and their Effectiveness

Alternative water conservation strategies, like improved irrigation techniques, drought-resistant crops, and water-recycling programs, offer promising avenues for addressing California’s water challenges. Implementing a combination of strategies could achieve greater water conservation efficiency than relying on a single approach. For example, transitioning to drought-resistant crops, combined with drip irrigation, could dramatically reduce water usage in agriculture. The effectiveness of each strategy varies depending on the specific conditions and circumstances of the agricultural operation.

The “what if” of taxing farmers on water in California is a hot topic, and some are already facing those pressures. This complex issue, though, isn’t isolated. The recent California State University system faculty strike highlights the broader struggles facing workers and institutions across the state. So, while water access is a vital concern for farmers, it’s crucial to consider the broader context when discussing potential taxation.

This demonstrates that a comprehensive approach, not just a tax, is necessary for sustainable water management.

Social Impacts

Taxing water in California’s agricultural sector will undoubtedly ripple through rural communities, impacting livelihoods and potentially sparking social unrest. The proposed policy, while aiming to address environmental and economic concerns, necessitates careful consideration of the potential social fallout. This section delves into the possible consequences on rural communities, farming practices, potential for resistance, and the diverse perspectives on fairness.The impact of water taxation on rural California communities is likely to be significant and multifaceted.

Farmers, often reliant on family-owned operations and deeply rooted in the local economy, will face challenges in adapting to a new financial landscape. This could lead to a range of responses, from adjustments in farming practices to a potential exodus from the region.

Potential Impacts on Rural Communities and Livelihoods

Water is the lifeblood of many rural California communities. Farmers are the backbone of these communities, directly or indirectly employing many people. A significant shift in water costs could lead to reduced profits, forcing some farmers to reduce their operations, or even abandon their farms entirely. This could result in job losses, reduced local economic activity, and a decline in the overall quality of life for rural residents.

A cascade effect is highly probable.

Potential for Displacement or Changes in Farming Practices

Farmers may respond to increased water costs by altering their farming practices. This might involve switching to less water-intensive crops, adopting more efficient irrigation techniques, or even relocating their operations to areas with more readily available and affordable water. These changes could reshape the agricultural landscape of California, impacting the types of produce available and potentially leading to a concentration of water-intensive operations in areas with lower costs.

For example, in areas where groundwater is over-exploited, this could lead to increased pressure on surface water resources.

Potential for Social Unrest or Resistance to Such Policies

Resistance to water taxation is possible, particularly if the policy is perceived as unfairly targeting specific socioeconomic groups within the farming community. Farmers might organize protests, engage in lobbying efforts, or take other forms of collective action to oppose the proposed measures. The potential for social unrest underscores the need for a transparent and inclusive policy-making process that addresses the concerns of all stakeholders.

Public awareness and engagement are crucial to mitigating potential conflicts.

Diverse Perspectives on the Fairness of the Proposed Taxation

Farmers’ perspectives on the fairness of the proposed water taxation will vary greatly based on their size, type of farming, and access to alternative water sources. Large-scale commercial farms may have more resources to adapt than smaller family farms, creating an unequal playing field. The fairness of the taxation must be critically assessed, and any exemptions or support programs designed to level the playing field for disadvantaged groups must be a key component of the policy.

Consideration of the historical context of water rights in California is also necessary.

Comparison of Impacts on Different Socioeconomic Groups Within the Farming Community

The impacts of water taxation will disproportionately affect different socioeconomic groups within the farming community. Small family farms, often operating on tight margins, may struggle more to adapt to increased costs compared to larger, more established operations. This could exacerbate existing inequalities and potentially lead to a decline in the diversity of agricultural practices within the region. Careful consideration of the needs of different groups is essential to mitigate these negative effects.

Potential Solutions and Alternatives

Addressing California’s water scarcity and ensuring agricultural sustainability requires a multifaceted approach encompassing innovative solutions, effective conservation strategies, and supportive policies. The current system faces significant challenges, necessitating a shift towards more sustainable practices and a re-evaluation of water allocation priorities. Farmers, policymakers, and consumers all have roles to play in finding lasting solutions.The future of California agriculture hinges on responsible water management.

Adopting water-efficient technologies, promoting responsible irrigation practices, and implementing robust policies can safeguard the state’s vital agricultural sector while ensuring the long-term availability of water resources. This section explores potential solutions to achieve this delicate balance.

Innovative Approaches to Water Conservation

Various innovative techniques are crucial for improving water use efficiency in agriculture. Precision irrigation systems, such as drip irrigation and soil moisture sensors, enable targeted water delivery, minimizing waste and maximizing crop yields. These technologies deliver water directly to the plant roots, significantly reducing evaporation and runoff. Moreover, the implementation of rainwater harvesting systems and greywater recycling programs can supplement existing water supplies, reducing reliance on scarce groundwater resources.

Speaking of tricky situations, the “what if farmers were taxed on water in California?” question is a hot topic. Some are already facing potential water restrictions, and the implications of such a policy are massive. This debate really highlights the complex issues surrounding water usage, and it’s interesting to see how it relates to broader discussions on national security.

Recent news about President Biden and Lloyd Austin’s defense strategies, especially concerning cancer research initiatives, like these efforts to bolster the nation’s defenses against cancer , are also significant. Ultimately, the water tax debate in California touches on resource management and national priorities, making it a complex and important discussion.

Water-Efficient Irrigation Practices

Transitioning to water-efficient irrigation methods is paramount for minimizing water waste in agriculture. Techniques like drip irrigation, which deliver water directly to plant roots, are significantly more efficient than traditional flood irrigation methods. Employing soil moisture sensors allows for precise watering schedules, preventing over-watering and maximizing water use. Furthermore, the implementation of cover crops and mulching can reduce evaporation and soil erosion, contributing to overall water conservation.

Subsidies and Support Programs for Water-Efficient Practices

Financial incentives and support programs can encourage farmers to adopt water-efficient technologies and practices. Subsidies for the installation of drip irrigation systems or the implementation of precision agriculture techniques can significantly reduce the upfront costs for farmers. Education and training programs focused on water-efficient irrigation methods and sustainable farming practices are also essential for equipping farmers with the necessary knowledge and skills.

These programs should be tailored to specific farming needs and contexts, considering local climate conditions and crop types.

Successful Water Conservation Programs in Other Regions

Successful water conservation programs in other regions offer valuable lessons and potential models for California. The Negev Desert in Israel, facing similar water scarcity challenges, has developed innovative water-efficient irrigation systems and water recycling technologies. Furthermore, the success of water conservation programs in Australia demonstrates the potential for significant water savings through the adoption of water-wise agricultural practices and policies.

These examples demonstrate the feasibility and effectiveness of water conservation strategies.

Comparison of Water Conservation Strategies, Quotation of the day what if farmers were taxed on water in california some are

| Conservation Strategy | Description | Advantages | Disadvantages |

|---|---|---|---|

| Drip Irrigation | Delivers water directly to plant roots | High efficiency, reduced water loss | Higher initial investment, potentially complex installation |

| Precision Agriculture | Uses sensors and data to optimize water use | Reduced water waste, improved yield | Requires investment in technology and data analysis |

| Rainwater Harvesting | Collects and stores rainwater for irrigation | Reduces reliance on scarce water resources | Requires infrastructure investment, potential for runoff |

| Greywater Recycling | Treats and reuses wastewater for irrigation | Reduces water demand, reduces pollution | Requires specialized treatment systems, public acceptance challenges |

Illustrative Case Studies

Examining water pricing policies and conservation initiatives in other regions provides valuable insights into potential outcomes and challenges associated with implementing similar strategies in California. These case studies illuminate successful adaptations to water scarcity, highlighting both the opportunities and obstacles inherent in such policies. By understanding the experiences of other jurisdictions, California can potentially learn from their successes and avoid repeating past mistakes.Successful water pricing policies and conservation initiatives in other states and countries demonstrate the viability of different approaches.

The “quotation of the day” about taxing California farmers on water is definitely sparking debate. While some farmers are already facing water restrictions, the idea of a tax raises a lot of questions. Meanwhile, the ongoing negotiations surrounding the Israel-Hamas hostage situation and ceasefire talks are dominating headlines, highlighting the global political landscape. Ultimately, these discussions about water access and usage in California mirror the complexities of international relations and highlight the multifaceted challenges facing different communities.

California can leverage these models to inform its own strategy, while also considering the unique characteristics of its agricultural sector and water resources.

Water Pricing Policies in Other States/Countries

Various states and countries have implemented water pricing policies, each with its own unique approach and outcomes. For instance, the State of Arizona utilizes tiered pricing systems, where water costs increase with consumption. This encourages water conservation and provides financial incentives for efficient water usage. Similarly, Israel has a highly developed system of water pricing and allocation, often with a focus on ensuring equitable access for all users.

These systems have demonstrably influenced agricultural practices and fostered a culture of water conservation. Furthermore, many regions in the western United States have implemented tiered water rates, reflecting the increasing scarcity and value of water resources.

Successful Water Conservation Initiatives in California

California has witnessed numerous successful water conservation initiatives, ranging from agricultural practices to urban water use. One example is the implementation of drip irrigation systems in agriculture, which drastically reduces water waste compared to traditional methods. Another is the adoption of water-efficient landscaping in urban areas, which significantly lowers water consumption for residential purposes. These successful initiatives demonstrate the potential for water conservation and the importance of adapting agricultural practices to meet water demand.

Farmer Adaptations to Water Scarcity

Farmers in California have demonstrated adaptability to water scarcity through various strategies. Innovative water management techniques, such as the use of drought-resistant crops and advanced irrigation systems, have been crucial in maintaining agricultural productivity. Furthermore, many farmers have explored alternative water sources and implemented water-saving technologies to ensure sustainable farming practices. These adaptations highlight the resilience of California’s agricultural sector and the importance of proactive measures to address water scarcity.

Potential Challenges and Successes of Implementing Similar Water Pricing Schemes

Implementing similar water pricing schemes in California, while potentially yielding positive outcomes, presents several challenges. For instance, the financial impact on farmers could be substantial, especially if the pricing structure is not carefully designed. Furthermore, the potential for social unrest and inequitable distribution of resources needs careful consideration. Conversely, success hinges on a well-defined and transparent pricing structure, coupled with comprehensive support programs for farmers to adapt to the new pricing regime.

Successful implementation requires strong public education campaigns and potentially subsidized investments in water-efficient technologies. Successful models, like those in the western United States, showcase how thoughtful implementation and stakeholder engagement can lead to positive outcomes.

Structuring the Discussion (HTML Table)

Analyzing the multifaceted implications of taxing water in California requires a structured approach to navigate the complex web of arguments, counterarguments, and potential solutions. This table provides a framework for understanding the key aspects of this policy proposal, facilitating a clear and comprehensive evaluation.

Framework for Evaluating Water Tax Proposals

This table presents a structured overview of the arguments for and against taxing water in California, alongside potential solutions. It aims to offer a balanced perspective, considering the various viewpoints and proposing possible pathways forward.

| Point of Discussion | Pro Arguments | Con Arguments | Potential Solutions |

|---|---|---|---|

| Introduction to the Concept | A water tax could incentivize water conservation, encouraging responsible water usage and potentially alleviating water scarcity. It could also generate revenue for water infrastructure improvements. | A water tax could disproportionately affect low-income households, potentially exacerbating existing inequalities. It might discourage agricultural production, a vital sector in California. | Implement progressive tax rates, providing exemptions or subsidies for low-income households. Explore alternative funding sources for water infrastructure projects to reduce the burden on water users. Consider targeted incentives for agricultural practices that prioritize water efficiency. |

| Economic Implications | Potential revenue generation could fund water projects, potentially leading to increased agricultural productivity, tourism, and job creation. Reduced water waste can boost economic efficiency across various sectors. | Increased costs for farmers and businesses could lead to decreased profits, impacting employment and economic growth in some areas. The tax could also lead to decreased investment in the agricultural sector. | Invest in water-efficient technologies for farmers and businesses, providing financial incentives for adoption. Establish clear guidelines and procedures to minimize the financial impact on vulnerable sectors. Explore economic modeling to anticipate potential impacts and develop strategies to mitigate negative consequences. |

| Environmental Considerations | A water tax can promote water conservation, reducing the strain on water resources and potentially preventing further environmental damage. Increased funding could support water quality improvement projects. | Potential impacts on biodiversity, particularly in sensitive ecosystems. The tax might lead to changes in land use that have detrimental effects on natural habitats. A poorly designed tax can have unintended consequences on ecosystems. | Develop clear environmental impact assessments for water projects funded by the tax. Include provisions for protecting sensitive ecosystems and ensuring water quality standards. Implement incentives for environmentally sustainable agricultural practices. |

| Social Impacts | A carefully designed water tax can promote equity and fairness in water access. It could provide incentives for sustainable practices, potentially reducing conflicts over water resources. | The tax could exacerbate existing inequalities, particularly for low-income communities who rely heavily on water for basic needs. Public perception and acceptance of the tax are crucial to its success. | Implement progressive tax rates to lessen the impact on low-income households. Provide access to water-efficient technologies and support for water conservation practices. Engage in public outreach and education to foster understanding and acceptance of the tax. |

| Potential Solutions and Alternatives | Exploring various funding mechanisms alongside the tax, such as water pricing reforms and water rights management, can provide a comprehensive approach. | The complexity of water management and rights may present significant challenges to implementing alternative solutions. Lack of political consensus or public support can hinder implementation of alternative approaches. | Investigate a multi-pronged approach that combines the tax with other water management tools and reforms. Prioritize transparency and public participation in the decision-making process. Develop clear communication strategies to address public concerns and anxieties. |

| Illustrative Case Studies | Reviewing similar water management programs in other regions can provide insights into successful strategies and potential pitfalls. | Contextual factors in other regions may differ significantly from California’s specific circumstances. Lack of readily available comparable data can hinder analysis. | Conduct thorough comparative analyses of water management programs in other regions, adapting successful models while considering local specifics. Collect and analyze data to identify relevant best practices and pitfalls. |

Illustrative Data Visualizations

Visualizing the complex interplay of water, agriculture, and economics in California is crucial for understanding the potential impacts of a water tax on farmers. Data visualizations can effectively communicate trends, potential consequences, and alternative solutions, making the discussion more accessible and engaging. These visualizations will highlight the scale of water usage, the potential financial burdens on different farm types, and the various environmental consequences of agricultural practices.

Historical Water Usage Trends in California

California’s agricultural sector has a long history of intensive water use. A visualization depicting historical water consumption trends would use a line graph, plotting water usage (in acre-feet) against time (e.g., years 1950-2023). Different colored lines could represent different agricultural categories (e.g., almonds, rice, vegetables) allowing for a comparison of usage patterns across various crops. Ideally, the graph would clearly illustrate the significant increase in water use during periods of drought and the fluctuations in consumption throughout the years.

This visual representation underscores the critical need for sustainable water management strategies.

Potential Economic Impact of the Tax on Various Farm Types

Visualizing the potential economic impact of a water tax on different farm types requires a combination of bar graphs and pie charts. A bar graph could show the projected tax burden for different farm types (e.g., large-scale almond orchards, small-scale vegetable farms, livestock operations) based on their water consumption. This visualization would highlight the potential disproportionate impact on smaller farms, which often have less financial flexibility to absorb higher water costs.

A pie chart could demonstrate how the tax revenue generated would be distributed across the state’s agricultural economy. This breakdown would aid in understanding how the tax revenue could be reinvested in water conservation projects.

Environmental Consequences of Agricultural Practices

Visualizing the environmental consequences of California’s agricultural practices would be a crucial component of this analysis. An infographic depicting these consequences would use a combination of icons, maps, and data points to illustrate the impact of agricultural runoff on water quality, the effect of pesticide use on ecosystems, and the contribution of certain crops to greenhouse gas emissions. The infographic would visually demonstrate the trade-offs between agricultural production and environmental protection.

For example, it could display the potential for water contamination in specific river basins due to agricultural runoff.

Potential Water Savings with Different Conservation Methods

Illustrating potential water savings through different conservation methods would be crucial. A set of stacked bar charts would compare the water savings achievable through different conservation techniques (e.g., drip irrigation, precision agriculture, drought-resistant crops). Each bar would represent the total water saved using a particular method, segmented by farm type. This visualization would help quantify the potential benefits of adopting different conservation measures, highlighting the significant impact of water-efficient irrigation techniques.

The chart would clearly display the substantial water savings achievable through the implementation of various conservation methods.

Summary

In conclusion, the potential taxation of water for California farmers sparks a wide-ranging debate encompassing economic, environmental, and social considerations. This discussion highlights the delicate balance required in managing California’s water resources while ensuring the sustainability of its agricultural sector. The proposed solutions and alternative approaches, including innovative conservation strategies and potential subsidies, will be crucial in navigating this complex challenge and shaping the future of California’s agriculture.

FAQ Summary

What are some examples of successful water conservation programs in other regions?

Many regions have implemented successful water conservation programs, often focusing on efficient irrigation techniques, water recycling, and public awareness campaigns. Examples include the implementation of drip irrigation systems in arid regions and the use of greywater recycling for agricultural purposes.

How might the tax revenue generated from water taxes be used?

The revenue generated from water taxes could potentially fund water conservation projects, research into new water-efficient technologies, and support programs for farmers adopting water-efficient practices. Additionally, the funds could be used to improve water infrastructure or provide financial assistance to affected communities.

What are the potential impacts on rural communities and livelihoods?

Implementing water taxes could have significant impacts on rural communities and livelihoods. Farmers might experience reduced profitability, leading to job losses or changes in farming practices. Support programs and policies are crucial to mitigate these potential negative effects.

What are the potential economic consequences for farmers if water is taxed?

A water tax could potentially increase operational costs for farmers, leading to reduced yields and profitability. This could also impact food prices and consumer costs, potentially leading to a cascade of effects throughout the supply chain.