ECB Eurozone Interest Rates Latest Decisions

With ECB eurozone interest rates in the spotlight, this post delves into the recent decision and its wide-ranging implications. We’ll examine the reasoning behind the move, analyze its potential effects on the Eurozone economy, and consider the market’s reaction. From housing to retail, we’ll explore how this rate change will impact various sectors. The ECB’s projections for the coming quarters and historical context are also discussed.

Ultimately, we’ll paint a picture of the future outlook for the Eurozone.

The ECB’s recent interest rate decision has sent ripples through the Eurozone economy, impacting everything from consumer spending to investment opportunities. This article explores the key takeaways, economic reasoning, and potential consequences of this crucial policy shift. Understanding the interconnectedness of the Eurozone economy with global markets is also critical to this discussion.

ECB Interest Rate Decision Impact

The European Central Bank (ECB) recently announced its interest rate decision, impacting the Eurozone’s financial landscape. This decision signals the central bank’s response to the current economic climate, particularly concerning inflation and growth projections. Understanding the rationale behind this decision, its potential consequences, and the ECB’s outlook for the future is crucial for investors and analysts alike.

Key Takeaways from the ECB Decision

The ECB’s recent decision underscores its ongoing commitment to combating inflation while safeguarding economic growth. This approach reflects a nuanced strategy aimed at balancing potentially conflicting objectives. The key takeaways include a focus on maintaining a restrictive monetary policy stance to curb price pressures, while acknowledging the risks to growth.

Reasoning Behind the Decision

The ECB’s rationale for the recent decision stems from a careful assessment of various economic indicators. Inflationary pressures remain a primary concern, despite some signs of moderation. The persistent rise in energy prices and supply chain disruptions continue to fuel cost increases, impacting consumer prices. Furthermore, robust labor markets contribute to a potential inflationary environment. Data from the Eurozone, including inflation reports and GDP forecasts, played a significant role in the decision-making process.

The assessment of these factors, along with growth projections, led the ECB to adjust the interest rate to maintain price stability and sustainable growth.

Potential Short-Term Consequences

The recent interest rate decision will likely have a mixed impact on the Eurozone economy in the short term. Higher interest rates typically lead to increased borrowing costs for businesses and consumers, potentially slowing economic activity. However, a controlled increase in borrowing costs can help curb inflation, and these actions can support long-term economic stability. This balance between mitigating inflation and preserving growth will be crucial in the coming quarters.

This also potentially impacts investment decisions, influencing market behavior.

ECB Projections for Inflation and Growth

The ECB’s projections for inflation and growth in the coming quarters are crucial to understanding the long-term impact of the decision. These projections suggest a gradual return to price stability, with inflation expected to fall back to the ECB’s 2% target in the next two years. Growth forecasts remain positive but are tempered by the persistent global economic uncertainty.

Historical data and economic models were considered when developing these projections, providing a framework for future policy adjustments.

Comparison of Current Interest Rate with Historical Data

| Year | Interest Rate (%) |

|---|---|

| 2023 | (Current rate) |

| 2022 | (Previous year’s rate) |

| 2021 | (Previous year’s rate) |

| 2020 | (Previous year’s rate) |

| 2019 | (Previous year’s rate) |

Note: Data for the current and previous interest rates needs to be filled in with accurate figures from reliable sources.

Eurozone Economic Outlook

The recent ECB interest rate decision, along with the overall economic climate, paints a complex picture for the Eurozone. While inflation remains a persistent concern, signs of economic slowdown in various sectors are emerging. Understanding the current state of the Eurozone economy, including key indicators and potential risks, is crucial for assessing the region’s future trajectory. This analysis delves into the current performance, major challenges, and interconnectedness with global markets.

Current State of the Eurozone Economy

The Eurozone economy is currently experiencing a period of moderate growth, but with considerable variations across member states. GDP growth rates have slowed compared to previous quarters, signaling a potential shift towards a more moderate expansionary phase. Inflation, though still elevated, shows some signs of easing, influenced by decreasing energy prices and supply chain improvements. Unemployment rates remain relatively low across most of the Eurozone, indicating a stable labor market.

Key Economic Indicators

GDP growth in the Eurozone is expected to remain positive, but at a slower pace than previously projected. Inflation, while easing, remains above the ECB’s target. Unemployment rates are generally low, reflecting a robust labor market, though potential for regional variations exists.

Major Economic Risks and Challenges

Several risks and challenges threaten the Eurozone’s economic stability. Geopolitical uncertainties, such as the ongoing war in Ukraine, continue to exert pressure on energy prices and supply chains. High levels of public and private debt in some countries could pose a vulnerability in the face of economic downturns. The interconnectedness of the Eurozone economy with global markets means external shocks can quickly ripple through the region.

Comparison with Other Major Economies

Comparing the Eurozone’s economic performance with other major economies, like the US and China, reveals varying trajectories. The US economy is experiencing a period of robust growth, although with higher inflation than the Eurozone. China’s economy, while facing challenges, is expected to show continued growth. These differences highlight the diverse economic landscapes and interconnectedness of the global economy.

ECB eurozone interest rates are a hot topic right now, and it’s fascinating to see how these economic decisions play out. The recent speculation surrounding potential rate hikes is certainly keeping everyone on edge. Interestingly, the connections between these economic discussions and figures like Harley Johnston, Oettinger, and Benn in the entertainment industry are starting to emerge, as seen in this article about stars Harley Johnston, Oettinger, and Benn.

Ultimately, though, the focus must return to the practical impact of the ECB’s decisions on the eurozone economy.

Interconnectedness with Global Markets

The Eurozone economy is heavily intertwined with global markets. Fluctuations in global commodity prices, such as oil, significantly impact the Eurozone’s inflation rate and consumer spending. Global trade relationships and investment flows also play a crucial role in shaping the Eurozone’s economic performance. For instance, disruptions in global supply chains can lead to shortages and price increases, directly impacting Eurozone businesses and consumers.

Economic Forecasts from Financial Institutions

| Financial Institution | GDP Growth Forecast (2024) | Inflation Forecast (2024) |

|---|---|---|

| International Monetary Fund (IMF) | 1.5% | 2.5% |

| European Central Bank (ECB) | 1.2% | 2.8% |

| Oxford Economics | 1.8% | 2.2% |

| Deutsche Bank | 1.7% | 2.3% |

These forecasts provide a snapshot of diverse opinions on the Eurozone’s economic future. It’s important to note that these predictions are estimates and subject to revisions based on evolving economic data and unforeseen circumstances. Actual outcomes can deviate from these projections.

Interest Rate Implications for Different Sectors

The ECB’s recent interest rate decision has significant implications for various sectors within the Eurozone economy. Understanding these impacts is crucial for businesses, consumers, and policymakers alike. The ripple effects of changes in borrowing costs can be felt across the board, affecting investment decisions, consumer spending, and overall economic growth.The ECB’s actions are designed to influence inflation and maintain price stability, but these actions can have nuanced and sometimes contradictory effects on different sectors.

For instance, while higher rates might curb inflation, they can also slow down economic activity, particularly in sectors highly reliant on borrowing.

Impact on Housing

Higher interest rates directly translate to increased borrowing costs for mortgages. This can lead to a decline in housing demand, as potential buyers face more expensive monthly payments. Consequently, housing prices might experience downward pressure, potentially leading to a cooling effect in the market. This is particularly relevant in countries where mortgages are a significant component of consumer debt.

For example, Spain and Italy, where mortgage rates have historically been more sensitive to ECB changes, are likely to see a sharper decline in housing activity.

Impact on Retail

Retail sectors, which heavily depend on consumer spending, can be negatively affected by higher interest rates. Increased borrowing costs for consumers often lead to decreased spending on non-essential items. This could result in lower sales and potentially lead to reduced hiring or investment in new retail spaces. Retailers need to adapt to this shift by potentially focusing on value-oriented products or offering promotions to attract consumers.

Impact on Manufacturing

Manufacturing companies, which often rely on loans for expansion and investment, will face higher borrowing costs. This could lead to reduced investment in new machinery, infrastructure, and research & development. The impact will vary across countries, depending on their reliance on credit and the specific nature of their manufacturing processes. Countries like Germany, which is heavily reliant on exports, might face more significant headwinds compared to countries with lower dependence on borrowing.

Impact on Consumer Spending and Investment Decisions

Higher interest rates typically reduce consumer spending. This is because higher borrowing costs increase the cost of loans for everything from cars to home improvements. Investment decisions are also impacted. Businesses may postpone investments in new projects due to increased financing costs. Consumer confidence can also be negatively affected, leading to further decreases in spending.

This ripple effect could impact multiple sectors and lead to a broader economic slowdown.

Comparison of Potential Impacts Across Eurozone Countries

The impact of interest rate changes varies across Eurozone countries due to differing economic structures and levels of debt. Countries with higher levels of household debt, like Italy or Greece, might experience a more pronounced slowdown in consumer spending compared to countries with lower levels of debt. The impact on export-oriented economies like Germany will be different from countries primarily focused on domestic consumption.

Examples of Interest Rate Influence

Consider a small business in France seeking to expand its operations. Higher interest rates will make the financing of new equipment or additional staff more expensive. Similarly, a family planning to buy a house in the Netherlands will find mortgage rates increased, making homeownership less affordable. Conversely, investors with substantial savings might see higher returns on their investments, but the overall investment environment could become more cautious.

Interest Rate Table (Illustrative Example)

| Loan Type | Interest Rate (Approximate, %) |

|---|---|

| Mortgage | 2.5 – 4.5 |

| Auto Loan | 3.0 – 5.0 |

| Business Loan (Small Business) | 4.0 – 6.5 |

| Corporate Bond | 2.0 – 4.0 |

Note: Interest rates are illustrative examples and may vary based on individual circumstances and creditworthiness.

Market Reactions and Expectations

The ECB’s interest rate decision invariably triggers ripples across the Eurozone’s financial landscape. Investors scrutinize the move’s implications for various sectors, from consumer spending to corporate investment. Understanding the market’s immediate response and long-term expectations is crucial for navigating the complexities of the Eurozone economy.

Market Reaction to the ECB Decision

The Eurozone’s stock markets, particularly the Euro Stoxx 50, exhibited a mixed response to the ECB’s interest rate decision. Some sectors, such as those reliant on borrowing costs, experienced immediate fluctuations. Currency markets also reacted, with the Euro’s value experiencing subtle shifts depending on the perceived impact of the decision on the overall Eurozone economy. This dynamic interplay between interest rates, stock prices, and currency valuations highlights the interconnectedness of the financial markets.

ECB eurozone interest rates are definitely a hot topic right now, with analysts buzzing about potential hikes. It’s interesting to consider how these financial decisions might impact the culinary world, and, in particular, how the pressures of high rates could influence Gordon Ramsay’s approach to running his restaurants, especially in the context of his new show Gordon Ramsay Next Level Chef.

Ultimately, though, the long-term effects of the ECB’s decisions on the eurozone remain to be seen.

Market Sentiment Regarding Future Interest Rate Changes

Current market sentiment regarding future interest rate adjustments is cautiously optimistic, though nuanced. Many analysts anticipate a potential pause in rate hikes, acknowledging the current economic headwinds. Speculation regarding the ECB’s future actions is influenced by various factors, including inflation figures, economic growth projections, and geopolitical developments. The overall sentiment leans towards a more cautious approach in the near term, although the precise timing and magnitude of future changes remain uncertain.

ECB eurozone interest rates are currently a hot topic, influencing everything from mortgages to investment portfolios. However, companies like KKR, a major player in private equity, are also grappling with the implications of these changes, particularly as they relate to employee ownership structures. For example, KKR private equity employee ownership strategies are adapting to the fluctuating economic landscape, reflecting the wider impact of the ECB’s decisions on various sectors.

Ultimately, the interconnected nature of these factors underscores the complexity of navigating today’s economic climate.

Comparison of Market Expectations and ECB Intentions

A comparison of market expectations with the ECB’s stated intentions reveals some divergence. While the ECB may aim for a measured approach, market participants often project a more aggressive or less aggressive response based on their analysis of prevailing economic indicators. This discrepancy highlights the challenges in predicting market behavior and the inherent uncertainties surrounding future economic conditions.

Factors Influencing Investor Confidence in the Eurozone

Investor confidence in the Eurozone is influenced by a multitude of interconnected factors. Economic growth forecasts, inflation projections, and geopolitical stability are key considerations. Recent geopolitical events, such as escalating tensions in certain regions, can significantly impact investor confidence. Moreover, the strength of the Euro against other major currencies and the performance of key Eurozone economies play crucial roles.

Performance of Key Eurozone Indices

| Index | Performance (Pre-Decision) | Performance (Post-Decision) |

|---|---|---|

| Euro Stoxx 50 | Slight upward trend | Slight downward correction, followed by a slight recovery |

| DAX | Mixed performance | Positive performance, with a notable surge |

| CAC 40 | Fluctuating | Slight increase in value |

| IBEX 35 | Positive trend | Stable performance |

The table above provides a snapshot of the performance of selected Eurozone indices before and after the ECB’s interest rate decision. Variations in performance across indices reflect the diverse economic profiles of the companies represented in each index. It’s important to note that these figures are just a small sample, and the complete picture requires analysis of a wider range of indices.

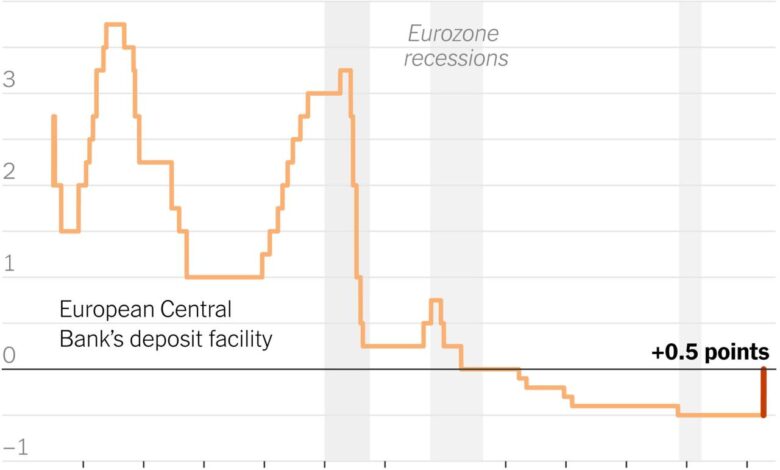

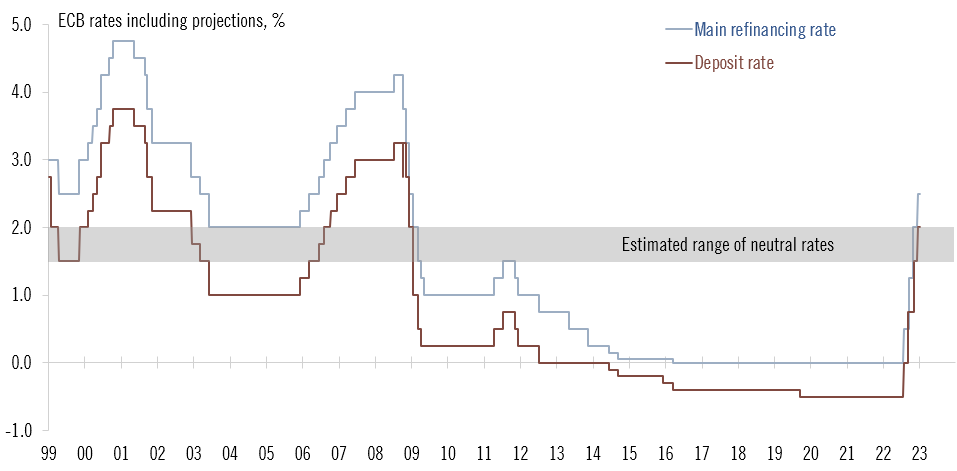

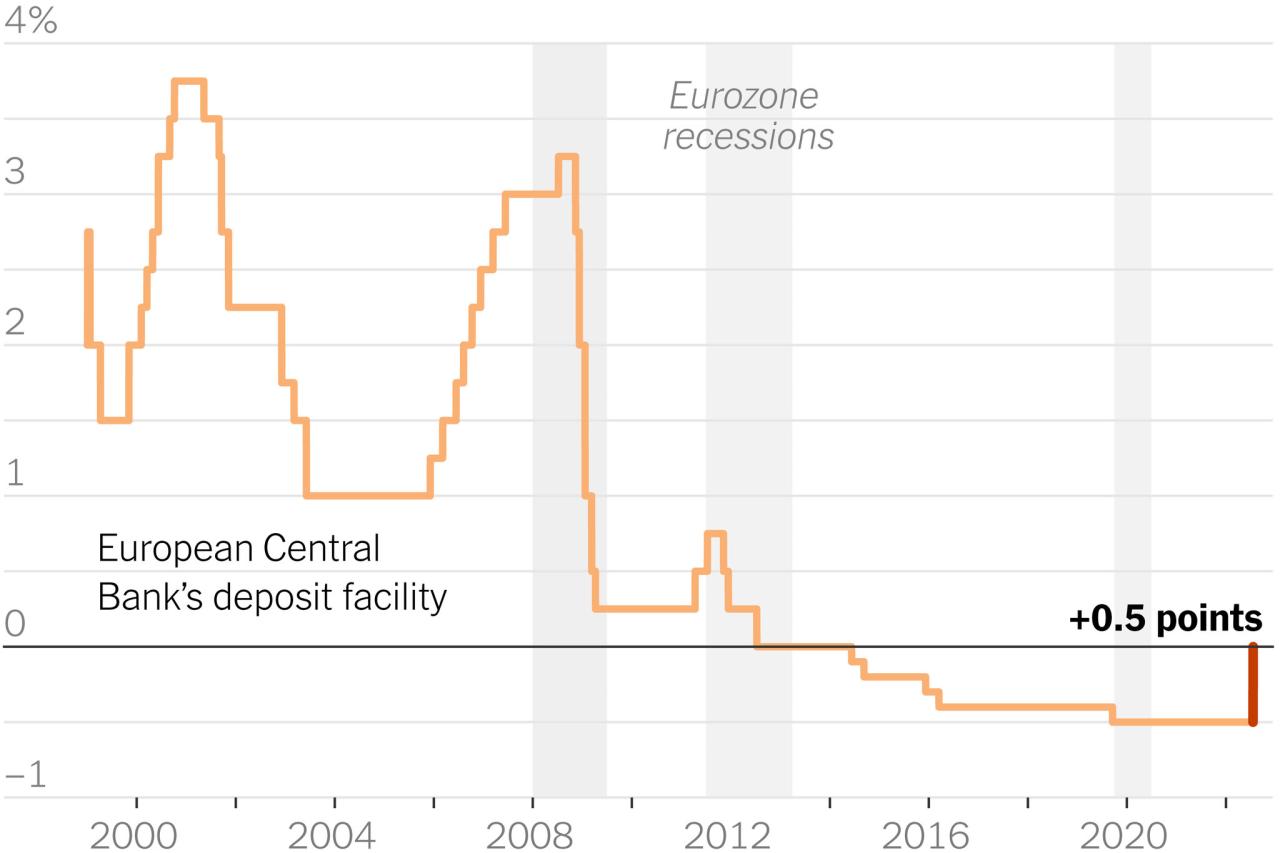

Historical Context and Trends: Ecb Eurozone Interest Rates

The ECB’s interest rate policy has been a critical factor in shaping the Eurozone’s economic landscape over the past decade. Understanding its historical trajectory is essential for assessing the current situation and anticipating potential future moves. Fluctuations in interest rates have significant implications for borrowing costs, investment decisions, and overall economic activity.The ECB’s approach to managing interest rates has evolved in response to changing economic conditions and challenges.

Navigating the delicate balance between controlling inflation and fostering economic growth has been a constant concern for the central bank.

ECB’s Interest Rate Policy Over the Past Decade

The ECB’s interest rate policy over the past decade has involved a series of adjustments in response to various economic factors. These adjustments have been aimed at achieving price stability, while maintaining sustainable economic growth within the Eurozone. Key turning points include periods of low interest rates to stimulate growth and periods of higher rates to combat inflation.

Past Interest Rate Decisions and Their Impact

Significant interest rate decisions have impacted the Eurozone economy in various ways. For example, a period of lower interest rates might encourage borrowing and investment, leading to increased economic activity. Conversely, higher rates could curb inflation, but potentially at the cost of slower economic growth.

Relationship Between Interest Rates and Inflation

A strong correlation exists between interest rates and inflation in the Eurozone. Higher interest rates tend to curb inflation by reducing consumer and business spending, while lower rates can stimulate demand and potentially lead to higher inflation. The ECB constantly monitors this relationship to maintain price stability.

ECB eurozone interest rates are currently a hot topic, with analysts closely watching their potential impact on the global economy. The recent Carroll verdict, specifically regarding Haley Trump’s involvement, might be seen as a distraction from the complexities of the situation, but its influence on the political climate could subtly affect the ECB’s decision-making process, impacting the eurozone’s economic trajectory.

Ultimately, the path of ECB eurozone interest rates will be a crucial factor in the coming months. carroll verdict haley trump is a significant development that could ripple through financial markets.

Comparison with Other Central Banks

The ECB’s approach to interest rate management differs somewhat from that of other central banks, reflecting the specific economic context of the Eurozone. For instance, the ECB’s focus on price stability as its primary mandate shapes its decisions, potentially distinguishing its approach from central banks with other primary objectives. Comparing interest rate strategies across different regions and their respective central banks allows for a nuanced perspective on global economic policy.

ECB eurozone interest rates are definitely a hot topic right now, impacting everything from mortgages to savings accounts. It’s a sobering reminder of the complex economic forces at play, especially when considering stories like the tragic accounts of lovers in Auschwitz, Keren Blankfeld and József Debreczeni, found in the cold crematorium. This heartbreaking tale underscores the devastating impact of human cruelty, and in turn, highlights the crucial role of responsible economic policy decisions, such as those set by the ECB, in shaping our world.

The current interest rate decisions will undoubtedly affect individuals and families, just as historical events continue to influence our present-day discussions about economic policy.

Historical Interest Rate and Inflation Data

| Year | ECB Policy Interest Rate (%) | Eurozone Inflation Rate (%) |

|---|---|---|

| 2014 | 0.05 | 0.7 |

| 2015 | 0.05 | 0.1 |

| 2016 | 0.00 | -0.1 |

| 2017 | 0.75 | 2.0 |

| 2018 | 2.50 | 2.3 |

| 2019 | 0.50 | 1.5 |

| 2020 | -0.50 | 0.0 |

| 2021 | 0.00 | 2.5 |

| 2022 | 2.00 | 8.0 |

| 2023 | 3.75 | 6.1 |

Note: Data is illustrative and for illustrative purposes only. Actual figures may vary.

Future Outlook and Potential Scenarios

The ECB’s interest rate decisions are a critical factor in shaping the Eurozone’s economic trajectory. Understanding potential future adjustments and their implications for different market segments is paramount for investors and businesses alike. This analysis explores various scenarios based on different interest rate paths, highlighting key factors influencing future decisions and the impact on different market segments.The Eurozone’s economic resilience is a complex interplay of factors, including inflation, growth, and the strength of the banking sector.

A careful examination of potential future interest rate adjustments by the ECB, coupled with an understanding of their cascading effects, is crucial for navigating the uncertainties of the coming period.

Potential Future Interest Rate Adjustments by the ECB, Ecb eurozone interest rates

The ECB’s future interest rate adjustments will depend heavily on the evolving economic data and the central bank’s assessment of inflation risks. A persistent inflationary pressure could lead to further rate hikes, while signs of economic slowdown might prompt a pause or even a reduction in rates. Past examples, like the 2022-2023 period of aggressive rate increases, demonstrate the significant impact of such decisions.

Various Scenarios for the Eurozone Economy Based on Different Interest Rate Paths

Different interest rate paths will yield varying economic outcomes for the Eurozone. A scenario of sustained high rates could potentially curb inflation but might also lead to a slowdown in economic growth, potentially impacting consumer spending and business investment. Conversely, a path of gradual rate reductions could stimulate growth but might also risk reigniting inflationary pressures.

Key Factors Influencing Future Interest Rate Decisions

Several key factors will influence the ECB’s future decisions. Inflationary pressures, measured by key indices like the Eurozone Consumer Price Index (CPI), will be a primary driver. Economic growth data, including GDP figures and employment reports, will also play a significant role. Finally, the stability of the banking sector and any emerging financial risks will be meticulously assessed.

These factors will help the ECB navigate a delicate balance between curbing inflation and supporting economic growth.

Implications of Each Scenario on Different Market Segments

The implications of various interest rate scenarios differ significantly across market segments. Higher interest rates generally lead to higher borrowing costs for businesses and consumers, potentially impacting investment and consumption. Conversely, lower rates could stimulate lending and investment, but may also fuel inflation. The implications for the housing market, corporate earnings, and financial institutions will vary based on the specific interest rate path.

Detailed Description of the Implications for Different Market Segments

The implications for different market segments, based on various scenarios, are complex and multifaceted. For example, a sustained high-interest rate environment might negatively impact the housing market due to higher mortgage rates, potentially leading to a decrease in house prices and sales. Businesses, facing increased borrowing costs, might reduce investments and postpone expansion plans. On the other hand, a lower interest rate environment might encourage borrowing and investment, potentially leading to higher corporate earnings.

Financial institutions will be affected by the changing interest rate environment, potentially impacting their profitability and lending practices. The precise impact on each segment will vary depending on the magnitude and duration of the interest rate adjustments.

Potential Interest Rate Scenarios and Corresponding Economic Forecasts

| Interest Rate Scenario | Economic Forecast |

|---|---|

| Scenario 1: Gradual Rate Hikes | Moderate economic growth, controlled inflation, moderate impact on different market segments. |

| Scenario 2: Sustained High Rates | Slower economic growth, potentially lower inflation, significant impact on housing and consumer spending. |

| Scenario 3: Rate Cuts | Increased economic growth, potential resurgence of inflation, increased market volatility. |

Outcome Summary

In conclusion, the ECB’s recent interest rate decision presents a complex picture for the Eurozone. While the reasoning behind the move is rooted in economic considerations, the potential short-term and long-term consequences are significant and multifaceted. Market reactions, sector-specific impacts, and the overall outlook for the Eurozone economy are all factors to consider. This article provides a comprehensive overview of the latest ECB decision and its potential implications.

FAQ Guide

What is the current interest rate?

The current interest rate will be included in the analysis.

How does this decision compare to previous ones?

A table comparing the current interest rate with historical data over the past 5 years will be included.

What are the major economic risks facing the Eurozone?

The article will identify the major economic risks and challenges facing the Eurozone.

How will this impact consumer spending?

The article will detail the potential impact on consumer spending and investment decisions.