Homeowners Insurance Bills Coverage Your Comprehensive Guide

Homeowners insurance bills coverage is a critical aspect of homeownership, yet it often feels like a complex labyrinth. Navigating policy details, coverage limits, and premium costs can feel overwhelming. This guide demystifies the process, providing a clear and concise overview of the essential components of your homeowners insurance policy, from basic coverage to optional add-ons, claims procedures, and even comparing different insurance providers.

We’ll delve into the specifics of your coverage, helping you understand what’s included, what’s excluded, and how to make the most of your policy. We’ll also explore the factors that influence premiums, and provide insights on how to assess your specific insurance needs. Whether you’re a seasoned homeowner or just starting your homeownership journey, this guide will equip you with the knowledge to make informed decisions.

Understanding Homeowners Insurance Coverage

Homeowners insurance is a crucial financial safeguard for your property and possessions. It protects you from unexpected events like fire, theft, or storms. Understanding the details of your policy is essential to ensure you’re adequately covered. This guide will break down the typical components of a homeowners insurance policy, highlighting coverage types, exclusions, and limitations.A well-structured homeowners insurance policy is designed to cover various risks associated with homeownership.

Homeowners insurance bills can be a real headache, especially when you’re trying to budget. Figuring out what’s covered can be tricky, and it’s easy to get caught up in all the details. For example, if you’re thinking about moving, understanding the coverage specifics can be especially important. Recent news about renters in Williamsburg, Brooklyn, and even Kyiv, Ukraine, highlights the need for comprehensive coverage, no matter your living situation.

Renters williamsburg brooklyn kiev ukraine are facing unique challenges, which further emphasizes the importance of reviewing your homeowners insurance coverage and ensuring you’re adequately protected, regardless of where you live. Ultimately, knowing what’s covered in your policy is key to avoiding unpleasant surprises down the road.

This detailed explanation will help you navigate the complexities of your coverage and understand the specifics of what your policy does and doesn’t protect.

Typical Components of a Homeowners Policy, Homeowners insurance bills coverage

Homeowners insurance policies typically include several key components. Understanding these elements will empower you to make informed decisions about your coverage needs.

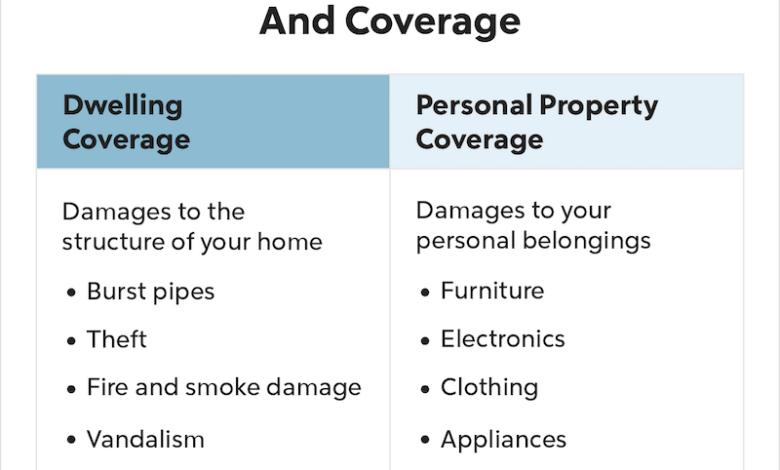

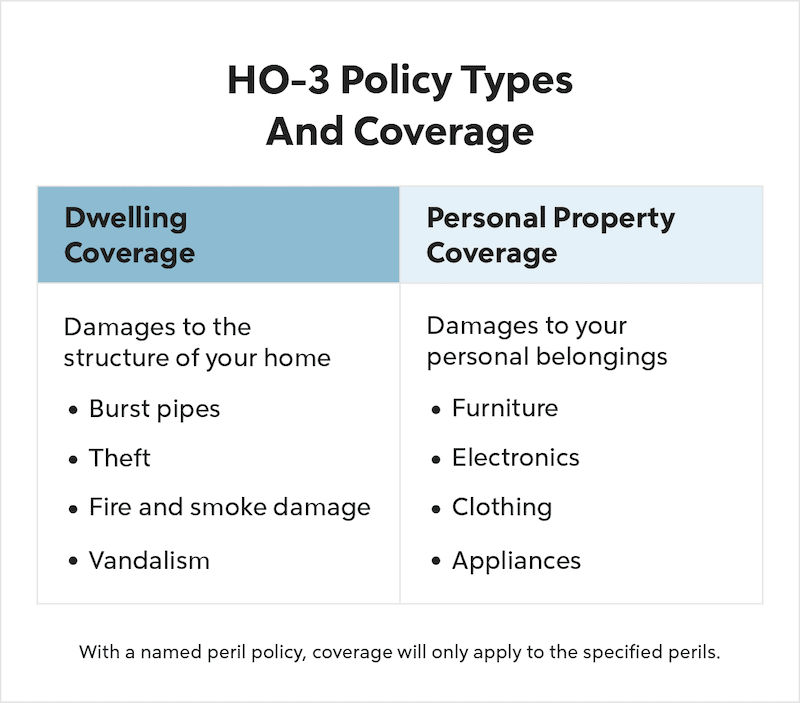

- Dwelling Coverage: This section protects the physical structure of your home. It covers damages from perils like fire, hail, windstorms, and vandalism. The coverage amount is usually based on the replacement cost of the home, not the current market value.

- Personal Property Coverage: This part of the policy safeguards your belongings inside your home. It covers losses from theft, fire, or water damage. This typically includes furniture, appliances, clothing, and other personal items. The coverage amount is often a percentage of the dwelling coverage.

- Liability Coverage: This crucial component protects you from financial responsibility for injuries or damages caused to others on your property. It covers legal fees and settlements if someone is injured or their property is damaged due to your negligence. For instance, if a guest slips and falls on your icy walkway, liability coverage will help manage the potential costs of the incident.

- Additional Coverages: Many policies offer supplemental coverages like replacement cost protection, which covers the full replacement cost of your home, not just the depreciated value. Flood insurance is another example of an additional coverage, often not included in a standard policy. These are crucial for specific potential risks.

Coverage Options and Exclusions

Different types of coverage options exist within a homeowners policy. Each option covers a distinct aspect of your property and possessions. Understanding the details of each coverage is vital to determine the best policy for your needs.

Homeowners insurance bills can be a real pain, especially when unexpected events hit. Recent global headlines like the Biden-Israel-Hamas cease fire situation, biden israel hamas cease fire , are often completely unrelated to home insurance, but it highlights the fact that unpredictable events can still impact our daily lives and financial situations. While these events might not directly affect your insurance premium, understanding your coverage is key to financial peace of mind.

| Coverage Type | Description | Examples of What’s Covered/Excluded |

|---|---|---|

| Dwelling | Protects the structure of your home. | Covered: Damage from fire, wind, hail, and other perils. Excluded: Earthquakes, floods (unless specifically added), wear and tear. |

| Personal Property | Covers belongings inside your home. | Covered: Furniture, appliances, clothing, and other personal items. Excluded: Items specifically excluded in the policy (e.g., antiques, jewelry with high value), loss due to normal wear and tear. |

| Liability | Protects you from financial responsibility for injuries or damages caused to others. | Covered: Medical expenses, legal fees, and settlements for injuries to guests. Excluded: Intentional acts, damage caused by a pre-existing condition. |

Exclusions and Limitations

Understanding exclusions and limitations within a homeowners policy is essential to avoid surprises. Knowing what your policy does not cover is just as important as understanding what it does cover.

Homeowners insurance bills can fluctuate, and sometimes unexpected events like rising interest rates or even global conflicts can impact those costs. For example, the recent Israel-Gaza cease fire israel gaza cease fire might have indirect economic ripples that could affect insurance premiums. Regardless of these external factors, understanding your coverage and policy details is key to managing your bills effectively.

- Exclusions: Certain events or types of damage are often excluded from coverage. Examples include earthquake damage, flood damage, and damage caused by war or nuclear events. These events typically require separate insurance policies.

- Limitations: Coverage amounts for specific items or situations may be limited. For example, jewelry or collectibles might have a specific coverage limit. It’s vital to review your policy details for specific limitations.

Analyzing Coverage Limits and Deductibles

Understanding your homeowners insurance policy’s coverage limits and deductibles is crucial for financial preparedness. These elements directly impact your protection and the cost of your policy. Knowing how they work empowers you to make informed decisions about your insurance needs.Coverage limits and deductibles are fundamental components of your homeowners insurance, shaping the amount you’re protected for and the out-of-pocket expenses you might face.

These elements aren’t static; they’re influenced by various factors, ultimately determining the level of financial security your policy provides.

Factors Influencing Coverage Limits

Coverage limits in a homeowners insurance policy are not a one-size-fits-all figure. Several factors play a role in determining the appropriate amount of coverage. These factors include the value of your home, the contents within it, and any special circumstances or risks associated with your property. For example, homes in flood-prone areas or located near high-risk environments often require higher coverage limits to adequately protect against potential damages.

Comparison of Coverage Limit Options

Different coverage limit options provide varying levels of protection. A higher coverage limit generally offers broader protection, but it also results in a higher premium. A lower coverage limit provides less protection, and in case of a significant loss, the payout might not fully cover the damage. For example, a policy with a $500,000 coverage limit for a home valued at $700,000 may offer insufficient protection if a major catastrophe occurs.

Conversely, a policy with a coverage limit exceeding the home’s replacement value may be unnecessarily expensive. Careful consideration of your home’s value and potential risks is essential when choosing a coverage limit.

Impact of Deductibles on Claims

Deductibles are the amount you pay out-of-pocket before your insurance company begins to cover the cost of a claim. A higher deductible typically leads to a lower premium, but it also means you’ll pay more out-of-pocket in the event of a covered loss. This is a trade-off between the cost of insurance and the amount you’ll pay if a claim occurs.

Table: Different Deductibles and Financial Implications

| Deductible Amount | Potential Premium Savings | Financial Implications (Example: Fire Damage $100,000) |

|---|---|---|

| $500 | Potentially Lower | You pay $500 initially, and the insurance company pays $99,500. |

| $1,000 | Potentially Moderate | You pay $1,000 initially, and the insurance company pays $99,000. |

| $2,500 | Potentially Higher | You pay $2,500 initially, and the insurance company pays $97,500. |

| $5,000 | Potentially Significant | You pay $5,000 initially, and the insurance company pays $95,000. |

The table illustrates the potential trade-off between premium costs and out-of-pocket expenses in case of a claim. A higher deductible leads to lower premiums but a larger financial responsibility in the event of a claim.

Exploring Policy Add-ons and Enhancements

Beyond the fundamental coverage Artikeld in your homeowners policy, various add-ons and enhancements can significantly bolster your protection. These options often cater to specific risks unique to your location or lifestyle, providing peace of mind and tailored security. Understanding these add-ons can help you make informed decisions about the best coverage for your home.Protecting your property and belongings from unforeseen events is crucial.

Policy add-ons can customize your coverage, extending it to perils not initially included. This proactive approach can safeguard your investment and minimize financial burdens in the event of a disaster.

Optional Add-ons for Enhanced Protection

A comprehensive homeowners insurance policy often provides a strong foundation. However, additional coverages can be vital to protect against risks specific to your area or personal circumstances. Adding these coverages ensures a more comprehensive and adaptable safety net.

Common Policy Enhancements

Several common add-ons can significantly improve your homeowners insurance coverage. These options often address potential hazards not initially covered.

- Flood Insurance: Flooding is a significant risk in many areas, often not covered by standard homeowners policies. Flood insurance specifically addresses the damage caused by excessive water. This is crucial in flood-prone regions and often requires a separate policy from your regular homeowner’s insurance. Failing to have flood insurance can leave you financially vulnerable in the event of a flood.

- Earthquake Insurance: In seismically active zones, earthquake insurance is essential. This coverage addresses damage caused by tremors, which can be extensive and expensive to repair. Many standard policies do not cover earthquake damage, highlighting the necessity of a separate policy or add-on.

- Personal Liability Coverage: This crucial add-on protects you from lawsuits arising from accidents on your property. It covers legal fees and settlements if someone is injured on your property due to your negligence. This coverage is often inadequate in a standard policy and may need to be upgraded or added separately.

Cost and Benefits of Add-ons

The cost of add-ons varies based on factors like your location, the type of coverage, and your home’s characteristics. Premiums can vary significantly, so comparing quotes from different providers is vital to ensure you’re getting the best deal.

| Add-on | Typical Cost Impact | Associated Benefits |

|---|---|---|

| Flood Insurance | Can range from a few dozen dollars to a few hundred dollars annually, depending on the risk in your area. | Covers damage from flooding, a significant risk in flood-prone areas. |

| Earthquake Insurance | Premiums vary greatly depending on the earthquake risk in your area. | Covers damage from earthquakes, a significant concern in seismically active regions. |

| Personal Liability | Usually a small addition to the overall premium. | Protects against legal costs and settlements from accidents on your property. |

Analyzing Policy Costs and Premiums

Understanding your homeowners insurance premium is crucial for budgeting and financial planning. Knowing what factors influence these costs allows you to make informed decisions about your coverage and potentially save money. This section delves into the various components that determine the price of your policy.Homeowners insurance premiums are not a fixed amount. They are calculated based on a complex interplay of factors, each with a significant impact on the final cost.

These factors range from the characteristics of your home and location to your chosen coverage level. Understanding these elements allows you to proactively manage your insurance expenses.

Factors Influencing Homeowners Insurance Premiums

Several factors contribute to the cost of your homeowners insurance. These factors are carefully evaluated by insurance companies to determine the risk associated with insuring your home.

- Location: Geographic location plays a pivotal role in premium calculations. Areas prone to natural disasters like hurricanes, earthquakes, or floods typically have higher premiums due to the increased risk of damage. For instance, coastal properties often face higher premiums compared to homes located in inland areas, reflecting the higher likelihood of storm damage.

- Home Characteristics: Home construction materials, age, and features significantly impact insurance costs. Modern, fire-resistant materials generally result in lower premiums than older, less durable structures. A home with a modern security system or a fire sprinkler system could potentially qualify for discounts.

- Coverage Levels: The amount of coverage you choose directly impacts your premium. Higher coverage levels, while providing more comprehensive protection, generally result in higher premiums. A policy that covers a higher replacement cost will be more expensive than one with a lower replacement cost.

- Claims History: A history of claims can significantly increase your premiums. Insurance companies assess your claim history to gauge your risk profile. A property with a recent history of damage will have a higher premium.

- Home Improvements and Renovations: Improvements and renovations to your home can affect your premium. Installing security features, like a security system, or reinforcing your home against natural hazards like installing storm shutters can reduce your risk, potentially leading to lower premiums. Conversely, extensive renovations that increase the value of the home may slightly increase premiums.

Home Improvement Impact on Premiums

Home improvements can have a mixed effect on your premiums. Some enhancements can lower your premiums, while others may slightly increase them.

- Safety Enhancements: Installing security systems, fire sprinklers, or reinforced roofing can often lead to lower premiums. These improvements reduce the risk of damage and theft, making your home a safer investment for the insurance company.

- Value Increases: Substantial renovations that significantly increase the home’s value may slightly increase your premium. The higher value of the home may make it a more appealing target for potential damage, leading to a slightly higher risk assessment.

Premium Analysis Table

The following table summarizes the factors influencing homeowners insurance premiums and their potential impact.

| Factor | Impact on Premium | Example |

|---|---|---|

| Location (high-risk area) | Higher premium | Coastal property near hurricane-prone areas |

| Home construction materials (older, less durable) | Higher premium | Home built with outdated, flammable materials |

| Coverage levels (high replacement cost) | Higher premium | Policy covering the full replacement value of the home |

| Security system | Potentially lower premium | Installation of a modern security system |

| Home renovation (value increase) | Potentially higher premium | Extensive kitchen or bathroom remodeling |

Claims Process and Settlements: Homeowners Insurance Bills Coverage

Navigating a home insurance claim can feel daunting, but understanding the process can make it much less stressful. This section Artikels the typical claims procedure, from initial filing to settlement, providing valuable insights to help you through the process. Knowing your rights and responsibilities will empower you to handle your claim efficiently and effectively.

The Homeowners Insurance Claim Process

The claims process typically begins with a report of the damage or loss to your insurance provider. This report will kick off a series of actions and assessments. Understanding the steps involved will help you anticipate the necessary documentation and timeline.

Filing a Claim: Required Documentation

To ensure a smooth claim process, having the right documentation is crucial. The documentation required can vary based on the nature of the claim, but generally includes:

- Proof of ownership: This could include a title deed or other legal documents demonstrating your ownership of the property.

- Policy details: Provide the policy number, effective dates, and any endorsements or add-ons related to the covered area.

- Photographs and videos: Documenting the damage with clear photographs and videos is critical, showcasing the extent and nature of the loss.

- Police report (if applicable): In cases of theft or vandalism, a police report is often required to substantiate the claim.

- Estimates from contractors (if applicable): If repairs are needed, provide estimates from qualified contractors for the necessary work.

- Other relevant documents: Your insurance company may request additional documentation depending on the specific claim, such as receipts for items damaged or lost.

Common Reasons for Claim Denial

Insurance companies have specific criteria for claims approval. Knowing the common reasons for denial can help you prevent potential issues:

- Failure to report damage promptly: Delaying reporting can affect the company’s ability to investigate and assess the claim. Contact your insurer as soon as possible after the incident.

- Pre-existing damage or wear and tear: Claims may be denied if the damage was pre-existing or caused by normal wear and tear, not covered by the policy.

- Lack of proper documentation: Providing incomplete or insufficient documentation can lead to a claim denial. Ensure you have all required documents ready for submission.

- Failure to follow policy requirements: Be aware of any specific requirements or procedures Artikeld in your policy for filing a claim.

- Acts of war or terrorism: These events are often excluded from coverage, as they are considered extraordinary events.

Appealing a Denied Claim

If your claim is denied, you have the right to appeal the decision. Review the denial letter carefully and address the specific reasons provided. Contact your insurance company to understand the appeal process and gather further information. Review your policy to see if there are specific appeal procedures.

Claim Filing Procedure: Step-by-Step

| Step | Action |

|---|---|

| 1 | Report the loss to your insurance company immediately. |

| 2 | Gather all required documentation, including photographs, videos, police reports, and estimates. |

| 3 | Complete the claim form provided by the insurance company and submit it along with supporting documents. |

| 4 | Cooperate with the insurance adjuster in the investigation of the claim. |

| 5 | Review the claim denial letter carefully, if applicable, and appeal if necessary, following the Artikeld procedures. |

Comparing Different Insurance Providers

Finding the right homeowners insurance can feel like navigating a maze. With so many providers vying for your business, comparing their offerings is crucial for securing the best possible coverage at a fair price. Understanding the nuances in coverage, costs, and customer service will empower you to make an informed decision.Insurance providers differ significantly in their approaches to coverage, costs, and customer service.

Some prioritize broad coverage at higher premiums, while others focus on affordability with potentially narrower policies. Customer service responsiveness and claims handling procedures can vary greatly, influencing your experience if you need to file a claim. A thorough comparison allows you to weigh these factors and select the provider best suited to your specific needs.

Homeowners insurance bills can be a real headache, especially when you’re trying to figure out what’s actually covered. While I’m usually focused on things like that, I’ve been keeping an eye on the recent trade interest surrounding Blues player Pavel Buchnevich, which has been making waves in hockey news circles. blues pavel buchnevich trade interest Regardless of the hockey excitement, it’s still important to remember to thoroughly review your homeowners insurance policy to ensure you’re well-protected for your home and belongings.

Comparing Coverage Options

Different providers offer varying levels of coverage. Some policies may exclude certain risks, like flood damage, or have lower limits for specific types of losses. Understanding the specifics of each policy is critical. Thorough research into the details of coverage options is essential.

Homeowners insurance bills can be a real pain, especially when you’re trying to budget. But sometimes, unexpected expenses, like the exciting subway weekend festivities in Jose Lasalle, subway weekend Jose Lasalle , can impact your coverage needs. It’s important to review your policy and understand what’s covered, so you’re prepared for any surprises. Thankfully, understanding your coverage limits helps you avoid unnecessary stress with unexpected expenses.

Evaluating Costs and Premiums

Insurance premiums are influenced by various factors, including your home’s location, value, construction type, and claims history. Different providers may assess these factors differently, leading to variations in premium costs. Be wary of providers offering exceptionally low premiums; they may have reduced coverage or exclusions. Compare not only the premium amount but also the total cost of coverage over a policy period.

Analyzing Customer Service Ratings

Customer service plays a vital role in your overall experience. Providers with consistently high customer satisfaction ratings often indicate a smoother claims process and more responsive support. Review online reviews and ratings to gauge the responsiveness and helpfulness of customer service representatives. Reading testimonials from previous policyholders can give you a valuable insight.

Comparing Different Providers

Comparing multiple insurance providers is straightforward. Start by researching reputable providers in your area. Request quotes from at least three different companies, providing them with similar information regarding your home’s details, coverage needs, and desired policy terms. Be sure to compare not only the premium amount but also the specific coverage details, deductibles, and any additional policy add-ons.

This comparative analysis helps you to determine the best fit.

Visual Comparison Table

| Insurance Provider | Premium (Annual) | Coverage Limits (Dwelling) | Deductible | Customer Rating (Average) |

|---|---|---|---|---|

| Company A | $1,500 | $300,000 | $1,000 | 4.5 out of 5 |

| Company B | $1,200 | $250,000 | $500 | 4.2 out of 5 |

| Company C | $1,800 | $400,000 | $2,000 | 4.7 out of 5 |

This table illustrates a sample comparison. Actual figures will vary based on your individual circumstances. Remember to verify all information directly with each insurance provider.

Evaluating Home Insurance Needs

Home insurance isn’t a one-size-fits-all solution. Your specific needs and the risks unique to your home and location play a crucial role in determining the right coverage. A tailored policy ensures you’re adequately protected without unnecessary expenses. This section delves into the process of evaluating your home insurance needs, enabling you to make informed decisions and secure the best protection for your investment.Understanding your individual risks and tailoring your coverage accordingly is vital for effective risk management.

By acknowledging potential hazards and vulnerabilities, you can secure the appropriate coverage to address these concerns. This proactive approach allows you to safeguard your assets and financial well-being.

Assessing Personal Risks

Personal risk factors significantly influence the type and extent of home insurance needed. Lifestyle choices, such as having pets or children, can introduce specific hazards. The likelihood of certain events, like flooding or wildfires, also varies based on your geographic location. Evaluating these elements enables the selection of appropriate coverage limits.

Evaluating Home Characteristics

Home characteristics significantly impact insurance needs. Older homes might require more extensive coverage for potential structural issues. High-value homes or those equipped with unique features, like a swimming pool, might necessitate specialized coverage. Properties located in high-risk areas, such as floodplains or wildfire zones, necessitate a higher level of coverage.

Creating a Home Insurance Needs Checklist

A checklist can guide your assessment of home insurance needs. Consider the following points to determine the appropriate coverage:

- Home Value: Determine the current market value of your home. This is crucial for calculating adequate coverage against potential losses.

- Personal Belongings: Assess the value of your personal possessions, including furniture, electronics, and jewelry. This information is essential for determining adequate contents coverage.

- Home Improvements: Note any recent or planned home improvements. These additions might affect your coverage requirements.

- Geographic Location: Identify potential risks based on your area, such as floods, wildfires, or severe storms. Consider the specific hazards present in your region.

- Existing Coverage: Review any existing insurance policies. This ensures there are no gaps in coverage and that existing policies adequately address your current needs.

- Potential Liabilities: Consider potential liabilities, such as injuries on your property. Determine if you need additional liability coverage to protect yourself from unforeseen events.

- Financial Resources: Assess your financial situation to understand your capacity to handle potential losses. This knowledge will help you determine a suitable deductible level.

Questions to Ask Yourself

A self-assessment can help you identify your home insurance needs. Use these questions to evaluate your specific circumstances:

- What is the current market value of my home?

- What is the total value of my personal belongings?

- What are the potential risks associated with my location (e.g., floods, wildfires, storms)?

- What are my current financial resources, and how much can I afford to pay for a deductible?

- Have I made any recent home improvements that might affect my coverage needs?

- Are there any potential liabilities that I need to consider?

Understanding Policy Terms and Conditions

Navigating the world of homeowners insurance can feel like deciphering a complex code. Understanding the policy’s terms and conditions is crucial to knowing exactly what your coverage entails. A seemingly minor clause can significantly impact your claims process or even invalidate coverage if not properly understood.Thorough review of these terms and conditions is paramount to ensuring you’re adequately protected and avoid unpleasant surprises down the line.

It’s not just about knowing what’s covered, but also what isn’t. Misunderstandings can lead to disputes and delays when filing a claim. Proactive review minimizes potential conflicts and empowers you to make informed decisions about your insurance.

Locating and Understanding Critical Clauses

Insurance policies are often dense documents filled with legal jargon. Finding the specific clauses that matter most requires a systematic approach. Look for sections explicitly outlining coverage, exclusions, and limitations. These are usually clearly labeled or referenced in the table of contents. Don’t hesitate to use the policy’s index or search function if available.

Reading the policy carefully, noting any unfamiliar terms, and cross-referencing these with the definitions provided in the policy is essential. Also, pay close attention to sections addressing property damage, liability, and the claims process. Reviewing the policy frequently, especially after major life changes like purchasing a home or a major home improvement, is advisable.

Understanding Insurance Policy Language

Insurance policies often employ specialized language that can be confusing to the average person. Understanding this language is essential for accurate interpretation of the policy’s terms and conditions. Terms like “actual cash value,” “replacement cost,” “perils,” and “deductibles” have specific meanings within the context of insurance. Referencing the glossary or definitions section provided in the policy document can be helpful.

Knowing these terms helps you grasp the specifics of your coverage. For example, “perils” refers to the causes of loss covered by the policy, while “deductibles” are the amounts you must pay out-of-pocket before your insurance company covers the rest of the loss.

Identifying Key Policy Terms

Understanding key terms in your homeowners insurance policy is crucial. Here’s a table to illustrate some common terms and their meanings:

| Term | Definition/Explanation |

|---|---|

| Actual Cash Value (ACV) | The estimated current value of the damaged property, considering depreciation. |

| Replacement Cost | The cost to repair or replace damaged property with like-kind and quality materials, without considering depreciation. |

| Deductible | The amount you must pay out-of-pocket before your insurance company pays for covered losses. |

| Perils | The causes of loss covered by the policy. Examples include fire, windstorm, or vandalism. |

| Exclusions | Specific situations or events not covered by the policy, such as flood, earthquake, or wear and tear. |

By understanding these key terms and clauses, you can make informed decisions about your insurance coverage.

Ending Remarks

In conclusion, understanding your homeowners insurance bills coverage is crucial for safeguarding your investment and peace of mind. By meticulously reviewing policy details, evaluating your needs, and comparing different providers, you can optimize your coverage and minimize potential financial burdens. Remember, proactive knowledge is key to effectively managing your home insurance.

FAQ Insights

What factors influence my homeowners insurance premiums?

Several factors affect your premiums, including your location (risk of natural disasters), home characteristics (age, construction materials, security features), and your chosen coverage levels. Even home improvements or renovations can impact your premium.

How do I file a claim?

The claims process usually involves reporting the incident, gathering necessary documentation (proof of damage, policy details), and cooperating with the insurance adjuster. Each insurance provider has specific claim procedures; check your policy for details.

What if my claim is denied?

If your claim is denied, review the denial letter carefully. It should explain the reason for denial. You may have options to appeal the decision, depending on your policy and the specific reason for denial.

What is the difference between dwelling and personal property coverage?

Dwelling coverage protects your home structure itself, while personal property coverage protects your belongings inside the home. Understanding the specifics of each is crucial for ensuring you’re fully protected.