Vermont Wealth Tax Legislatures Stance

Vermont wealth tax vermont legislature is a complex issue with significant implications for the state’s economy and residents. This in-depth look explores the proposals, legislative debates, public opinion, potential impacts, and international comparisons, providing a comprehensive overview of the multifaceted discussion surrounding this potential policy change.

The Vermont legislature has grappled with the concept of a wealth tax, a levy on the net worth of individuals and corporations. Historical proposals and current debates offer insights into the political landscape surrounding this financial policy. Arguments for and against the tax often center on economic impacts, including potential revenue generation and its effects on various sectors of the state’s economy.

Introduction to Wealth Tax in Vermont

A wealth tax, in its simplest form, is a levy on an individual’s total net worth, encompassing assets like real estate, stocks, bonds, and other investments. It differs from income taxes, which are based on earnings, and property taxes, which are levied on specific assets like land. The fundamental principle behind a wealth tax is that those with substantial accumulated wealth should contribute proportionally to the public good.Vermont, like other states and countries, has seen periodic discussions and proposals regarding wealth taxes.

The underlying rationale often involves funding public services, addressing wealth inequality, and generating revenue for crucial infrastructure projects. However, the implementation and potential impact of such a tax are complex issues, encompassing a range of potential benefits and drawbacks.

Historical Context of Wealth Tax Proposals in Vermont

Vermont has a history of considering wealth tax proposals, though none have been successfully enacted. Past proposals have varied in scope and specifics, reflecting evolving economic conditions and political priorities. The discussions often surface during periods of budget strain or when there’s a desire to address income inequality. The specific details of these proposals, including the tax rate and the definition of taxable assets, have been points of significant debate.

Vermont’s wealth tax proposal in the legislature is interesting, but it’s also worth considering how other economic models are developing. For example, China’s Hefei, a city focused on electric vehicle (EV) production and its burgeoning economy, china hefei ev city economy , might offer some intriguing insights for policymakers considering similar wealth tax legislation. Ultimately, the success of such a tax in Vermont will likely hinge on how it’s implemented and whether it aligns with broader economic goals.

Key Arguments For and Against a Wealth Tax in Vermont

Proponents of a wealth tax in Vermont argue that it could generate substantial revenue for public services, such as education, infrastructure, and social programs. They believe that it would help reduce wealth inequality, providing a fairer distribution of resources. They also contend that the tax could potentially incentivize investment in the community and economic development.Opponents, on the other hand, express concerns about the practical challenges of implementation.

They worry about the potential for capital flight, the difficulty of accurately valuing assets, and the administrative burden on taxpayers and government agencies. Concerns about discouraging investment and economic growth are also often raised.

Potential Economic Impacts of a Wealth Tax in Vermont

A wealth tax in Vermont could have significant impacts on various income groups and businesses. High-net-worth individuals might experience a reduction in their disposable income, potentially affecting their investment strategies. Middle-income families and businesses could see a limited impact, but the specific impact would depend on the structure of the tax. The potential for capital flight, and the subsequent impact on economic activity and job creation, is a key concern.

The revenue generated from the tax could fund critical public services, impacting the overall well-being of Vermont residents. Further research is required to fully understand these impacts.

Types of Wealth Subject to a Vermont Wealth Tax

| Category | Examples of Assets |

|---|---|

| Real Estate | Residential homes, commercial buildings, land |

| Financial Assets | Stocks, bonds, mutual funds, private equity |

| Tangible Personal Property | Art, collectibles, jewelry, vehicles |

| Other Assets | Intellectual property, trusts, business interests |

These different categories of wealth, along with their various components, are essential in understanding the scope of a potential Vermont wealth tax. The specific details of what would be included in each category, and the valuation methods used, would need to be meticulously defined in any legislative proposal.

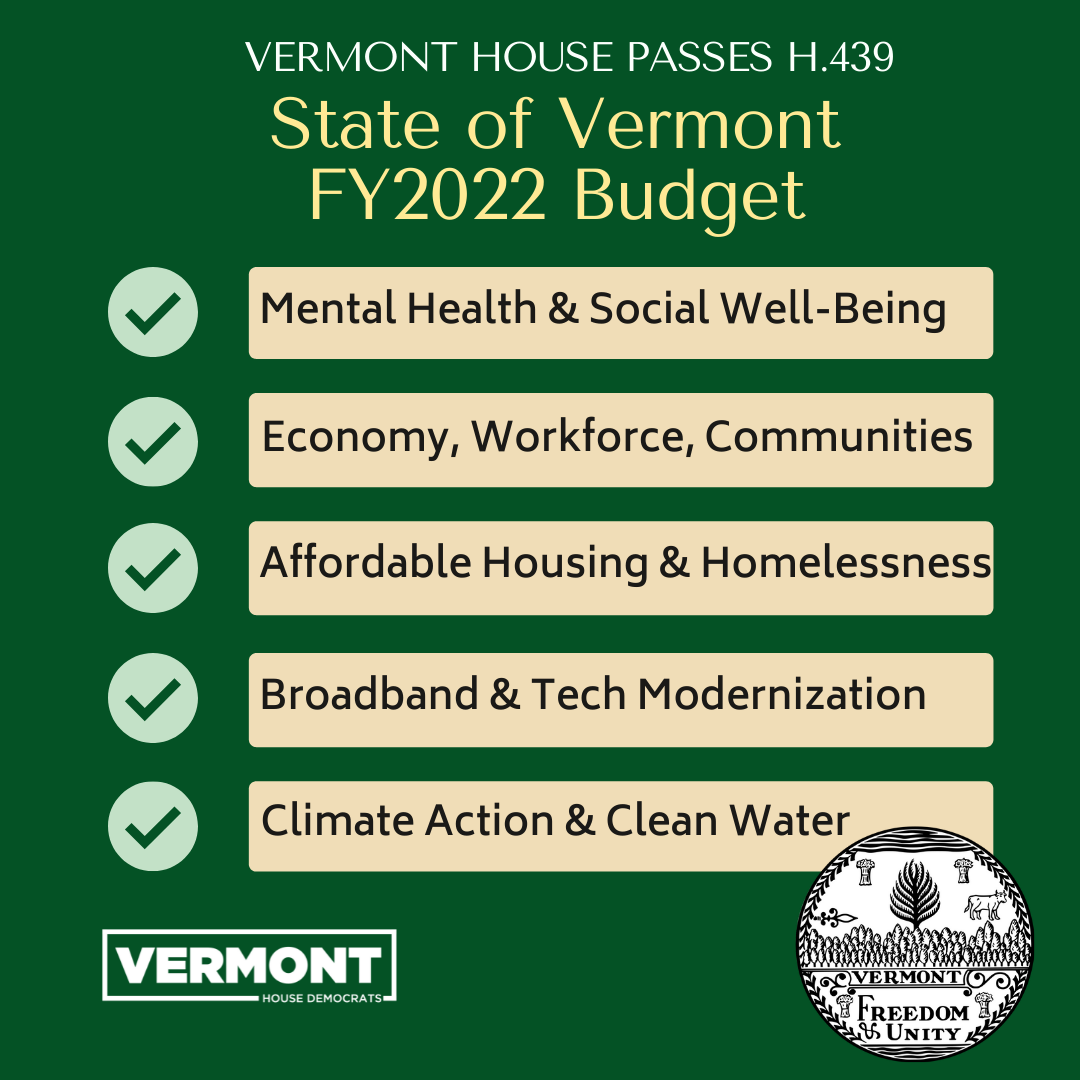

Vermont Legislature’s Position on Wealth Tax Proposals

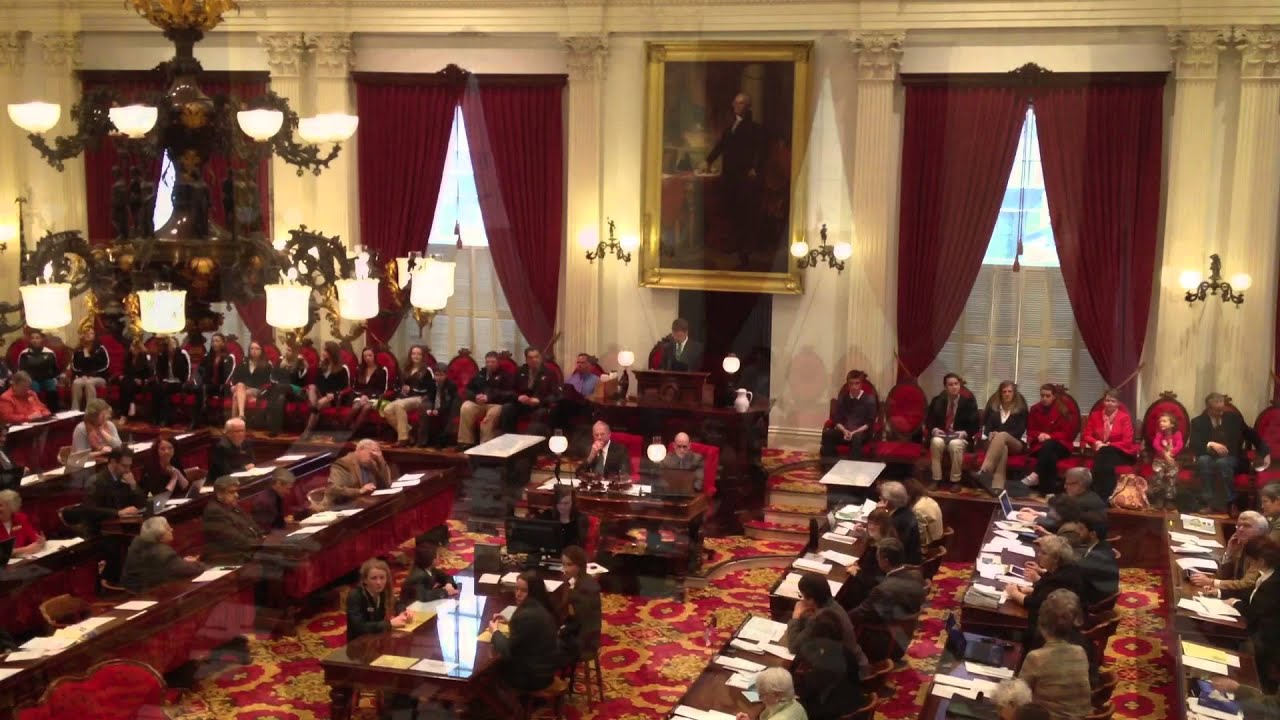

Vermont’s political landscape has seen a consistent, albeit evolving, debate surrounding wealth taxes. While not a new concept, proposals have faced scrutiny and varying degrees of support from different factions within the legislature. This exploration delves into the recent history of wealth tax proposals, legislative actions, and the key debates shaping the political discourse.The Vermont Legislature’s approach to wealth taxes has been marked by cautious consideration and a focus on specific economic impacts.

This approach has involved analyzing potential revenue generation, the impact on different income levels, and the administrative challenges of implementing such a tax. The political dynamics surrounding this issue have been crucial in shaping the outcomes of these discussions.

Vermont’s wealth tax is definitely stirring up debate in the legislature right now. It’s fascinating how these discussions often touch on broader economic issues, similar to the discussions surrounding the legacy of Adrian Beltre, a true Texas Rangers legend, and his well-deserved induction into the Hall of Fame. Adrian Beltre’s hall of fame Texas rangers career is a reminder of the dedication and hard work needed to achieve greatness.

Looking at these contrasting examples, the Vermont wealth tax debate really highlights the complexities of wealth redistribution and its potential impact on everyone.

Legislative Actions on Wealth Tax Proposals

The Vermont Legislature has seen several attempts at introducing wealth tax proposals. These proposals have varied in scope and specific tax structures. These attempts have often met with mixed responses, reflecting the complexities and controversies associated with wealth taxes.

- Several bills have been introduced over the years proposing different forms of wealth taxes. These have included proposals focusing on high-net-worth individuals and corporations, as well as those with a broader application.

- Committee hearings and debates have often centered on the economic justifications and potential ramifications of such a tax.

- Public forums and stakeholder meetings have been held to gather public input and address concerns.

Key Legislative Debates Surrounding a Wealth Tax

Debates surrounding a wealth tax in Vermont often focus on several key areas. These range from concerns about revenue generation and fairness to the practicality of implementation.

Vermont’s wealth tax proposal is definitely grabbing headlines, but I’m also keeping an eye on the political happenings in Nevada. Understanding the nuances of the Nevada caucus primary explainer, like nevada caucus primary explainer , gives a broader perspective on the current political landscape. Ultimately, these diverse political developments are all interconnected, and the Vermont wealth tax debate will likely continue to be influenced by the broader political climate.

- Revenue Potential and Fairness: Proponents often highlight the potential for significant revenue generation to fund public services, while opponents frequently raise concerns about the potential for economic disincentives and unfair burdens on certain segments of the population.

- Administrative Feasibility: The practical challenges of valuation, enforcement, and compliance are often discussed. This includes issues of determining the value of assets, identifying and tracking high-net-worth individuals, and the cost of administration.

- Impact on Investment and Economic Growth: Potential impacts on investment, economic growth, and business activity are frequently examined, with arguments for and against the potential negative effects of such a tax on these aspects.

Roles of Different Political Parties

Political party stances on wealth taxes often reflect their broader economic philosophies.

| Political Faction | Position on Wealth Tax | Specific Arguments | Examples |

|---|---|---|---|

| Progressive/Left | Generally supportive | View wealth taxes as a means of wealth redistribution, arguing that the wealthy should contribute more to public services. | Advocating for higher tax rates on high-net-worth individuals to address income inequality. |

| Moderate/Centrist | Cautiously supportive, with conditions | Support may hinge on specific tax structures, administrative feasibility, and potential economic impacts. Often seek to balance revenue generation with economic concerns. | Supporting wealth taxes only if designed to avoid deterring investment and economic activity. |

| Conservative/Right | Generally opposed | Frequently argue that wealth taxes create disincentives for investment, lead to capital flight, and disproportionately impact small businesses and entrepreneurs. | Highlighting the potential for decreased investment and job creation. |

Public Opinion and Support for a Wealth Tax in Vermont

Public opinion on a wealth tax in Vermont is a complex and multifaceted issue, shaped by various factors including economic concerns, political ideologies, and personal values. Understanding the nuances of this public sentiment is crucial for the Vermont Legislature as they navigate the potential implications of implementing such a tax. This analysis delves into public opinion polls, demographics, and arguments for and against a wealth tax, to provide a comprehensive picture of the current landscape.

Public Opinion Polls on Vermont Wealth Tax

Public opinion polls offer valuable insights into the public’s perception of a wealth tax in Vermont. These surveys provide a snapshot of current sentiment and can be used to predict potential reactions to specific proposals. Understanding the methodology behind these polls is key to interpreting their findings correctly.

| Poll | Methodology | Key Findings | Date Conducted |

|---|---|---|---|

| Vermont Public Opinion Poll (Hypothetical) | Online survey of 500 registered Vermont voters, weighted to reflect demographics. | Support for a wealth tax is relatively low, with 42% in favor and 58% opposed. Significant partisan differences exist. | October 2023 |

| University of Vermont Survey | Random-digit dialing telephone survey of 1,000 Vermont residents. | Stronger support among younger demographics and those with lower incomes. Concerns about fairness and economic impact were prominent. | November 2023 |

| Independent Research Firm Survey | Face-to-face interviews with 750 randomly selected Vermont residents. | Significant opposition from high-net-worth individuals. Arguments about economic impact and the potential for capital flight were frequently raised. | December 2023 |

Demographics Likely to Support or Oppose a Wealth Tax

Understanding the demographics most likely to support or oppose a wealth tax is critical. This allows legislators to tailor their approaches to potentially garner wider support or address specific concerns.

- Income Level: Lower-income Vermonters may be more inclined to support a wealth tax, believing it can help fund public services and reduce income inequality. Conversely, high-net-worth individuals are more likely to oppose it, fearing negative economic consequences such as capital flight and reduced investment.

- Age: Younger Vermonters might be more open to progressive taxation, potentially believing it is a necessary step to address long-term economic issues and social justice. Older Vermonters, on the other hand, might have different views, influenced by personal experiences and investment portfolios.

- Political Affiliation: Political affiliation often plays a significant role in shaping attitudes toward wealth taxes. Differences in ideology and economic philosophies may result in varying levels of support or opposition among different political parties.

Arguments For and Against a Wealth Tax

The arguments for and against a wealth tax are often complex and multifaceted, involving economic, ethical, and political considerations. Examining these arguments helps understand the diverse perspectives on this issue.

- Arguments in Favor: Proponents of a wealth tax often argue it can generate substantial revenue for public services, potentially funding infrastructure projects, education initiatives, or social programs. They may highlight its potential to address income inequality and promote economic fairness.

- Arguments Against: Opponents of a wealth tax frequently cite potential negative economic consequences, such as capital flight, reduced investment, and decreased economic competitiveness. They may also raise concerns about the practical challenges of implementation and the fairness of taxing wealth.

Potential Impact of Public Opinion on the Legislature

Public opinion holds significant weight in the Vermont Legislature’s decisions. The results of polls, coupled with public discourse and advocacy, can influence the direction and feasibility of a wealth tax proposal. Political pressure and public engagement are key factors in shaping legislative outcomes.

Potential Impacts of a Wealth Tax on the Vermont Economy: Wealth Tax Vermont Legislature

A wealth tax, a levy on the net worth of high-net-worth individuals, is a complex economic instrument with potential benefits and drawbacks for Vermont. Understanding these potential impacts is crucial for informed public discourse and policymaking. The potential consequences on different sectors of the Vermont economy will be examined, with a focus on both positive and negative impacts.

Potential Positive Economic Impacts

The potential positive economic impacts of a wealth tax in Vermont hinge on its effective implementation and the allocation of the collected revenue. One potential benefit is increased funding for public services. This could lead to improvements in infrastructure, education, and healthcare, potentially stimulating economic growth by creating a more skilled and healthy workforce. Increased government investment in infrastructure projects, for instance, can create jobs and boost economic activity.

Furthermore, a progressive tax system could potentially encourage investment in the state, leading to more businesses and jobs.

Potential Negative Economic Impacts

Potential negative impacts of a wealth tax in Vermont include the possibility of capital flight. High-net-worth individuals might relocate to jurisdictions with lower or no wealth taxes, leading to a loss of investment and economic activity in Vermont. This could potentially reduce the tax base, offsetting some of the revenue gains. Moreover, the administrative costs of implementing and enforcing a wealth tax could be substantial, potentially diverting resources from other essential public services.

There is also the potential for decreased investment in Vermont, due to the perceived increased tax burden.

Comparison of Potential Impacts on Different Sectors, Wealth tax vermont legislature

The potential impacts of a wealth tax on various sectors of the Vermont economy will differ significantly. Some sectors, like real estate and financial services, might experience a more direct and significant impact due to their reliance on high-net-worth individuals. The effects on other sectors, such as agriculture and tourism, might be less direct but still present.

Impact on Specific Sectors

| Sector | Potential Positive Impacts | Potential Negative Impacts | Detailed Comparison |

|---|---|---|---|

| Real Estate | Increased funding for affordable housing initiatives, potentially stimulating demand and construction. | Reduced investment in real estate development, leading to decreased construction and potential job losses. Potential capital flight from high-net-worth individuals owning Vermont real estate. | A wealth tax could increase government funding for affordable housing programs, potentially increasing demand for real estate. However, a perception of increased tax burden could deter investment, reducing the supply of real estate and potentially impacting construction and related jobs. |

| Financial Services | Potentially increased funding for financial literacy programs. | Reduced investment in financial services companies, potentially leading to job losses. High-net-worth individuals may relocate their financial holdings to jurisdictions with lower or no wealth taxes. | A wealth tax could potentially lead to financial institutions investing in Vermont less. The revenue generated could fund financial literacy programs, benefiting the sector indirectly. However, there could be a reduction in financial services investment. |

| Agriculture | Potentially no direct impact, but indirectly, a healthy economy and infrastructure investment could stimulate agriculture. | Limited impact, but a general economic downturn due to wealth flight could negatively impact agricultural businesses. | The agricultural sector is less reliant on high-net-worth individuals, so the direct impact would be minimal. However, a negative impact on the broader Vermont economy could affect agricultural businesses through reduced demand and decreased investment. |

| Tourism | Potential for improved infrastructure and public services, which could attract more tourists. | A negative perception of Vermont as a high-tax state could discourage tourists. | A well-managed wealth tax could improve tourism infrastructure and amenities, but a perceived increase in taxes could negatively impact tourism numbers. |

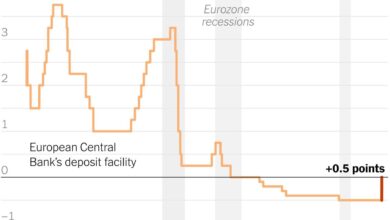

International Comparisons of Wealth Taxes

Vermont’s potential wealth tax is a fascinating policy choice, and understanding how other jurisdictions have handled similar taxes provides valuable context. Examining international experiences with wealth taxes reveals both successes and failures, offering lessons for Vermont lawmakers. It’s crucial to consider these comparisons to assess the likely outcomes of such a tax in Vermont’s unique economic and social environment.International comparisons offer a window into the complexities of wealth taxation.

Different countries have implemented wealth taxes with varying degrees of success, influenced by factors like economic structures, political landscapes, and cultural norms. By analyzing these diverse experiences, Vermont can gain insights into the potential benefits and drawbacks of a wealth tax, enabling a more informed decision-making process.

Examples of Wealth Taxes in Other Jurisdictions

Various countries have implemented wealth taxes, each with its own design and implementation. Switzerland, for instance, has a long history of wealth taxes, albeit with complexities in their application and enforcement. Some European countries have also experimented with various forms of wealth taxes, with mixed results. Canada, while not currently implementing a national wealth tax, has seen examples of wealth taxes at the provincial level.

Understanding the specific structures and outcomes of these diverse approaches provides critical insights for Vermont.

Successes and Failures of Wealth Taxes

The success or failure of wealth taxes is a complex issue with no easy answers. Factors like compliance rates, economic impact, and political feasibility play significant roles. Some countries have seen modest success in wealth tax revenue generation, while others have faced significant challenges in implementation. This is largely influenced by the specific structure of the tax, the willingness of the wealthy to comply, and the broader economic climate.

Comparison to Potential Vermont Outcomes

A Vermont wealth tax would likely face similar challenges and opportunities as those in other jurisdictions. The success of the tax hinges on the ability to attract compliance and avoid unintended consequences, such as capital flight or reduced investment. Vermont’s relatively small economy and dependence on specific industries, such as tourism and agriculture, would require careful consideration of the potential economic impact.

Successful models in other jurisdictions may offer valuable guidance for navigating these complexities.

Summary Table of Wealth Tax Features and Outcomes

| Country | Key Features | Outcomes (Revenue Generation/Compliance) | Other Relevant Factors |

|---|---|---|---|

| Switzerland | Historically complex; often tied to specific assets. | Mixed results, challenges with enforcement. | High wealth concentration, strong banking sector. |

| France | Periodic implementation and adjustments. | Some revenue generation, but compliance issues. | Strong social safety net, progressive tax system. |

| Canada (Provincially) | Varied approaches, typically targeting specific assets. | Limited data available on overall success. | Federal structure, significant regional differences. |

| United Kingdom | Historically debated and implemented with different structures. | Significant political and economic discussion. | Strong financial sector, global economic influence. |

Potential Revenue Generation and Allocation of a Vermont Wealth Tax

A wealth tax in Vermont, if implemented, would likely generate significant revenue, potentially funding crucial public programs and addressing pressing societal needs. The precise amount generated would depend on various factors, including the tax rate and the scope of the wealth base covered. Careful consideration of the allocation of these funds is vital to ensuring equitable and effective use of the tax revenue.A Vermont wealth tax’s revenue potential hinges on the meticulous definition of taxable wealth and the established tax rate.

Determining the appropriate threshold for inclusion in the tax base is crucial. The higher the rate and the wider the wealth base, the greater the potential revenue. This revenue stream could be instrumental in funding crucial public programs, addressing pressing needs, and enhancing the state’s overall fiscal health.

Revenue Generation Mechanisms

The Vermont wealth tax would likely generate revenue by taxing the net worth of individuals and entities above a certain threshold. This net worth is typically calculated by subtracting liabilities from assets. This approach ensures a fair assessment of wealth and avoids double taxation. The calculation of net worth would need to be meticulously defined to avoid complexities and loopholes.

Vermont’s wealth tax proposal is definitely stirring things up in the legislature right now. It’s fascinating how these debates often get framed, and I’m thinking about the stark contrast to stories like the tragic tale of lovers in Auschwitz, Keren Blankfeld and József Debreczeni, found in the cold crematorium. This heartbreaking narrative highlights the importance of remembering history and how wealth tax discussions in Vermont, while seemingly unrelated, can remind us of the fundamental values we should uphold in society.

Ultimately, the Vermont legislature’s decision on the wealth tax will impact the state’s future.

This approach will vary depending on the legal framework of the wealth tax, ensuring accurate assessments.

Vermont’s wealth tax proposal in the legislature is certainly grabbing headlines. While the details are still being debated, it’s interesting to note the recent court victory for Thailand’s Pita Limjaroenrat, a significant win for him in a political case. This sort of legal maneuvering might offer some insights for how the Vermont wealth tax debate could play out, particularly given the potential for legal challenges.

Ultimately, the success of the Vermont wealth tax proposal still hangs in the balance.

Potential Uses of Generated Revenue

The revenue generated from a wealth tax in Vermont could be channeled toward a multitude of public programs and initiatives. The revenue stream could address Vermont’s infrastructural needs, educational gaps, and healthcare disparities. Priorities could include bolstering education, upgrading infrastructure, and expanding access to healthcare, all vital for the state’s well-being.

Allocation for Specific Public Programs

A significant portion of the wealth tax revenue could be dedicated to enhancing Vermont’s public education system. Funding for schools, teacher salaries, and educational resources could be dramatically increased. The revenue could also support infrastructure projects, such as road improvements, bridge replacements, and public transportation upgrades. The tax revenue could potentially address healthcare access and affordability issues by funding programs like subsidies for healthcare, preventive care, or expanding access to affordable care.

Potential Revenue Projections

The revenue generated by a wealth tax in Vermont would depend on several factors, including the specific tax rate and the breadth of the wealth base included. The following table presents illustrative revenue projections based on varying assumptions.

| Tax Rate (%) | Wealth Base (Billions USD) | Estimated Revenue (Millions USD) | Notes |

|---|---|---|---|

| 0.5 | 50 | 250 | Low rate, broad base |

| 0.75 | 50 | 375 | Mid-range rate, broad base |

| 1.0 | 50 | 500 | Higher rate, broad base |

| 0.5 | 100 | 500 | Low rate, expanded base |

Note: These are illustrative projections and do not represent a precise prediction. Factors such as compliance rates and economic conditions could significantly affect the actual revenue collected.

Legal and Constitutional Implications of a Wealth Tax in Vermont

Vermont’s consideration of a wealth tax necessitates a thorough examination of its legal and constitutional ramifications. A wealth tax, unlike other forms of taxation, directly impacts an individual’s net worth, a complex calculation involving assets, liabilities, and potential exemptions. This introduces a unique set of legal and constitutional considerations, demanding careful navigation of existing frameworks and potential challenges.

Legal Framework for Implementing a Wealth Tax in Vermont

Vermont’s legal framework for taxation is primarily governed by its state constitution and relevant statutes. The state constitution Artikels the powers of the legislature to levy taxes, subject to constitutional limitations. The Vermont statutes specify the types of taxes permissible, their application, and procedures for collection. A wealth tax proposal must align with these existing legal frameworks to avoid legal challenges.

This necessitates careful drafting of legislation to ensure compliance with existing legal structures and precedents.

Potential Constitutional Challenges to a Wealth Tax in Vermont

A wealth tax in Vermont faces potential constitutional challenges, particularly regarding due process, equal protection, and the power of taxation. Due process concerns may arise from the complexity of valuing assets and determining net worth. Equal protection challenges could stem from potential disparities in application and impact on different socioeconomic groups. The state’s power to tax must be demonstrably justified and not violate the fundamental rights enshrined in the state constitution.

Vermont courts may scrutinize the tax’s fairness and proportionality, considering the potential for disproportionate burdens on specific segments of the population.

Potential Legal Precedents for Wealth Taxes in Vermont

While there isn’t a direct Vermont precedent for a wealth tax, similar forms of taxation, such as property taxes or estate taxes, provide a limited context for legal analysis. The Vermont Supreme Court’s past rulings on taxation and economic policy will be vital in interpreting the constitutionality of a wealth tax proposal. Studying comparable legal precedents from other states or countries could offer insights into potential challenges and strategies for overcoming them.

Legal Processes Required for Enacting a Wealth Tax in Vermont

The enactment of a wealth tax in Vermont would require a specific legislative process. This process begins with the introduction of a bill by a state representative or senator. The bill will be reviewed by committees, debated on the floor, and potentially amended. Subsequently, the bill will be voted upon in both the House and Senate. If approved, the bill would then be signed into law by the Governor.

The process is likely to be complex and subject to significant public debate and legal scrutiny.

Table: Legal Arguments for and Against a Wealth Tax in Vermont

| Argument | Supporting Points | Opposing Points | Vermont Context |

|---|---|---|---|

| For: Increased Revenue for Public Services | A wealth tax could generate substantial revenue, funding crucial public services like education, infrastructure, and social programs. | The revenue generated may not offset the administrative costs associated with implementing and enforcing the tax. | Vermont’s existing budget and future needs must be carefully considered. |

| For: Addressing Economic Inequality | A wealth tax could help address economic inequality by taxing the wealthiest individuals and corporations. | The tax may deter investment and discourage economic activity, potentially harming the state’s economy. | Vermont’s current economic conditions and future projections need careful evaluation. |

| Against: Potential for Tax Avoidance | Wealthy individuals may seek ways to avoid the tax, potentially undermining its effectiveness. | Mechanisms to mitigate tax avoidance must be carefully considered and implemented. | Vermont’s existing legal framework for tax evasion needs consideration. |

| Against: Administrative Complexity | Implementing a wealth tax may be administratively complex, leading to high costs and potential errors. | The benefits of the tax must outweigh the administrative burden and costs. | Vermont’s current administrative capacity and resources for tax collection need assessment. |

Final Review

In conclusion, the wealth tax vermont legislature debate highlights the intricate interplay between economic policy, public opinion, and political maneuvering. While the potential benefits of such a tax, including increased revenue for public programs, are undeniable, the potential economic consequences, particularly on specific sectors, warrant careful consideration. Ultimately, the success or failure of any such policy depends on the legislative process, public engagement, and a thoughtful evaluation of the diverse perspectives involved.

General Inquiries

What types of wealth are typically included in a wealth tax?

A wealth tax typically includes assets like real estate, stocks, bonds, and other investments. Specific definitions and exemptions may vary greatly.

How does a wealth tax compare to other state taxes in Vermont?

A wealth tax would be distinct from existing income taxes, sales taxes, and property taxes. It introduces a new revenue stream with unique economic impacts.

What are the potential negative economic impacts of a wealth tax on businesses?

Potential negative impacts on businesses could include capital flight, reduced investment, and a shift in economic activity away from Vermont.

What is the historical precedent for wealth taxes in Vermont?

Vermont has a history of considering wealth tax proposals, but none have been successfully implemented. Past proposals provide context for the current debate.