Economy Recession Soft Landing Explained

Economy recession soft landing is a delicate balancing act. It’s the goal of policymakers to avoid a full-blown recession while still addressing inflation. This in-depth look explores what a soft landing means, the factors influencing its potential, the challenges, and real-world examples.

Understanding the indicators that signal a soft landing is crucial, and we’ll explore how different economic data points can provide clues. The comparison between soft landings and recessions will highlight the subtle differences and the potential consequences of each scenario.

Defining a Soft Landing Economy

A soft landing economy, in contrast to a recession, represents a period of economic slowdown that avoids a significant contraction. It’s a delicate balancing act where the economy manages to cool down without triggering a full-blown downturn. This controlled deceleration is crucial for mitigating inflationary pressures while avoiding a sharp decline in economic activity.A key characteristic distinguishing a soft landing from a recession is the sustained, albeit moderate, growth in key economic indicators.

While the pace of expansion slows, it doesn’t fall into negative territory, unlike a recession. Instead, it maintains a positive trajectory, signaling controlled adjustments within the system. This measured approach to cooling the economy helps to prevent the job losses and economic hardship associated with a recession.

Key Economic Indicators for Identifying a Soft Landing

Economic indicators play a crucial role in determining whether an economy is experiencing a soft landing. Monitoring these indicators allows for a proactive approach to managing the economy, enabling policymakers to respond effectively to any potential risks. The indicators often considered include GDP growth, unemployment rate, and inflation rate.

Comparison of Economic Indicators: Soft Landing vs. Recession

The following table compares and contrasts the key economic indicators between a soft landing and a recession, highlighting the subtle yet significant differences:

| Indicator | Soft Landing | Recession |

|---|---|---|

| GDP Growth | Positive, but slower than prior periods; growth rate might dip below previous trends but stays positive. Example: 2% GDP growth, compared to 3% previously. | Negative; GDP shrinks for two consecutive quarters or more. Example: -1% GDP growth for two quarters. |

| Unemployment Rate | Stable or slightly rising, but not sharply increasing. Example: 4.5% unemployment rate, slightly higher than the previous 4.2% rate. | Increasing significantly; substantial job losses are evident. Example: 6% unemployment rate, a notable jump from the previous 4%. |

| Inflation Rate | Moderating, but remaining above a desired target. Example: 4.5% inflation, slowly declining from a prior 5% high. | Potentially falling, but often accompanied by significant economic contraction. Example: 2% inflation, a fall but indicative of a weak economy. |

Potential Drivers of a Soft Landing

A soft landing, a delicate economic maneuver, is the aspiration of policymakers worldwide. It involves navigating a period of economic slowdown without triggering a full-blown recession. This requires careful management of various economic forces, including monetary and fiscal policies, and sensitivity to global economic trends. Successfully achieving a soft landing hinges on the interplay of these factors and the ability to mitigate the potential negative consequences of economic shocks.Successfully navigating a period of economic slowdown while avoiding a full-blown recession hinges on various intertwined factors.

The interplay of these elements dictates the likelihood of a successful soft landing. Monetary and fiscal policies, along with global economic conditions, play crucial roles in shaping the outcome.

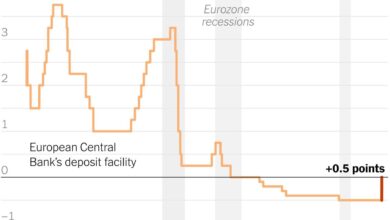

Monetary Policy’s Role

Monetary policy, primarily managed by central banks, plays a pivotal role in influencing interest rates and credit availability. Lowering interest rates can stimulate borrowing and investment, while raising rates can cool down the economy to curb inflation. Central banks carefully calibrate these adjustments to achieve the delicate balance between price stability and economic growth. The Federal Reserve, for instance, has used interest rate adjustments to combat inflation while attempting to avoid a recession.

Fiscal Policy’s Impact

Fiscal policy, determined by government spending and taxation, can also contribute to a soft landing. Government spending on infrastructure projects or social programs can boost economic activity during a slowdown, while tax cuts can stimulate private sector investment. However, excessive government spending can fuel inflation, potentially undermining the desired outcome. A balanced approach is crucial to avoid exacerbating inflationary pressures.

The economy’s potential for a soft landing during this recession is definitely a hot topic right now. A recent memo from Haley in New Hampshire, haley memo new hampshire , is adding fuel to the fire regarding different strategies to navigate the current economic climate. While the memo offers insights into the political landscape, it’s ultimately the economic indicators that will dictate whether a soft landing is achievable or if a deeper downturn is on the horizon.

Government responses to the 2008 financial crisis, including stimulus packages, provide examples of fiscal policy’s potential impact.

Impact of Different Economic Shocks

Economic shocks, such as supply chain disruptions, geopolitical tensions, or sudden shifts in consumer confidence, can significantly affect the likelihood of a soft landing. Supply chain disruptions, as witnessed during the COVID-19 pandemic, can lead to inflation and reduced output, making a soft landing more challenging. Effective responses to these shocks, including targeted interventions, are essential to minimize their negative consequences.

Global Economic Conditions

Global economic conditions are intertwined with a nation’s economic performance. A strong global economy can support domestic growth, while a global downturn can significantly impact domestic businesses and consumers. The global recession of 2008-2009, for example, severely impacted numerous economies, demonstrating the importance of global interconnectedness. A synchronized slowdown among major economies could significantly affect the likelihood of a soft landing.

Countries must consider the global context to effectively manage their domestic economies.

Challenges and Risks in Achieving a Soft Landing

A soft landing, where the economy slows but avoids a recession, is a delicate balancing act. Central banks must carefully manage interest rates and inflation to prevent a sharper downturn while also cooling down an overheating economy. The delicate dance between growth and stability is fraught with potential pitfalls. Navigating these complexities requires a deep understanding of the intricate mechanisms driving the economy.The path to a soft landing is fraught with potential obstacles, requiring precise calibration of economic policies.

Inflation, a persistent concern, can quickly spiral out of control if not addressed effectively. Simultaneously, maintaining robust economic growth is crucial to avoid widespread job losses and consumer hardship. The delicate balance between these two goals poses significant challenges.

Potential Obstacles to a Soft Landing

The success of a soft landing hinges on numerous factors. One major concern is the possibility of a sudden shift in consumer or investor sentiment. Unforeseen shocks, such as geopolitical instability or supply chain disruptions, can easily disrupt the delicate equilibrium, pushing the economy towards a more severe downturn. Another factor is the lagged effect of interest rate hikes.

The full impact of increased borrowing costs on economic activity may not be immediately apparent, potentially leading to an overcorrection or undercorrection in policy response. Furthermore, unforeseen external events, such as a significant global economic downturn or a natural disaster, can have significant cascading effects on the domestic economy, jeopardizing the soft landing strategy.

Risks Associated with Inflation and Interest Rate Hikes

High inflation, coupled with aggressive interest rate hikes, can create a double whammy for consumers and businesses. Rising borrowing costs can stifle investment and consumption, potentially leading to a recession. Furthermore, the impact on different sectors can vary, with some industries more vulnerable than others. The risk of a sharp economic contraction is heightened when inflation expectations become entrenched.

The debate over a soft landing for the economy is intense right now. With so much uncertainty, it’s hard to predict the future. Israel’s foreign minister’s trip to Brussels amid domestic discord over the war, as reported in this article , adds another layer of complexity to the economic picture. Ultimately, a soft landing will depend on a multitude of factors, including global cooperation and domestic stability.

Historical examples, such as the 1980s inflation crisis, demonstrate how persistent inflation can necessitate aggressive measures that, while ultimately beneficial in the long term, can inflict short-term pain.

Challenges of Balancing Economic Growth with Inflation Control

The delicate balance between maintaining economic growth and curbing inflation requires a nuanced approach. A central bank’s response to inflation often necessitates policies that might hinder economic growth, potentially creating a recession. The challenge lies in precisely identifying the point where policy interventions start to negatively affect growth while still addressing inflationary pressures. Furthermore, differing economic conditions across sectors and regions can further complicate the process, requiring targeted policies rather than a one-size-fits-all approach.

The economy’s potential for a soft landing during this recession is looking increasingly uncertain. While the recent news about Chris Young’s charges being dropped ( chris young charges dropped ) might seem unrelated, it highlights the complex interplay of factors affecting our economic climate. Hopefully, these recent developments won’t further destabilize the already precarious situation, and the path to a soft landing will remain achievable.

The interplay of these factors is complex and often unpredictable.

The economy’s potential for a soft landing during this recession is definitely up in the air. While economists debate the specifics, it’s fascinating to see how figures like Chita Rivera have navigated similar turbulent times in their own careers. For a deep dive into Chita Rivera’s key moments, check out this excellent article about her career chita rivera key moments career.

Ultimately, a soft landing for the economy remains a complex goal, demanding careful policy adjustments and public resilience.

Potential Consequences of a Failed Soft Landing

A failed soft landing can lead to significant economic and social consequences. The potential for a recession, accompanied by job losses and reduced consumer spending, is a significant risk. This can lead to a prolonged period of economic weakness, affecting businesses and households. The damage to consumer confidence can be profound, impacting spending habits and investment decisions for an extended period.

Table of Potential Consequences of a Failed Soft Landing

| Area | Consequences |

|---|---|

| Employment | Increased unemployment, reduced hiring, and business closures. |

| Consumer Confidence | Significant decline in consumer spending, reduced investment, and decreased economic activity. |

| Market Stability | Stock market volatility, bond market disruptions, and reduced investor confidence. |

Economic Indicators and Data

Navigating the complexities of a potential soft landing requires a keen understanding of the economic signals. Economic indicators act as barometers, reflecting the health and direction of the economy. Analyzing these indicators provides insights into whether the economy is softening gracefully or heading towards a more severe downturn. By tracking key metrics, policymakers and analysts can assess the likelihood of a successful soft landing.

Key Economic Indicators for a Soft Landing

Economic indicators paint a comprehensive picture of the economy’s performance. A soft landing scenario is characterized by a slowdown in growth without a significant contraction. This implies a moderation in inflation without a drastic increase in unemployment. Key indicators crucial for gauging this delicate balance include:

- Gross Domestic Product (GDP): GDP growth rates are fundamental to evaluating overall economic performance. A slowdown in GDP growth, but not a negative growth rate, suggests a potential soft landing. A decline in GDP growth rate from a previous high would be a strong indicator. For instance, a transition from 5% GDP growth to 2% GDP growth, without any contraction, is a potential sign of a soft landing.

- Inflation Rate: Inflation is another critical indicator. A soft landing typically involves a decline in the inflation rate, but not a sharp, destabilizing drop. Sustained inflation reduction without a surge in unemployment signifies a favorable outcome. For example, a gradual decline from double-digit inflation to a manageable single-digit level could indicate a soft landing.

- Unemployment Rate: A healthy labor market is essential for a soft landing. A stable or slightly rising unemployment rate, without a dramatic surge, suggests a smooth economic transition. A significant increase in unemployment during a period of decelerating inflation is not a soft landing. A soft landing would likely show a relatively stable unemployment rate.

- Consumer Confidence: Consumer confidence measures consumer sentiment about the economy. A decline in consumer confidence could signal a softening of the economy. However, a decline must not be severe or rapid to be considered a sign of a soft landing.

- Housing Market Data: Housing starts, home prices, and mortgage rates are crucial for understanding the health of the housing market. A stabilization or a moderate decline in these metrics suggests a soft landing. A sharp drop in housing market data usually points to a harder economic downturn.

- Industrial Production: Data on industrial production, manufacturing output, and capacity utilization can signal the pace of economic activity. A gradual slowdown in industrial production, without a collapse, can be a component of a soft landing.

Illustrative Data on Soft Landings

The following table presents hypothetical data to illustrate the trends of key economic indicators during soft landing periods. It’s important to note that real-world data is complex and these are simplified examples.

| Indicator | Year | Value | Description |

|---|---|---|---|

| GDP | 2023 | 2.5% | Moderate growth rate, a deceleration from previous years. |

| GDP | 2024 | 2.0% | Continued deceleration, but still positive. |

| Inflation Rate | 2023 | 5.0% | Inflation starts to cool down from a higher rate. |

| Inflation Rate | 2024 | 3.5% | Inflation continues to decline, but remains positive. |

| Unemployment Rate | 2023 | 3.8% | Stable unemployment rate, not significantly changing. |

| Unemployment Rate | 2024 | 4.0% | Unemployment rate continues to be relatively stable. |

| Consumer Confidence | 2023 | 90 | Consumer confidence is relatively high but starting to decline. |

| Consumer Confidence | 2024 | 85 | Further decline in consumer confidence, but remains above a threshold indicating potential for soft landing. |

Case Studies of Soft Landings (or Similar Scenarios): Economy Recession Soft Landing

Navigating economic downturns without triggering a full-blown recession is a delicate balancing act. Understanding how policymakers and economies have successfully managed similar situations in the past offers valuable insights into the potential paths forward. Examining past soft landings provides a framework for analyzing the current economic landscape and the necessary policy responses.

Historical Examples of Soft Landings

The concept of a “soft landing” implies a gradual deceleration of the economy, avoiding the sharp contractions of a recession while also cooling inflation. Historical events showcasing successful soft landings are often characterized by a delicate dance between controlling inflation and maintaining economic growth.

The talk of a soft landing for the economy is interesting, but when you look at things like the soaring prices of homes in California, like those 2 million dollar homes california , it makes you wonder if that narrative holds water. Maybe a soft landing is just a euphemism for a very bumpy ride. The economic recovery is still a huge question mark, regardless of the current forecasts.

The 1990s US Economy, Economy recession soft landing

The US economy in the 1990s experienced a period of sustained growth with relatively low inflation. This period saw the Federal Reserve effectively managing interest rates to curb inflationary pressures without triggering a recession. A key factor was the strong productivity growth, which allowed for continued economic expansion alongside controlled price increases.

The Early 2000s Japanese Economy

Japan faced significant economic challenges in the early 2000s, including deflation and slow growth. While not a perfect example of a soft landing, the prolonged period of low inflation and growth highlights the complexities of achieving a controlled economic slowdown. Central bank policies and government stimulus measures aimed to boost demand and address deflationary pressures, showcasing the intricate strategies employed during such periods.

The Post-2008 Recovery in the US

Following the 2008 financial crisis, the US economy experienced a period of recovery that, in some aspects, could be viewed as a soft landing. This recovery was characterized by substantial government intervention, including fiscal stimulus and monetary easing. The Federal Reserve played a pivotal role in maintaining low interest rates to support borrowing and investment.

Similarities and Differences to the Current Climate

Comparing past soft landings with the current economic climate reveals both similarities and differences. Each scenario presented unique circumstances, including varying levels of inflation, unemployment rates, and global economic conditions. While the current situation involves unique challenges such as persistent inflation and geopolitical uncertainties, policymakers can draw upon historical strategies and adapt them to the present context.

Policy Responses in Past Soft Landings

Understanding the policy responses in past soft landings provides valuable insights. Central banks played a crucial role in managing interest rates and credit conditions. Fiscal policies, such as government spending and tax measures, also played a part in mitigating the economic slowdown. The combination of these policies aimed to balance the need to control inflation with the desire to avoid a recession.

Detailed Summary of Each Case Study

- 1990s US Economy: Sustained growth, low inflation, strong productivity growth. The Federal Reserve effectively managed interest rates to curb inflation without triggering a recession.

- Early 2000s Japan: Deflation and slow growth. Central bank policies and government stimulus aimed to boost demand and address deflationary pressures. Not a perfect example of a soft landing.

- Post-2008 US Recovery: Recovery following a major financial crisis. Government intervention, fiscal stimulus, and monetary easing played crucial roles in maintaining economic stability. The Federal Reserve’s actions to keep interest rates low were instrumental in fostering recovery.

Sources for Case Studies

- Federal Reserve Economic Data (FRED): Provides historical economic data for the US.

- International Monetary Fund (IMF) publications: Offer global economic analysis and data.

- The Congressional Budget Office (CBO) reports: Provide in-depth analyses of US fiscal policy.

- Academic journals and research papers: Offer detailed studies on economic history and policy.

Forecasting and Modeling

Economists employ sophisticated models to anticipate future economic conditions and the potential for a soft landing. These models, often complex mathematical representations of the economy, are crucial tools for policymakers navigating the intricate relationship between inflation, growth, and employment. By simulating various scenarios, economists can project the impact of different policies and identify potential pitfalls. Understanding these models is essential for grasping the complexities of achieving a soft landing.

Methods of Economic Modeling

Economic models are built on various assumptions and incorporate a wide range of variables. These models, which often use regression analysis or econometrics, attempt to capture the intricate relationships between factors such as interest rates, consumer spending, investment, and government policies. They are not perfect representations of reality but rather simplified depictions designed to reveal key trends and potential outcomes.

Factors Considered in Soft Landing Models

Forecasting a soft landing necessitates considering a multitude of factors. Models must incorporate variables like inflation rates, unemployment figures, GDP growth, and interest rate adjustments. These variables are interconnected and affect each other in complex ways, making accurate predictions challenging. Furthermore, the impact of global economic events, such as trade wars or supply chain disruptions, needs to be factored into the model.

Policy Impact Projections

Economic models are instrumental in evaluating the potential effects of different policy decisions on the economy. For example, a model might project how a central bank’s interest rate adjustments will influence inflation and growth. Such projections help policymakers understand the trade-offs between different policy choices and make informed decisions.

Weaknesses in Current Economic Models

Despite their utility, economic models have inherent limitations. One significant weakness is the difficulty in capturing the unpredictable nature of human behavior. External shocks, such as unexpected geopolitical events or technological advancements, can significantly disrupt the assumptions underlying the models. Moreover, models are only as good as the data they are built upon, and data collection and analysis can be fraught with errors or biases.

Reliability of Forecasting Techniques

The reliability of different forecasting techniques varies significantly. Some methods, like those based on historical data and statistical relationships, tend to be more reliable for short-term predictions. However, long-term predictions become more uncertain as external factors and unforeseen events can alter the trajectory of the economy. Models relying on complex mathematical equations and algorithms, while potentially offering more nuanced insights, might not always yield more accurate predictions.

A combination of diverse forecasting techniques and a critical assessment of model limitations can provide a more comprehensive and reliable picture. For instance, a simple model might project a soft landing, while a more sophisticated model might identify potential risks, prompting policymakers to consider alternative courses of action. The crucial point is to understand the limitations of any given model.

Examples of Economic Models

The Phillips curve, for example, illustrates the inverse relationship between unemployment and inflation. Sophisticated models often utilize complex mathematical equations and algorithms to simulate economic scenarios. These models often use econometric techniques and historical data to predict future outcomes. Models also include factors such as consumer confidence, government spending, and global economic conditions.

Last Recap

In conclusion, achieving a soft landing in an economy facing recession is a complex and delicate process. Numerous factors come into play, from monetary policy decisions to global economic conditions. The potential pitfalls and consequences of a failed soft landing underscore the importance of careful planning and accurate forecasting. Navigating these economic waters requires a nuanced understanding of the interplay between various economic indicators and the potential for unforeseen shocks.

Popular Questions

What are the key differences between GDP growth in a soft landing and a recession?

In a soft landing, GDP growth might slow but remains positive, whereas a recession sees a significant decline in GDP. The rate of decline is a key differentiator. A soft landing aims for a controlled slowdown without a full contraction.

How does inflation affect the likelihood of a soft landing?

High inflation makes a soft landing harder to achieve. Central banks must carefully manage interest rate increases to curb inflation without triggering a recession. The delicate balance between these two factors is crucial.

What are some historical examples of soft landings, and what can we learn from them?

Historical case studies offer valuable insights. Examining past events, such as the 1980s, can provide clues about successful and failed strategies. However, each economic situation is unique, and past events aren’t a perfect predictor of the future.