IPO Executive Options Discounts A Deep Dive

IPO executive options discounts are a complex issue with significant implications for both executives and shareholders. This blog post delves into the intricacies of IPO executive options discounts, exploring the rationale behind them, their potential impacts, and the best practices for companies navigating this delicate landscape.

We’ll examine the typical components of executive compensation packages, including equity-based incentives, and analyze how these packages are calculated and valued during an IPO. Understanding the regulatory and legal implications is crucial, along with recognizing potential conflicts of interest. We’ll also look at historical trends and industry comparisons to get a clearer picture of this dynamic topic.

Executive Compensation Structure

Executive compensation packages are a critical aspect of corporate governance, directly impacting employee motivation, company performance, and long-term strategic alignment. These packages are designed to attract, retain, and motivate top talent while incentivizing them to maximize shareholder value. Understanding the structure and components of these packages is essential for both investors and employees.Executive compensation packages typically comprise a mix of fixed salary, short-term incentives (bonuses), and long-term incentives, often heavily weighted towards equity-based compensation.

This structure reflects the long-term nature of strategic decisions and the desire to align executive interests with those of shareholders.

IPO executive option discounts can be a real game-changer, offering a significant financial boost to key players. It’s a fascinating look at how companies reward leadership, but sometimes those rewards are overshadowed by the larger-than-life stories of sports heroes, like Adrian Beltre, a truly legendary player for the Texas Rangers who deservedly earned a place in the Hall of Fame.

Adrian Beltre Hall of Fame Texas Rangers Ultimately, these executive options remain a vital aspect of company valuation and the compensation strategies that drive successful businesses.

Components of Executive Compensation

Executive compensation packages typically consist of several key components. These components are designed to create a comprehensive reward system, motivating executives to pursue company goals while ensuring a fair balance between risk and reward.

- Fixed Salary: A base salary provides a predictable income stream, forming the foundation of the compensation structure. This component is often determined by market standards, experience level, and the company’s overall compensation philosophy.

- Short-Term Incentives (Bonuses): These incentives, typically tied to quarterly or annual performance metrics, provide a more immediate link between executive actions and company results. Examples include sales targets, profit margins, or market share growth.

- Long-Term Incentives: These incentives, often equity-based, encourage executives to focus on the long-term success of the company. This alignment with shareholder interests fosters a sustained focus on value creation.

- Equity-Based Incentives: Stock options, restricted stock, and other forms of equity compensation provide a powerful incentive for executives to maximize shareholder value by increasing the company’s stock price.

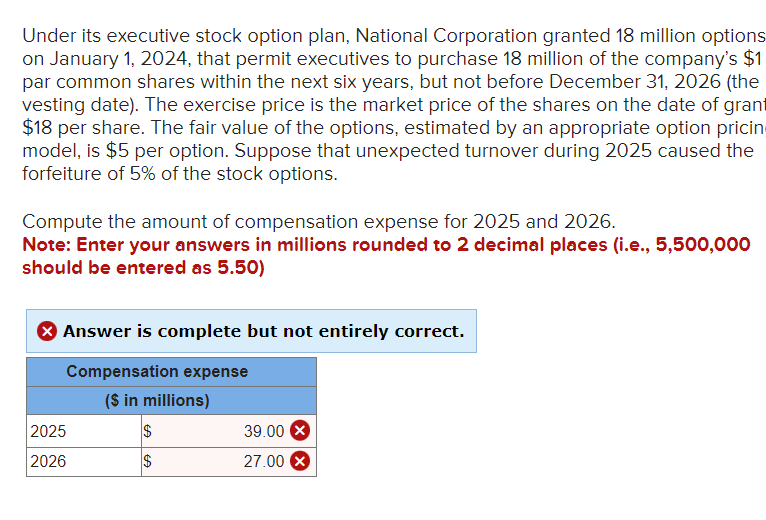

Equity-Based Incentive Calculation

Determining the value of executive stock options involves several key steps. The valuation methodology depends on factors such as the company’s financial performance, the current market conditions, and the specific terms of the option agreement.

The most common method for calculating the value of stock options is the Black-Scholes model. This model considers the current stock price, the strike price, the time to expiration, the volatility of the stock, and the risk-free interest rate.

Equity Compensation Models

Various equity compensation models exist, each with unique characteristics and implications for executive behavior and company performance.

| Model | Description | Advantages | Disadvantages |

|---|---|---|---|

| Stock Options | Executives receive the right, but not the obligation, to purchase company stock at a predetermined price (strike price) within a specific time frame. | Incentivizes executives to increase the stock price. Can be more attractive to executives than restricted stock. | Complex to value and manage. Risk of not exercising the option. |

| Restricted Stock | Executives receive shares of company stock, but the shares are subject to vesting periods, meaning they are not fully owned until certain conditions are met. | Simpler to value and manage than stock options. Less risk of forfeiture. | May not be as motivating as stock options, as there’s no upside beyond the vested shares. |

| Performance Shares | Executives receive shares of company stock contingent on achieving predetermined performance goals. | Directly ties executive compensation to company performance. | Performance targets can be subjective and difficult to define. Risk of not achieving targets. |

Forms of Equity Compensation

Companies utilize various forms of equity compensation to incentivize executives. These choices reflect the company’s strategic goals and the specific risk appetite of the board.

- Stock Options: Grants the right, but not the obligation, to purchase company stock at a specific price (strike price).

- Restricted Stock: Grants company stock that is subject to vesting conditions.

- Performance Shares: Grant shares contingent on achieving predetermined performance goals.

- Phantom Stock: Represents the value of company stock without actual ownership.

Board of Directors’ Role

The board of directors plays a crucial role in setting executive compensation. Their responsibility extends beyond simply approving the structure; it involves a deep understanding of market practices, the company’s performance, and executive performance.

- Compensation Committee: A dedicated committee within the board, typically composed of independent directors, is responsible for overseeing executive compensation.

- Market Benchmarking: The committee often benchmarks executive compensation against industry peers and comparable companies.

- Performance Evaluation: The committee assesses executive performance against established goals and metrics.

IPO Executive Option Discounts: Ipo Executive Options Discounts

Offering discounted stock options to executives during an IPO is a common practice, often aimed at aligning their interests with those of the company and investors. This strategy seeks to incentivize executives to perform well, ensuring the success of the company’s initial public offering and subsequent growth. Understanding the rationale, potential pitfalls, and regulatory considerations is crucial for both companies and executives.This approach aims to attract and retain top talent, while also potentially fostering a sense of shared ownership and responsibility among executives.

However, the practice also carries the risk of creating conflicts of interest and raising ethical concerns. It is imperative to structure these discounts carefully, considering the specific circumstances of the IPO and the potential impact on various stakeholders.

Rationale Behind Offering Discounts

Companies often offer discounts on executive stock options during IPOs to attract and retain key personnel. This can be a significant factor in securing the expertise needed to navigate the complexities of a public company. By incentivizing executives with potentially higher returns, the company aims to create a strong leadership team aligned with its long-term objectives. This strategic approach aims to secure and motivate talented individuals, potentially enhancing the overall success of the IPO.

Advantages of Offering Discounts

Offering discounts to executives can potentially attract and retain top talent. It provides a financial incentive that can motivate executives to work diligently and contribute to the company’s success, which directly benefits shareholders. This alignment of interests is often viewed as a positive aspect of the compensation structure. Furthermore, it can enhance the reputation of the company as an attractive employer.

Disadvantages of Offering Discounts

The potential for conflicts of interest is a major concern. Discounts can create situations where executives’ personal financial gains might supersede their fiduciary duties to shareholders. Furthermore, perceived unfairness or inequity in compensation structures can lead to reputational damage and erode investor trust. Discretionary decision-making can be perceived as inappropriate.

Regulatory and Legal Implications

Companies must adhere to various regulatory and legal requirements regarding executive compensation. These regulations often dictate the disclosure of executive compensation packages, including any discounts offered on stock options. Non-compliance with these regulations can lead to substantial penalties. It is crucial for companies to carefully review and comply with all relevant legal and regulatory frameworks. The specific regulations vary depending on the jurisdiction.

Potential Conflicts of Interest

A primary concern is the potential for conflicts of interest. If executives benefit disproportionately from discounted stock options, it could create a conflict between their personal interests and the interests of shareholders. This requires careful structuring of the discount program to minimize these conflicts and ensure transparency. Careful review of the company’s corporate governance policies is crucial.

Examples of Discount Structures

| Discount Structure | Description | Potential Advantages | Potential Disadvantages |

|---|---|---|---|

| Percentage Discount | A fixed percentage reduction on the market price of the stock options. | Simplicity and ease of implementation. | Potential for uneven returns for different executives. |

| Tiered Discount | Discounts based on different performance criteria or time horizons. | Alignment with performance and retention. | Complexity in administration and potential for misinterpretation. |

| Performance-Based Discount | Discounts linked to specific company performance targets. | Direct alignment of executive incentives with company success. | Potential for manipulation of targets and challenges in objective evaluation. |

Valuation and Pricing Considerations

Determining the fair value of executive stock options during an Initial Public Offering (IPO) is a critical process. Accurate valuation is crucial for ensuring both the fairness of the compensation package and the long-term health of the company. This process involves navigating complex factors, including the company’s financial outlook, market conditions, and the specific terms of the option grants.

Valuation Models for Executive Stock Options

Several models exist for valuing executive stock options. Choosing the appropriate model depends on the specific circumstances of the IPO and the desired level of precision. Common models include the Black-Scholes model and binomial models. The Black-Scholes model, a widely used option pricing model, considers factors like the underlying stock price, time to expiration, volatility, risk-free interest rate, and the strike price.

Binomial models provide a more flexible approach, allowing for more complex scenarios and risk factors.

IPO executive options discounts are always a hot topic, especially when considering the potential for significant gains. The recent results from the New Hampshire Democratic primary, available here , highlight the dynamic nature of political and financial markets. Understanding the nuances of these options, particularly in the context of current market trends, is crucial for anyone looking to maximize their potential returns from IPO executive compensation packages.

Impact of Market Conditions and IPO Pricing

Market conditions play a significant role in determining the value of executive stock options. A robust and positive market sentiment generally results in higher valuations, while a bearish market can lead to lower valuations. IPO pricing directly impacts the value of executive stock options, as a high IPO price typically translates to higher option values, and vice-versa. A higher IPO price suggests a higher perceived value of the company, which consequently influences the perceived value of the associated options.

Impact of IPO Pricing Strategies on Executive Option Discounts

Different IPO pricing strategies can have varying effects on the discounts offered for executive stock options. For example, a firm using a “high-end” pricing strategy, aiming for a premium valuation, may result in a lower discount for executive options compared to a “value-oriented” strategy. Understanding the relationship between IPO pricing and option discounts is crucial for accurately evaluating executive compensation.

Risk Assessment in Executive Option Pricing

Risk assessment is an essential part of valuing executive stock options during an IPO. Factors such as the company’s financial performance, industry trends, and competitive landscape contribute to the overall risk profile. A higher perceived risk often leads to a lower valuation of executive options, reflecting the potential for decreased value if the company’s performance does not meet expectations.

For example, a company in a highly competitive industry with fluctuating market conditions might warrant a lower discount compared to a company with a more stable market position. A rigorous risk assessment should include detailed analysis of the company’s historical performance, current financial position, and future projections. A company facing significant risks, such as high debt or unfavorable regulatory environments, may require a larger discount to incentivize executives to take on these risks.

Impact on Shareholder Value

Executive option discounts, while potentially beneficial for attracting and retaining talent, can have a nuanced impact on shareholder value. Understanding this impact is crucial for investors and board members alike, as these decisions directly affect the long-term health and prosperity of the company. This analysis explores the potential benefits and drawbacks, considering the long-term implications and mitigating factors.Executive compensation packages often include stock options, designed to align executive interests with those of shareholders.

However, when these options are discounted, it creates a complex dynamic that requires careful consideration. A discounted option grants the executive a lower price to acquire shares, potentially increasing the executive’s wealth while potentially reducing shareholder value, depending on the extent of the discount and the overall market performance.

Potential Benefits for Shareholders

The potential benefits of executive option discounts for shareholders are limited, often indirect and dependent on the specific circumstances. A well-structured discount program might incentivize executives to focus on long-term value creation, leading to higher company performance and, ultimately, higher shareholder returns. This incentive alignment can be particularly effective when the company’s long-term strategy is closely tied to the goals that the executive options are designed to achieve.

Potential Drawbacks for Shareholders

While aligning incentives can be a potential benefit, excessive discounts can reduce shareholder value. If the discount is too substantial, it may dilute the ownership of existing shareholders. This dilution can impact the return on investment for those shareholders. For example, if the company’s performance does not meet expectations, the value of the diluted shares may decrease more significantly for existing shareholders.

Further, the discount might signal a lack of confidence in the company’s future prospects, negatively impacting investor sentiment and potentially hindering future fundraising efforts.

Effect on Long-Term Company Performance

The impact on long-term company performance depends on the extent of the discount and how well it aligns with executive incentives. If the discount is modest and tied to specific performance metrics, it could motivate executives to pursue strategies that maximize long-term shareholder value. Conversely, a substantial discount without strong performance targets could incentivize short-term gains at the expense of long-term sustainability.

The effect is often amplified by market conditions and the specific business model.

Scenarios of Discount Levels and Shareholder Returns

| Discount Level | Potential Effect on Shareholder Returns | Mitigating Factors |

|---|---|---|

| Low (e.g., 10-15%) | Potentially neutral or slightly positive, if linked to performance targets. | Strong performance targets, transparent compensation structure, and effective executive oversight. |

| Moderate (e.g., 15-25%) | Potential for a slight decrease in shareholder returns if not tied to performance targets. | Clear and measurable performance metrics, strong financial results, and investor confidence. |

| High (e.g., 25%+ ) | Significant decrease in shareholder returns, potentially signalling poor management or lack of confidence. | Exceptional circumstances, such as attracting a highly sought-after executive with a demonstrably unique skill set and proven track record. |

Factors Mitigating Negative Effects, Ipo executive options discounts

Several factors can mitigate the potential negative effects of executive option discounts on shareholder value. Clear performance targets, transparent compensation structures, and robust executive oversight mechanisms can help ensure that the discounts are linked to value creation and not simply to the enrichment of executives. Furthermore, a strong track record of financial performance and positive investor sentiment can offset the negative perception that a substantial discount might create.

Best Practices and Recommendations

Navigating the complexities of executive compensation during an IPO requires a delicate balance. Fairness, equity, and transparency are paramount, while minimizing potential conflicts of interest is crucial for protecting shareholder value and maintaining investor confidence. This section Artikels best practices for establishing robust and responsible executive compensation structures, particularly focusing on stock option discounts.Setting executive compensation structures during an IPO involves careful consideration of market benchmarks, company performance, and the specific roles of executives.

Transparency and clear communication throughout the process are essential to building trust and avoiding misunderstandings. Robust governance structures are also critical for ensuring accountability and mitigating potential conflicts of interest.

Fair and Equitable Compensation Structures

Establishing fair and equitable executive compensation structures is vital for long-term success. This involves analyzing comparable companies’ compensation practices and considering factors such as market trends, performance metrics, and the specific responsibilities of each executive role. A comprehensive compensation structure should not only attract and retain top talent but also align their incentives with the company’s overall objectives.

Minimizing Conflicts of Interest

Potential conflicts of interest must be proactively addressed. Independent compensation committees are crucial for evaluating compensation proposals objectively and ensuring that decisions are made in the best interests of shareholders. Clear separation of duties and rigorous disclosure requirements can significantly reduce the likelihood of conflicts arising. By implementing these safeguards, companies can foster a culture of integrity and accountability.

Transparency and Accountability

Transparency and accountability are cornerstones of a well-functioning IPO. The compensation process should be clearly documented, with detailed explanations of the methodologies used for setting executive compensation, particularly stock option discounts. Regular reporting on executive compensation to shareholders, including the rationale behind decisions, builds trust and fosters a culture of transparency. This also allows for ongoing scrutiny and accountability.

Regulatory Requirements and Best Practices

Compliance with regulatory requirements and best practices is critical. These requirements often include detailed disclosure of executive compensation information, including stock option grants, in SEC filings. The specific requirements may vary depending on jurisdiction and industry.

| Regulatory Requirement/Best Practice | Description |

|---|---|

| SEC Filings (Form S-1, 8-K) | Disclosure of executive compensation details, including stock options, is mandatory in SEC filings. |

| Independent Compensation Committee | An independent committee reviews and approves executive compensation plans. |

| Compensation Policies and Procedures | Documented procedures and policies to ensure fairness and transparency in compensation decisions. |

| Market Benchmarking | Comparing executive compensation to industry peers. |

| Performance-Based Incentives | Linking executive compensation to company performance metrics. |

Approaches to Setting IPO Executive Stock Option Discounts

Various approaches exist for setting IPO executive stock option discounts. A common approach involves benchmarking against similar companies’ practices, considering market conditions, and incorporating performance-based metrics.

- Benchmarking: Comparing the discount structure with the compensation packages of executives at comparable public companies.

- Performance-Based Metrics: Linking the discount to the executive’s performance during a specified period, ensuring alignment of incentives.

- Market Conditions: Adjusting the discount based on the current market valuation of the company’s stock.

- Role-Specific Considerations: Tailoring the discount to reflect the specific responsibilities and contributions of different executive roles.

Historical Trends and Examples

Executive stock option discounts in IPOs are a complex issue with a long history. Understanding the trends and examples of both successful and problematic implementations can help companies design more effective and equitable compensation packages. Navigating these complexities is crucial to ensuring both executive and shareholder interests are aligned.A significant aspect of IPO executive compensation is the balance between incentivizing top talent and ensuring fair value for shareholders.

Historical trends reveal varying degrees of discounts, impacting the overall equity structure and long-term financial health of the company.

IPO executive options discounts can be a significant perk, but the complexities of these deals are often overlooked. Thinking about the sheer magnitude of financial gain, it’s easy to forget the deeply personal tragedies that can be connected to such wealth. For example, stories like the tragic lovers in Auschwitz, Keren Blankfeld and József Debreczeni, found in this heartbreaking news report , offer a stark reminder of the human cost that often shadows even the most lucrative financial opportunities.

Ultimately, IPO executive option discounts, while attractive, should be considered with a balanced perspective, acknowledging both the potential rewards and the wider context of human experience.

Historical Examples of Executive Stock Option Discounts

Early IPOs often featured relatively modest discounts, reflecting a less sophisticated understanding of the long-term implications of executive compensation. However, as the IPO market matured, so did the complexities of compensation packages. The increasing prevalence of financial engineering and the need to attract and retain top talent led to more significant discounts in some instances.

Trends in the Frequency and Magnitude of Discounts

The frequency and magnitude of executive stock option discounts in IPOs have fluctuated over time. Periods of robust market conditions have sometimes seen larger discounts, as companies compete to attract top executives. Conversely, periods of market downturn often lead to a more cautious approach, with smaller discounts being offered.

Companies that Successfully Navigated IPO Executive Compensation

Several companies have demonstrated a successful balance between executive compensation and shareholder value. One example involves a technology startup that offered competitive, yet justifiable, discounts to attract key engineers and product managers. This strategy effectively incentivized the executives, while also maintaining a reasonable valuation for the company’s shares. Careful due diligence and market analysis were critical to achieving this balance.

IPO executive option discounts are fascinating, but they’re also a bit complex. The lavish world of high-finance, as demonstrated by the snow polo tournaments in St. Moritz, often intersects with these practices. For example, the very existence of these events, and the impact of climate change on the snowy environment where they take place, like that highlighted in snow polo st moritz climate change , highlights the larger issues at play regarding the connection between executive compensation and the world around us.

Ultimately, these executive option discounts, and their potential implications, require careful consideration.

Another example comes from the pharmaceutical industry where the company, through meticulous valuation analysis, established a clear and justified compensation structure for key scientific personnel, thus ensuring fair market practices and shareholder value.

Case Studies of Companies Facing Negative Consequences

Conversely, some companies have faced negative consequences due to poorly designed IPO executive compensation packages. One example involves a company in the renewable energy sector where the substantial discounts given to executives during the IPO were not justified by the company’s market valuation or projected performance. This led to shareholder dissatisfaction and a negative impact on the company’s reputation.

IPO executive option discounts are a fascinating topic, but the upcoming Nevada caucus primary is also grabbing headlines. Understanding the intricacies of these executive compensation packages requires a deep dive, similar to how a good explainer, like the Nevada caucus primary explainer , clarifies complex political processes. Ultimately, both executive compensation and political landscapes involve navigating intricacies and potential conflicts of interest, impacting everyone from investors to voters.

Another instance highlights a software company where overly generous discounts led to significant dilution of shareholder equity, ultimately impacting the company’s long-term viability. In both cases, poor risk assessment and inadequate valuation analysis resulted in unfavorable outcomes.

Table Illustrating the Historical Range of Executive Option Discounts in Different Industries

| Industry | Historical Range of Discounts (%) |

|---|---|

| Technology | 5-15 |

| Pharmaceuticals | 3-10 |

| Finance | 4-12 |

| Consumer Goods | 2-8 |

| Renewable Energy | 6-15 |

This table provides a general overview. Actual discounts can vary significantly based on individual company circumstances, executive roles, and market conditions.

Industry Comparisons

Executive compensation, especially during initial public offerings (IPOs), varies significantly across industries. Understanding these variations is crucial for evaluating the fairness and appropriateness of compensation packages. Different sectors face unique competitive pressures, regulatory landscapes, and market dynamics, which impact how companies structure executive compensation. This analysis delves into industry-specific trends, highlighting patterns in option discounts and overall compensation structures.Industry-specific norms, regulatory frameworks, and market dynamics all contribute to the observed variations in executive compensation.

Companies in highly regulated industries, such as pharmaceuticals or finance, may face stricter requirements regarding executive compensation, leading to less flexibility in offering discounts. Conversely, industries with less stringent regulatory environments may exhibit more diverse compensation practices. Competition within an industry also plays a significant role, influencing the attractiveness of compensation packages offered to attract and retain top talent.

Executive Compensation Structures Across Industries

Different industries exhibit unique compensation structures, often reflecting the specific risks, rewards, and regulatory environments. Technology companies, for example, frequently use performance-based metrics, stock options, and equity grants to align executive incentives with shareholder value. Conversely, companies in the healthcare sector may prioritize stability and long-term growth, resulting in more traditional salary structures.

Patterns in IPO Executive Option Discounts

The use of executive stock options and discounts during IPOs varies across industries. The technology sector often sees a higher prevalence of substantial discounts, driven by the need to attract and retain top engineering and management talent in a highly competitive market. Conversely, industries with less volatile market conditions may exhibit less pronounced use of IPO option discounts.

This variance reflects the unique competitive landscape and talent requirements of each industry.

Influence of Industry-Specific Regulations and Norms

Regulatory requirements significantly impact executive compensation structures. Financial institutions, for instance, are subject to stringent regulations regarding executive compensation, often limiting the use of equity grants and option discounts. In contrast, industries with less stringent regulations may have more leeway in structuring executive compensation packages.

Market Competition and Regulatory Environment Impact

The level of market competition and the regulatory environment influence the practice of granting IPO executive option discounts. In highly competitive industries, offering attractive compensation packages, including discounts, is often necessary to attract and retain top talent. Conversely, in industries with limited competition or stringent regulatory environments, the use of option discounts may be less prevalent. Examples of this dynamic include the pharmaceutical and energy sectors.

Comparative Table of Executive Compensation Practices

| Industry | Compensation Structure | IPO Option Discount (Typical Range) | Influence of Regulations | |-----------------|------------------------------------------------------------------------------------------------------------------------------------------------------------|-----------------------------------|-------------------------| | Technology | Performance-based metrics, stock options, equity grants, higher compensation expectations | 10-30% | Moderate | | Finance | More traditional salary structures, performance-based bonuses, restricted stock units (RSUs), strict regulatory constraints | 5-15% | High | | Healthcare | Traditional salary structures, long-term incentives, focus on stability and long-term growth | 5-10% | Moderate | | Energy | Focus on long-term sustainability, stability, and potential for large capital projects, less emphasis on immediate stock price appreciation | 5-10% | Moderate | | Retail | More traditional salary and bonus structures, less reliance on equity compensation | 2-5% | Low |

This table provides a general overview.

Specific practices within each industry may vary significantly based on individual company circumstances, market conditions, and other factors.

Last Recap

In conclusion, IPO executive options discounts present a delicate balancing act between incentivizing executives, ensuring fairness to shareholders, and adhering to regulatory requirements. Companies must carefully consider the potential benefits and drawbacks, carefully assessing risk and making strategic decisions about valuations and pricing. By understanding the nuances of this complex topic, companies can create more effective compensation structures that benefit all stakeholders.

Detailed FAQs

What are some common valuation models used for executive stock options during an IPO?

Common valuation models include the Black-Scholes model, the binomial model, and the Monte Carlo simulation. The choice of model often depends on the specific circumstances of the IPO and the company.

How do market conditions affect executive stock option valuations during an IPO?

Market conditions significantly influence IPO pricing and, consequently, executive stock option valuations. A strong market generally leads to higher valuations, potentially impacting the discount offered. Conversely, a weak market might result in lower valuations and potentially less generous discounts.

What are the potential conflicts of interest that can arise from discounted stock options?

Potential conflicts of interest include a possible misalignment between executive and shareholder interests. Executives might be incentivized to prioritize short-term gains over long-term company success if the discount structure heavily favors their immediate financial benefit.

What are some best practices for minimizing potential conflicts of interest related to these discounts?

Transparency, rigorous valuation processes, and a board of directors actively involved in oversight are crucial for minimizing conflicts of interest. Clear communication and disclosure regarding the discount structure are also essential.