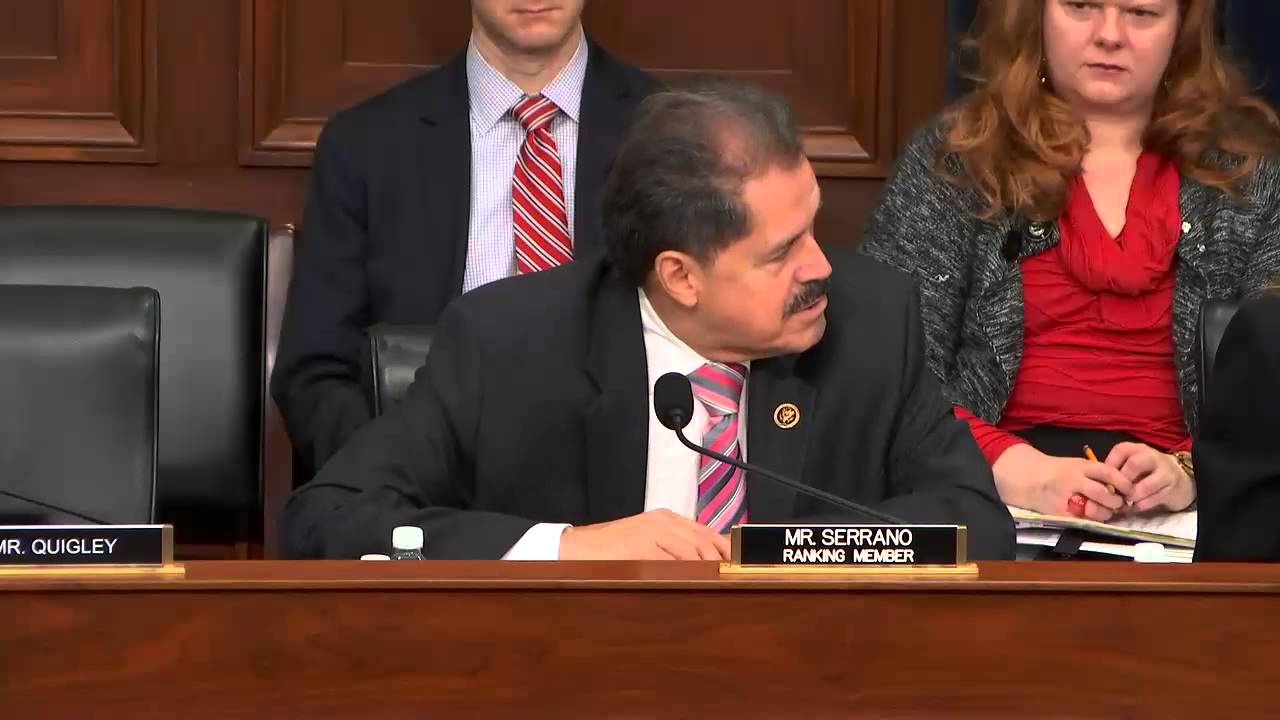

IRS Budget Cuts Hearing Impact & Alternatives

Internal revenue service budget cuts hearing is underway, sparking debate about the future of tax collection and services. This hearing delves into the potential ramifications of these cuts, from decreased tax compliance to possible delays in refunds. The political and economic context surrounding these proposed cuts is also heavily scrutinized.

The hearing examines the historical trends of IRS budget fluctuations, highlighting previous cuts and their effects on operations. Stakeholders, including taxpayers, businesses, and government officials, have presented differing viewpoints on the proposed cuts, emphasizing the potential consequences for tax collection, enforcement, and customer service.

Background of the Internal Revenue Service Budget Cuts Hearing

The Internal Revenue Service (IRS) is a crucial component of the U.S. government, responsible for collecting taxes and ensuring compliance. Its budget, however, is a frequent topic of discussion, with fluctuations impacting its ability to fulfill its duties. Understanding the history of these budget adjustments is key to grasping the current hearing’s context.The IRS budget is not static; it’s influenced by numerous factors, including economic conditions, political priorities, and the evolving tax code itself.

Changes in these factors often lead to adjustments in the IRS’s funding, with both increases and decreases impacting its capacity to effectively serve taxpayers and maintain compliance.

Historical Overview of IRS Budget Fluctuations

The IRS budget has experienced significant variations throughout its history. Budget cuts have often followed periods of economic downturn or political shifts, sometimes impacting the agency’s ability to handle increased taxpayer responsibilities or technological advancements. Conversely, periods of economic growth and political support have often led to budget increases, enabling the IRS to improve its services and infrastructure.

Previous Budget Cuts and Their Impacts

Analyzing past budget cuts offers valuable insights into the consequences for IRS operations. A notable example is the 2013 budget cuts, which resulted in significant staff reductions and operational limitations. This led to longer wait times for taxpayers, slower processing of tax returns, and decreased effectiveness in identifying and pursuing tax evasion.

| Year | Budget Amount (estimated) | Impact on IRS Services |

|---|---|---|

| 2013 | $X (Estimated amount) | Staff reductions, longer wait times, slower processing of returns, decreased effectiveness in identifying tax evasion |

| 2019 | $Y (Estimated amount) | Reduced enforcement capacity, limited IT investment, potential for backlogs in processing returns. |

| 2022 | $Z (Estimated amount) | Reduced customer service availability, delays in responding to taxpayer inquiries, limited ability to respond to new tax law implementation. |

Note: Specific amounts are estimates, as precise data may not be publicly available.

Context of the Current Budget Cuts Hearing

The current budget cuts hearing occurs within a specific economic and political environment. Factors like the rising national debt, ongoing inflation, and changing political priorities significantly influence the proposed budget cuts. This complex interplay of economic and political forces directly impacts the IRS’s ability to perform its duties effectively. The impact of these cuts on taxpayer experience, compliance, and the agency’s long-term sustainability is a key concern in the current hearing.

Specific Issues Addressed in the Hearing: Internal Revenue Service Budget Cuts Hearing

The recent hearing on proposed budget cuts to the Internal Revenue Service (IRS) highlighted critical concerns about the agency’s future capabilities and the impact on taxpayers and the economy. Stakeholders across the spectrum, from individual taxpayers to large corporations, expressed varying degrees of worry about the potential consequences of these cuts. This analysis delves into the specific issues raised during the hearing, exploring the perspectives of various interest groups and the potential ramifications of the proposed reductions.The hearing revealed a complex landscape of competing interests and potential consequences, underscoring the need for a comprehensive understanding of the proposed cuts and their implications.

Understanding the diverse perspectives and potential impacts on different stakeholders is crucial for a balanced discussion.

Key Concerns Raised by Stakeholders

Stakeholders voiced numerous concerns about the proposed budget cuts. These included reductions in staffing levels, diminished resources for crucial functions, and potential negative consequences for tax compliance and enforcement. Concerns regarding the efficiency of tax collection, accuracy of tax returns, and the responsiveness of customer service were also prominently featured.

- Taxpayers worried about the potential for increased delays in processing tax returns, longer wait times for customer service inquiries, and a decrease in the quality of tax advice available through IRS channels. Many feared a decline in the efficiency of tax refund processing.

- Businesses, particularly small and medium-sized enterprises (SMEs), expressed concern over the impact on tax audits and compliance assistance. They worried about the potential for increased tax evasion and the negative effect on their operations.

- Government officials, while acknowledging the need for fiscal responsibility, highlighted the importance of the IRS in maintaining a fair and efficient tax system. They also emphasized the agency’s role in supporting economic growth through accurate tax collection and enforcement.

Potential Consequences of the Cuts

The proposed budget cuts could have far-reaching consequences for various aspects of IRS operations. The impact on tax collection, enforcement, and customer service could be substantial and have cascading effects on the broader economy.

- Reduced tax collection capacity could lead to significant revenue losses for the government, impacting public spending on crucial services like infrastructure, education, and healthcare. This, in turn, could hinder economic growth and development.

- Decreased enforcement resources could result in a rise in tax evasion, leading to a loss of revenue for the government and an unfair advantage for those who evade taxes. This would likely lead to an erosion of public trust in the fairness of the tax system.

- Reduced customer service resources could lead to longer wait times, increased frustration among taxpayers, and a decline in public satisfaction with the IRS. This could negatively affect taxpayer morale and their willingness to cooperate with the IRS.

Different Perspectives on the Proposed Budget Cuts

Different interest groups presented contrasting perspectives on the proposed budget cuts. Taxpayers, businesses, and government officials had varying opinions on the need for the cuts and their potential effects.

The IRS budget cuts hearing is generating a lot of buzz, and it’s got me thinking about how these decisions will impact everyday folks. The recent influx of Ukrainian refugees seeking housing in areas like Williamsburg, Brooklyn, and even Kiev, renters williamsburg brooklyn kiev ukraine face a challenging market. This, in turn, raises questions about the broader implications of the budget cuts on essential services and economic stability for all citizens.

I’m still keeping an eye on the IRS hearing’s outcome.

- Taxpayers, often concerned about the efficiency and accessibility of the tax system, expressed opposition to the cuts, fearing a decline in services and an increase in complexity for tax preparation.

- Businesses, particularly those reliant on the IRS for compliance assistance and tax advice, often argued against the cuts, citing their importance in maintaining a fair and equitable tax environment.

- Government officials, often balancing the need for fiscal responsibility with the importance of a functioning tax system, frequently presented a nuanced perspective, acknowledging the potential downsides of the cuts but also emphasizing the necessity of controlling government spending.

Comparison of Arguments for and Against the Budget Cuts

The following table summarizes the key arguments for and against the proposed budget cuts to the IRS.

| Argument | Supporting Points | Counterarguments |

|---|---|---|

| For Budget Cuts | Improved government efficiency; reduced spending; redirection of funds to other areas. | Potential negative impact on tax collection, enforcement, and customer service; increase in tax evasion; economic slowdown. |

| Against Budget Cuts | Maintenance of a fair and efficient tax system; crucial for tax compliance; support for economic growth. | Potential for increased government spending; lack of alternative solutions for improving government efficiency. |

Potential Impacts of the Budget Cuts

The proposed cuts to the Internal Revenue Service (IRS) budget raise serious concerns about the agency’s ability to fulfill its crucial role in tax collection and compliance. These cuts will likely have a cascading effect on taxpayers, the economy, and the government’s revenue stream. The consequences are multifaceted and potentially far-reaching.The IRS plays a critical role in ensuring a fair and efficient tax system.

The internal revenue service budget cuts hearing is a serious matter, and it’s definitely worth watching. It’s impacting many aspects of the tax system, but it’s also important to consider how these cuts might affect the broader political landscape. For example, the recent actions of Steve Garvey in the California Senate, as seen in this article steve garvey california senate , highlight the complexity of these budgetary decisions.

Ultimately, the hearing’s outcome will significantly influence the future of the IRS and its ability to effectively collect taxes.

A weakened IRS could lead to a decrease in tax compliance, ultimately impacting the government’s ability to fund essential services. Understanding the potential consequences of these cuts is vital for policymakers and taxpayers alike.

Projected Effects on Tax Compliance and Revenue Collection

The IRS is responsible for enforcing tax laws and collecting taxes from individuals and businesses. Reduced funding will inevitably impact the agency’s ability to perform these functions effectively. A smaller workforce and fewer resources will translate into fewer audits, slower processing of tax returns, and increased difficulty in identifying and addressing tax evasion. This, in turn, could lead to a significant decline in tax revenue.

Impact on IRS Efficiency and Effectiveness

The efficiency and effectiveness of the IRS will undoubtedly suffer from budget cuts. Reduced staffing levels will lead to longer wait times for taxpayers seeking assistance, hindering the agency’s ability to provide timely and accurate services. This could lead to a significant backlog in processing tax returns and resolving taxpayer inquiries. The IRS may also struggle to maintain its current level of technological support, which is critical for modern tax administration.

Consequences for Taxpayers

Taxpayers will experience direct consequences from the proposed cuts. Increased wait times for processing tax returns and resolving issues will be a significant concern. Delays in refund processing could negatively impact individuals’ financial planning. Furthermore, the ability to file taxes accurately and resolve disputes could become more challenging. The IRS’s reduced capacity to address taxpayer concerns could result in frustration and increased difficulty for individuals navigating the tax system.

Projected Revenue Losses and Increased Taxpayer Burden

The budget cuts will likely result in revenue losses for the government and an increased burden on taxpayers. A reduction in IRS staff could translate into a smaller number of audits and a decrease in the detection of tax evasion. This will ultimately lead to a decrease in the amount of tax revenue collected. The increased burden on taxpayers will come in the form of longer wait times for refunds, increased complexity in navigating the tax system, and potentially a higher risk of non-compliance.

| Projected Impact | Description | Example |

|---|---|---|

| Revenue Loss | Decrease in tax revenue collected due to reduced IRS capacity to enforce tax laws and identify tax evasion. | A reduction in audits could result in millions of dollars in lost revenue. |

| Increased Taxpayer Burden | Longer wait times for refunds, more complicated tax processes, and a higher likelihood of errors. | Taxpayers may experience delays of several weeks or months in receiving refunds, leading to financial hardship. |

Alternatives and Recommendations for Budget Cuts

The proposed budget cuts to the Internal Revenue Service (IRS) raise significant concerns about the agency’s ability to effectively collect taxes and serve taxpayers. Finding alternative approaches to address these constraints is crucial to maintaining the integrity of the tax system and minimizing disruption to crucial services. This section Artikels potential solutions, emphasizing strategies to mitigate the negative impacts of the cuts while ensuring continued IRS functionality.Finding ways to streamline IRS operations and reduce costs without compromising service levels is paramount.

Innovative solutions are needed to tackle the budget deficit while preserving the vital role the IRS plays in the American economy.

Alternative Funding Models, Internal revenue service budget cuts hearing

The current funding model for the IRS is primarily through appropriations from Congress. Alternative funding models, such as a small, dedicated tax on financial transactions or a more robust user fee structure, can supplement these appropriations and potentially provide a more stable revenue stream. These alternative revenue streams could lessen the need for drastic budget cuts. A key element of exploring these options is to ensure any new tax or fee does not unduly burden taxpayers or impede economic activity.

For example, the existing excise tax on certain products has provided a source of funding for specific government programs without significantly affecting the overall economy.

Prioritizing IRS Functions

Prioritizing IRS functions in the face of budget constraints is essential. A thorough analysis of the IRS’s core responsibilities, such as tax collection, taxpayer service, and enforcement, should be undertaken. Critical functions, such as tax collection and compliance, which directly affect revenue generation, should be given priority over less critical areas. This prioritization should be driven by data and metrics that accurately reflect the effectiveness and impact of each function.

For instance, investing in advanced technology for tax processing could increase efficiency, which could be measured by reducing processing times. Likewise, strengthening taxpayer assistance could minimize compliance issues and reduce the need for enforcement actions.

Streamlining IRS Processes

Streamlining IRS processes is vital to reducing operational costs without compromising service levels. This involves leveraging technology, such as advanced data analytics and automation tools, to improve efficiency and reduce manual processes. The use of cloud-based systems for storage and data processing could reduce infrastructure costs and improve accessibility. A comprehensive review of current IRS procedures and processes is needed to identify areas for automation and digitization.

Implementing these improvements could potentially reduce processing times, minimize errors, and free up staff for more complex tasks. For example, electronic filing systems have dramatically reduced the time it takes for taxpayers to file and for the IRS to process returns.

Technology Investments

Investing in advanced technology, such as artificial intelligence (AI) and machine learning (ML) tools, can significantly improve IRS efficiency and accuracy. AI can automate tasks like processing tax returns, identifying fraudulent activities, and providing tailored taxpayer assistance. For instance, AI-powered systems can analyze vast amounts of data to identify patterns of tax evasion, thereby improving enforcement efforts. Machine learning algorithms can be employed to enhance the accuracy of tax calculations and to anticipate potential issues, allowing for proactive interventions.

Implementing such technologies will require training and support for IRS staff, but the long-term benefits can outweigh the initial investment.

Staffing and Training

Optimizing staffing levels through strategic hiring and training programs is also critical. This involves identifying the most critical skills and expertise needed to address future challenges and investing in programs to develop these skills. Upskilling and reskilling existing staff to perform more complex tasks, such as handling complex tax cases, can maximize their efficiency and reduce reliance on external consultants.

Implementing a structured training program will ensure that staff are equipped with the latest technologies and procedures. Such training should focus on improving accuracy, efficiency, and the overall taxpayer experience.

Role of Congress and the Executive Branch

The Internal Revenue Service (IRS) budget, a critical component of the U.S. government’s fiscal framework, is a product of intricate interplay between Congress and the Executive Branch. Understanding their respective roles and the influence of political considerations is paramount to comprehending the current budget cuts hearing. Both branches possess significant authority in shaping the IRS’s financial landscape, with the potential for substantial impact on tax collection, enforcement, and taxpayer service.The allocation of funds for the IRS is not a simple matter of numbers; it’s a complex process reflecting the priorities and political dynamics of the current administration and the legislative body.

The IRS budget cuts hearing was pretty intense, wasn’t it? While everyone’s focused on the potential impacts, I’ve been weirdly drawn to the viral trend of Acne Studios scarves on TikTok. Acne studios scarf tiktok is totally taking over, and the sheer volume of videos about them is fascinating. Regardless of the viral fashion obsession, the IRS hearing still feels like a much bigger deal for the country.

Factors like perceived effectiveness of IRS programs, public opinion on tax policies, and the overall economic climate all play significant roles in the debate surrounding budget allocations. These considerations often lead to compromises and adjustments in the final budget.

Congressional Role in IRS Budget Allocation

Congress, the legislative branch, holds the ultimate power to approve the IRS budget. This power is enshrined in the U.S. Constitution, specifically in the Article I, Section 8, granting Congress the power to “lay and collect Taxes.” The process involves several key steps: The House of Representatives and the Senate each consider the President’s budget proposal, often proposing amendments and modifications.

A budget resolution outlining spending priorities is then passed by both chambers. This resolution sets the framework for specific appropriations bills, which fund various government agencies, including the IRS. Finally, these bills are reconciled and passed into law.

- Congress initiates the budget process through the introduction of appropriations bills, detailing the funds allocated to the IRS.

- Committees within Congress, such as the House Ways and Means Committee and the Senate Finance Committee, play crucial roles in shaping the budget by conducting hearings, gathering expert testimony, and debating proposed allocations.

- Congressional oversight of the IRS ensures that the agency is using allocated funds effectively and in accordance with established laws and regulations.

Executive Branch’s Role in IRS Budget Allocation

The Executive Branch, led by the President, plays a significant role in the budget process. The President submits a proposed budget to Congress, outlining funding requests for all federal agencies, including the IRS. This budget proposal often reflects the administration’s policy priorities and economic forecasts. The President’s budget request serves as a starting point for the congressional process.

The administration also has the power to allocate funds within the approved budget.

- The Executive Branch, through the President’s Office of Management and Budget (OMB), formulates and presents the budget request to Congress, offering justifications for the proposed IRS funding.

- The Executive Branch often advocates for specific funding priorities related to IRS programs, such as enforcement initiatives or taxpayer assistance programs, during the budget process.

- The President can influence the budget through executive orders and directives, which may impact the IRS’s operational priorities and funding needs.

Influence of Political Considerations

Political considerations exert a profound influence on the IRS budget. Ideological differences between the political parties can lead to differing opinions on the optimal level of IRS funding and the agency’s role in the tax system. For example, one party might prioritize increased tax enforcement, while another might focus on taxpayer assistance programs. Public opinion, media coverage, and lobbying efforts from various interest groups can also shape the political landscape surrounding the budget.

The internal revenue service budget cuts hearing is raising some serious concerns. While the focus is understandably on the potential impact on tax collection and compliance, it’s worth considering the wider geopolitical context. Recent developments in the Gaza cease fire, particularly involving Russia and NATO, as detailed in gaza cease fire russia nato , highlight the need for balanced resources across different areas.

Ultimately, the IRS budget cuts hearing needs to be viewed in the light of these global issues and their potential effects on domestic policy.

Political pressure can often lead to compromise or adjustments to the budget allocation.

Legislative Processes for Approving or Rejecting Budget Cuts

Approving or rejecting budget cuts for the IRS is a multi-step legislative process. The proposed cuts are scrutinized by committees, debated on the floor of both chambers, and subjected to amendments. The process is influenced by political bargaining, compromises, and potential for compromise and negotiations. The final decision on the budget cuts, if any, is determined by a vote in both the House and Senate.

The IRS budget cuts hearing is a significant issue, and it’s prompting a lot of discussion about government priorities. While this debate unfolds, it’s worth noting the recent legal battles surrounding the rights of children conceived through frozen embryos in Alabama. The legal cases surrounding alabama frozen embryos children are raising complex questions about reproductive rights and parental responsibilities, which, in turn, highlight the need for careful consideration of the potential implications of the IRS budget cuts hearing on various sectors of society.

This entire situation really underscores the importance of balanced government spending.

| Branch of Government | Responsibilities in IRS Budget |

|---|---|

| Congress | Approves appropriations bills, conducts oversight, and amends the budget proposal. |

| Executive Branch | Formulates the budget proposal, advocates for its priorities, and allocates funds within the approved budget. |

Public Opinion and Stakeholder Engagement

Public opinion on proposed budget cuts to the Internal Revenue Service (IRS) is a complex mix of concerns and perspectives. Taxpayers, businesses, and advocacy groups have varying viewpoints, often shaped by their individual experiences and perceived impacts of the cuts. Understanding these perspectives is crucial for navigating the debate and crafting effective solutions.

Public Perception of Budget Cuts

Public perception of IRS budget cuts is largely negative, with many believing the cuts will negatively affect tax compliance and enforcement. Surveys and polls consistently show a significant portion of the public worried about the consequences of reduced IRS resources. Concerns include potential increases in tax evasion, delays in refunds, and difficulties in resolving tax disputes. This concern often extends to the broader impact on the economy and public trust in government institutions.

Stakeholder Engagement with the Budget Cuts Debate

Stakeholders, including taxpayers and businesses, are actively engaging in the budget cuts debate through various channels. This includes submitting written comments to congressional committees, participating in public hearings, and contacting elected officials directly. Organized advocacy groups and coalitions are also leveraging their networks to raise awareness and mobilize support. These efforts highlight the diverse viewpoints and potential impacts of the proposed cuts on various segments of the population.

Examples of Public Comments and Testimony

Public comments and testimonies often express concerns about the potential for increased tax fraud and the resulting financial burden on honest taxpayers. Some individuals may express support for the cuts if they believe the IRS is inefficient or wasteful. Testimonies in congressional hearings frequently underscore the importance of the IRS in collecting taxes to fund government services. Many emphasize the need for an efficient and effective IRS to ensure fair and equitable tax collection.

Public Opinion Poll Data Presentation Format

Presenting data from public opinion polls and surveys requires a clear and concise format. A table format, as detailed below, can effectively summarize key findings:

| Poll/Survey | Date Conducted | Sample Size | Key Finding | Percentage/Specific Value |

|---|---|---|---|---|

| Gallup Poll | October 2023 | 1,000 | Percentage of respondents believing IRS budget cuts will negatively impact tax compliance. | 78% |

| Pew Research Center | November 2023 | 2,000 | Percentage of respondents concerned about the impact of cuts on their own tax experience. | 65% |

| National Taxpayers Union Survey | December 2023 | 500 | Percentage of respondents who believe the IRS needs more funding for enforcement. | 82% |

This table provides a structured overview of poll results, enabling a quick comparison of different surveys and their findings. Additional details, such as the specific wording of questions and the methodology employed, should be provided in the accompanying notes.

Potential Long-Term Effects of the Hearing

The IRS budget cuts hearing serves as a crucial moment for the future of the agency. The discussion of potential reductions in funding and their impact on the IRS’s capacity to function effectively will have ripple effects across the tax system and the economy as a whole. Understanding these long-term implications is vital for crafting a sustainable and equitable tax system.

Long-Term Implications for the IRS

The outcome of the hearing directly impacts the IRS’s ability to fulfill its core mission. Sustained budget cuts could lead to reduced staffing levels, potentially hindering the agency’s ability to process tax returns efficiently, conduct audits effectively, and collect revenue accurately. This could lead to a backlog of unprocessed returns, increasing the workload on the remaining staff and potentially causing delays in refunds and tax payments.

Reduced enforcement capabilities could also affect compliance, potentially leading to a decrease in tax revenue.

Impact on Future Budget Cycles and Funding

The hearing’s outcome will significantly influence future budget cycles and funding allocations for the IRS. If the hearing highlights the detrimental effects of budget cuts on revenue collection and taxpayer compliance, it could lead to a more nuanced approach to funding decisions in the future. Conversely, if the hearing presents a case for further cuts, it could potentially set a precedent for similar budget reductions in subsequent years, which could negatively impact the IRS’s long-term effectiveness.

For example, the Tax Cuts and Jobs Act of 2017, which reduced the IRS budget, contributed to a noticeable decline in the agency’s capacity to enforce tax laws.

Potential Reforms or Changes in IRS Organizational Structure

Budget constraints might necessitate reforms in the IRS’s organizational structure. Possible changes include streamlining processes, automating tasks, and potentially re-evaluating the current staffing model. This could involve a shift toward a more technology-driven approach, including improvements in IT infrastructure and the development of new digital tools to improve efficiency. For instance, the IRS could implement more advanced data analytics and machine learning to identify potential tax fraud or errors.

Long-Term Impact on the Economy and Society

The hearing’s outcomes have far-reaching implications for the economy and society. Reduced IRS capacity could lead to a decrease in tax revenue collection, impacting government spending on vital services such as infrastructure, education, and healthcare. A less efficient tax system could lead to increased inequality, as those who are able to avoid or evade taxes could benefit at the expense of those who comply.

A recent study by the Brookings Institution indicated that a less effective IRS can lead to a significant decrease in tax revenues, ultimately impacting the economy’s ability to fund public programs. For example, if the IRS is less effective at detecting and preventing tax evasion, it could result in a loss of billions of dollars in potential revenue.

Last Word

The internal revenue service budget cuts hearing presents a complex and multifaceted discussion. The hearing explores various perspectives, potential impacts, and alternative solutions. Ultimately, the outcome of this hearing will significantly shape the future of the IRS and its role in tax administration. The long-term effects of these cuts, including potential reforms and changes to the IRS’s structure, are also discussed in detail.

FAQ Summary

What are some potential consequences for taxpayers due to the budget cuts?

Potential consequences for taxpayers include longer wait times for refunds, delays in processing tax returns, and increased difficulties in filing taxes. The cuts may also lead to reduced IRS assistance, affecting those needing support with complex tax situations.

How do political considerations influence the budget allocation for the IRS?

Political considerations play a significant role in the budget allocation for the IRS. Different political parties and ideologies often have varying priorities, which can influence how funds are allocated. This can affect the IRS’s ability to maintain its current level of service.

What alternative approaches can address budget constraints without significantly impacting IRS services?

Alternative approaches to address budget constraints include exploring strategies for streamlining IRS processes, automating tasks, and finding ways to reduce operational costs while maintaining service levels. This could involve implementing technological upgrades or reorganizing workflows.

What is the projected effect of the budget cuts on revenue collection?

The budget cuts may lead to decreased revenue collection due to lower enforcement efforts and reduced customer service. This could affect the government’s ability to fund essential services. The extent of the impact is dependent on the specific cuts and the subsequent response from taxpayers.