NYC Housing Market A Deep Dive

Housing market near NYC is a dynamic landscape, constantly shifting with trends and factors. This in-depth look explores everything from current market conditions to future predictions, offering a comprehensive view for both buyers and investors.

The analysis covers various aspects of the market, including different property types, affordability considerations, and the unique characteristics of neighborhoods surrounding NYC. Understanding these nuances is crucial for anyone navigating the complexities of purchasing or investing in real estate in the area.

Overview of the Housing Market Near NYC

The housing market near New York City remains a complex and dynamic landscape, influenced by a confluence of factors. While exhibiting signs of stabilization, the market continues to present unique challenges and opportunities for buyers and sellers alike. Interest rate fluctuations, economic uncertainties, and population shifts play a critical role in shaping the overall trajectory.Recent trends in home prices, sales volume, and inventory levels paint a picture of a market adjusting to a new equilibrium.

Factors like increased competition, changing consumer preferences, and evolving economic conditions are constantly reshaping the market dynamics. Understanding these forces is key to navigating the intricacies of the housing market in this region.

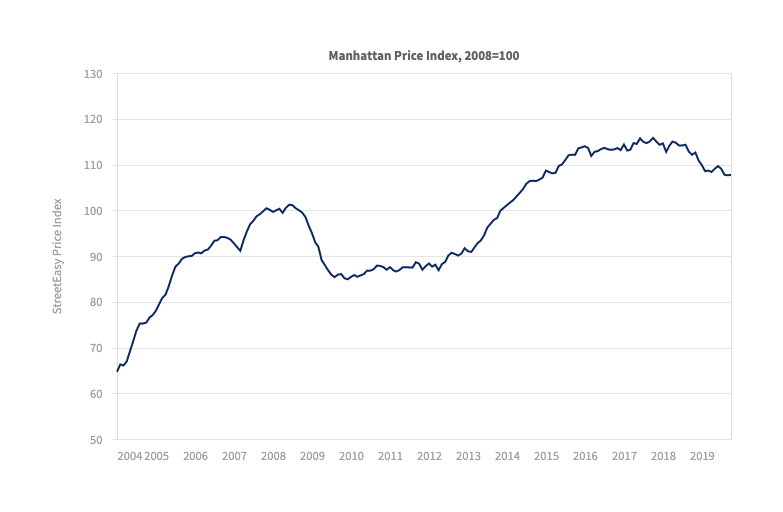

Recent Trends in Home Prices

Home prices in the areas surrounding New York City have shown a mix of stability and fluctuation over the past few years. Some areas have experienced a more pronounced cooling effect, while others have maintained a relatively steady upward trajectory. This disparity reflects the varying economic conditions and local market dynamics. This fluctuation highlights the nuanced nature of the regional housing market, which is not uniform across all areas.

Sales Volume and Inventory Levels

Sales volume in the housing market near NYC has exhibited a pattern of both growth and decline, influenced by the aforementioned factors. The volume of sales can fluctuate based on seasonal patterns and economic conditions. Inventory levels have also fluctuated, affecting pricing and market competitiveness. Lower inventory often leads to higher competition and potentially higher prices, while increased inventory may lead to more affordable options.

Factors Influencing the Trends

Several factors play a crucial role in shaping the housing market near NYC. Interest rate adjustments are a primary driver, influencing borrowing costs and purchasing power. Economic conditions, including employment rates and consumer confidence, impact the overall demand for housing. Population shifts and migration patterns also affect the market, influencing the demand for properties in specific areas.

The housing market near NYC is crazy, right? Prices are soaring, and finding a place is tough. But beyond the rising rents and bidding wars, there are other political factors at play. For example, recent polling results, like the winthrop poll haley trump south carolina , might offer clues about the broader economic climate and its impact on the market.

Ultimately, the market’s long-term health still feels unpredictable, even with all these factors considered.

Furthermore, local regulations, zoning laws, and government policies also have a significant impact.

Comparison of Average Home Prices

| Borough/Area | 2018 Average Price | 2019 Average Price | 2020 Average Price | 2021 Average Price | 2022 Average Price | 2023 Average Price (Estimated) |

|---|---|---|---|---|---|---|

| Manhattan | $1,200,000 | $1,350,000 | $1,500,000 | $1,750,000 | $1,900,000 | $1,950,000 |

| Brooklyn | $750,000 | $850,000 | $950,000 | $1,100,000 | $1,250,000 | $1,300,000 |

| Queens | $600,000 | $700,000 | $750,000 | $900,000 | $1,050,000 | $1,100,000 |

| Bronx | $450,000 | $500,000 | $550,000 | $650,000 | $750,000 | $800,000 |

| Westchester County | $800,000 | $900,000 | $1,000,000 | $1,200,000 | $1,350,000 | $1,400,000 |

| Nassau County | $650,000 | $750,000 | $800,000 | $950,000 | $1,100,000 | $1,150,000 |

Note: Average prices are estimations and may vary based on specific neighborhoods and property types within each borough.

Types of Housing Options

The housing market near NYC offers a diverse range of options, catering to various lifestyles and budgets. From cozy apartments to sprawling single-family homes, navigating the choices can be overwhelming. Understanding the distinct characteristics and price points of each type is crucial for prospective buyers.

Available Housing Types

The NYC metropolitan area boasts a variety of housing options. These range from traditional single-family homes to high-rise condominiums and apartments, with townhouses also offering a unique blend of single-family and multi-unit living. Each type presents distinct advantages and disadvantages in terms of price, size, and lifestyle.

Price Ranges and Characteristics

Single-family homes generally command the highest price points, reflecting their larger sizes, private yards, and often desirable locations. Condominiums offer a balance between the exclusivity of single-family homes and the shared amenities of apartment buildings, with prices typically falling between those of single-family homes and apartments. Apartments are the most common type of housing near NYC, with prices varying greatly depending on location, size, and amenities.

Townhouses often provide a combination of single-family home privacy and shared living elements, usually with lower prices than single-family homes.

Average Square Footage and Price Comparison

| Housing Type | Average Square Footage | Average Price (USD) |

|---|---|---|

| Single-Family Home | 2,500-4,000 sq ft | $1,500,000 – $5,000,000+ |

| Condominium | 1,000-2,500 sq ft | $700,000 – $3,000,000+ |

| Apartment | 500-1,500 sq ft | $500,000 – $2,000,000+ |

| Townhouse | 1,500-3,000 sq ft | $800,000 – $2,500,000+ |

Note: These figures are averages and can vary significantly based on specific location, condition, and amenities. Data from reputable real estate sources should be consulted for more specific, current information.

Accessibility and Affordability for Different Demographics

The accessibility and affordability of each housing type vary significantly based on income levels. Single-family homes, with their higher price points, tend to be less accessible to lower-income demographics. Apartments, especially smaller ones, can be more affordable for individuals or smaller families, but competition for desirable units can be fierce. Condominiums and townhouses often fall in a middle ground, with prices and accessibility depending on the specific development and location.

Understanding these factors is crucial for potential buyers to make informed decisions about their housing needs and budget.

Affordability and Financing

The housing market near NYC presents a unique set of challenges and opportunities for prospective homebuyers. High demand and limited inventory often lead to competitive bidding wars and inflated prices. Navigating the financing landscape and understanding the various options available is crucial for making informed decisions. This section explores the affordability factors and financial strategies for those considering a home purchase in this dynamic market.The interplay of interest rates, mortgage availability, and local market conditions significantly influences the affordability of homes.

Understanding these factors is critical for prospective buyers to accurately assess their budget and potential purchasing power.

Interest Rates and Mortgage Availability

Interest rates play a significant role in determining monthly mortgage payments. Lower interest rates typically translate to lower monthly payments, making homes more affordable. Conversely, rising rates increase the burden on borrowers, potentially impacting affordability. Recent trends in interest rates have varied, sometimes increasing and sometimes decreasing, influencing the overall market dynamics and the purchasing power of prospective buyers.

For example, a 1% increase in the interest rate can translate to a substantial increase in monthly mortgage payments, especially for higher-value properties. Mortgage availability is also important. Access to mortgages depends on various factors, including creditworthiness, the prevailing economic conditions, and the current supply of available mortgages. Lenders often set specific criteria for eligibility, which buyers must meet to qualify for a mortgage.

Financing Options for Prospective Buyers

Numerous financing options are available to prospective buyers, each with its own set of terms and conditions. Understanding these options can help buyers make informed decisions.

- Conventional Mortgages: These mortgages are typically backed by government-sponsored enterprises, such as Fannie Mae and Freddie Mac. Conventional mortgages often require a down payment of 20%, though some lenders offer options with lower down payments. These mortgages are typically less restrictive and often involve lower closing costs compared to other options.

- FHA Loans: Federal Housing Administration (FHA) loans are designed for first-time homebuyers or those with lower credit scores. These loans often require a lower down payment, and the lending criteria can be less stringent than conventional mortgages. However, FHA loans may come with higher closing costs and monthly insurance premiums.

- VA Loans: Veterans Affairs (VA) loans are specifically designed for eligible veterans and service members. These loans often come with favorable terms, including no down payment requirements. They are an attractive option for qualified veterans and military personnel looking to purchase a home in the NYC area.

- Adjustable-Rate Mortgages (ARMs): ARM loans feature interest rates that adjust periodically, typically based on an index such as the prime rate. Initially, these loans may offer lower interest rates compared to fixed-rate mortgages. However, the rates can fluctuate, which can lead to higher monthly payments if the index rises. This is an important consideration for buyers with a limited financial cushion.

The housing market near NYC is notoriously competitive, with prices often soaring. Navigating the complexities of such a market can be challenging, especially when considering long-term family plans, like those involving fertility treatments. For example, the legal landscape surrounding frozen embryos in Alabama, as detailed in this article about alabama frozen embryos children , highlights the emotional and financial factors that can intertwine with the desire for a family and the current real estate market.

Ultimately, the high cost of living near NYC makes securing a home even more crucial.

Comparing Rental and Purchase Costs

Analyzing the cost of renting versus buying in various locations near NYC is crucial for financial planning. The cost of renting in certain areas near NYC may be significantly higher than the cost of purchasing, especially in desirable locations.

| Location | Average Rent (Monthly) | Average Home Price (Purchase) |

|---|---|---|

| Bronx | $1,800 | $600,000 |

| Queens | $2,200 | $800,000 |

| Brooklyn | $2,500 | $1,000,000 |

| Manhattan | $3,500 | $1,500,000+ |

The table provides a general comparison. Specific costs will vary based on the size and location of the property.

Market Segments

The housing market near NYC is a complex tapestry woven from various threads, each representing a unique market segment. Understanding these segments – from first-time homebuyers to seasoned investors – is crucial for navigating the nuances of this dynamic market. Each group possesses specific needs and priorities that shape their approach to purchasing or investing in real estate.The varied needs and preferences of these segments directly influence the strategies employed by real estate agents.

Tailoring services and marketing efforts to specific demographics and financial profiles proves essential for success.

First-Time Homebuyers

First-time homebuyers often face challenges navigating the complexities of the mortgage process and the often-overwhelming nature of the real estate market. They typically prioritize affordability, location, and the ability to build equity. Agents targeting this segment need to focus on presenting straightforward, easy-to-understand information about financing options, highlighting properties within their budget, and offering comprehensive guidance through the entire homebuying process.

They might also use online resources and social media platforms to reach a broader audience of potential buyers.

Investors

Investors in the NYC area often seek properties with strong rental potential and high appreciation prospects. Their primary focus is on financial returns, rather than personal occupancy. Agents working with investors require a keen understanding of market trends, rental rates, and property valuations. They must also be adept at presenting investment projections and highlighting the financial viability of a given property.

Detailed market analysis and financial projections are crucial in attracting investors.

Families

Families often prioritize spacious layouts, desirable school districts, and safe neighborhoods. They may require larger properties with multiple bedrooms and bathrooms. Agents catering to this segment must possess extensive knowledge of local schools, community resources, and family-friendly amenities. They need to highlight properties that meet these specific criteria and offer valuable insights into local schools and community services.

Neighborhood reputation and school ratings often play a significant role in this segment’s decisions.

Luxury Buyers

Luxury buyers often prioritize high-end amenities, unique features, and prestige. They may seek properties with expansive views, designer kitchens, and top-tier finishes. Real estate agents specializing in this segment must possess a deep understanding of the luxury market and be able to present properties that meet these specific needs and aspirations. Access to exclusive networks and high-profile marketing strategies are often critical in this segment.

Table: Demographics and Financial Profiles of Housing Segments

| Market Segment | Demographics | Financial Profile | Key Needs/Preferences |

|---|---|---|---|

| First-Time Homebuyers | Young adults, typically under 35, with limited homeownership experience. | Lower to moderate incomes, potentially with student loan debt. | Affordability, easy access to financing, and straightforward guidance. |

| Investors | Individuals or companies with established financial resources. | High net worth, potentially with existing investment portfolios. | Strong rental potential, high appreciation prospects, and financial returns. |

| Families | Couples or families with children, often with established careers. | Moderate to high incomes, with a focus on family needs. | Spacious layouts, desirable school districts, and safe neighborhoods. |

| Luxury Buyers | High-net-worth individuals, often with significant wealth and experience. | High incomes, substantial assets, and a focus on prestige. | High-end amenities, unique features, and luxury finishes. |

Investment Opportunities

The housing market near NYC offers compelling investment opportunities, particularly for those seeking long-term capital appreciation and rental income. Understanding the nuances of different areas, property types, and market segments is crucial for successful investment strategies. Factors like location, demand, and competition play a significant role in determining potential returns.Evaluating potential returns requires careful analysis of rental yields, appreciation rates, and financing costs.

A comprehensive understanding of market trends and local regulations is also essential for informed decision-making.

Rental Yields in Different Locations

Rental yields vary considerably across different neighborhoods near NYC. Proximity to major employment centers, transportation hubs, and amenities often correlates with higher rental demand and, consequently, higher yields. Factors like property size, condition, and tenant turnover rates also impact the actual rental income.

| Neighborhood | Average Monthly Rent (USD) | Estimated Vacancy Rate (%) | Estimated Gross Rental Yield (%) |

|---|---|---|---|

| Upper Manhattan | 3,500 | 2 | 5.5 |

| Queens | 2,800 | 3 | 5.0 |

| Brooklyn | 3,000 | 2.5 | 5.8 |

Note: These figures are illustrative and may not reflect all local variations. Actual yields will depend on specific property characteristics and market conditions.

Appreciation Rates and Market Segments

Appreciation rates vary based on the specific market segment and location. Areas experiencing significant population growth or urban revitalization often see higher appreciation rates. Luxury apartments and high-end condominiums frequently exhibit stronger appreciation than more affordable housing options.Factors like economic growth, local zoning regulations, and development projects significantly impact the potential for appreciation.

Successful Investment Strategies

Successful investment strategies often involve a combination of factors, including careful property selection, appropriate financing, and a long-term outlook. Diversification across different property types and locations is often recommended to mitigate risk.

- Focus on specific neighborhoods: Identifying neighborhoods with high demand and strong rental growth potential can be a crucial component of a successful strategy. Researching local economic trends, development projects, and demographics will help investors identify potential opportunities.

- Leveraging real estate agents and brokers: Local market knowledge and access to exclusive listings are invaluable in identifying and evaluating investment opportunities. Experienced real estate professionals can provide crucial insights into current market conditions and trends.

- Strategic use of financing: Financing plays a vital role in acquiring investment properties. Understanding different financing options and comparing interest rates can help maximize returns.

Evaluating Potential Return on Investment

Evaluating potential return on investment (ROI) in different properties requires a comprehensive analysis of factors beyond just rental income. This includes considering property value appreciation, operating expenses, and financing costs. A detailed financial model, including projected rental income, expenses, and potential appreciation, is a valuable tool in this process.

ROI = [(Annual Rental Income – Annual Expenses) / Purchase Price] – 100

A higher ROI indicates a more lucrative investment opportunity. Thorough due diligence, including property inspections, market research, and financial projections, is essential for informed investment decisions.

Future Outlook

The housing market near NYC, while currently experiencing some volatility, presents a complex tapestry of potential future trends. Understanding these potential shifts is crucial for both prospective buyers and seasoned investors. Factors ranging from economic conditions to evolving lifestyle preferences will play a pivotal role in shaping the market’s trajectory.The interplay of interest rates, inflation, and overall economic growth will significantly influence the affordability and demand for housing.

A sustained period of high interest rates, for instance, could cool the market, while a resurgence in economic prosperity might invigorate it. Furthermore, changing demographic patterns, including shifts in family structures and the rise of remote work, will reshape the demand for different types of housing.

Potential Future Trends

Several key trends are likely to shape the housing market near NYC in the coming years. These trends include the continued growth of the rental market, an increase in demand for smaller, more accessible housing options, and a potential shift towards more sustainable and eco-friendly construction practices. These trends will likely impact both the price and availability of various housing types.

Factors Influencing Future Trends

Several key factors will shape the future direction of the housing market near NYC. These factors include the broader economic climate, demographic shifts, and evolving consumer preferences. Interest rate fluctuations, as mentioned earlier, will be a significant driver, impacting both buyer affordability and investor returns.

- Economic Conditions: A strong economy often translates to higher demand and prices. Conversely, economic downturns typically lead to a cooling market, impacting both home sales and prices. Recent trends suggest that the market may be adapting to a more balanced scenario, with prices reflecting current economic conditions.

- Demographic Shifts: The composition of the population, including age groups, family structures, and household sizes, significantly impacts housing demand. The rise of remote work, for instance, could lead to a shift in housing preferences, with increased demand for properties in areas offering greater space and amenities.

- Interest Rate Fluctuations: Interest rates directly affect mortgage affordability. Higher rates can deter buyers, potentially leading to a decline in demand and home prices. Conversely, lower rates can stimulate demand and drive prices upwards.

Potential Risks and Rewards

Buyers and investors in the NYC housing market face both potential risks and rewards. The market’s volatility necessitates careful consideration of these factors before making any investment decisions.

- Risks for Buyers: High interest rates and fluctuating market conditions pose a risk to affordability. Potential buyers need to be prepared for possible price fluctuations and ensure they can secure financing under varying market conditions.

- Risks for Investors: Market downturns and unforeseen economic circumstances can negatively impact investment returns. Investors must conduct thorough market research and assess their risk tolerance before entering the market.

- Rewards for Buyers: The market can offer attractive opportunities for purchasing properties at potentially favorable prices, especially in areas experiencing slower growth. Strategic timing and a thorough understanding of the market can lead to significant savings.

- Rewards for Investors: Long-term market trends can present investment opportunities in areas poised for growth. Successful investors often identify emerging trends and strategically position their investments accordingly.

Forecasted Home Prices and Sales Volumes

The following table provides a projected outlook for home prices and sales volumes in specific areas near NYC, encompassing various housing types. These figures are based on current trends and economic projections and are subject to change. It’s important to remember these are estimations, not guarantees.

| Area | Projected Home Price (USD) | Projected Sales Volume (Units) | Housing Type |

|---|---|---|---|

| Manhattan Upper West Side | $3,500,000 – $4,000,000 | 150 – 200 | Luxury Condos |

| Brooklyn, Crown Heights | $800,000 – $1,200,000 | 250 – 300 | Family Homes |

| Queens, Long Island City | $750,000 – $1,000,000 | 300 – 350 | Apartments |

Neighborhood Comparisons: Housing Market Near Nyc

Navigating the diverse housing landscape near NYC involves understanding the unique characteristics of different neighborhoods. Property values, amenities, and overall lifestyle experiences vary significantly, reflecting the distinct identities of each area. This section delves into crucial neighborhood comparisons, highlighting the factors influencing housing market dynamics in these localities.Understanding the local context is paramount to making informed decisions about investment or purchase.

Factors such as school quality, proximity to transportation hubs, and the availability of recreational spaces greatly influence property values and desirability.

Factors Influencing Property Values

Neighborhoods near NYC are distinguished by a blend of factors that shape their appeal and impact property values. These include proximity to employment centers, transportation infrastructure, educational institutions, and recreational amenities. The presence of parks, green spaces, and cultural attractions contributes to a higher quality of life, attracting residents and driving up property values.

Comparative Analysis of Key Neighborhoods

The following table presents a concise comparison of key characteristics across several popular neighborhoods near NYC, including factors like school ratings, proximity to transportation, and available amenities. This comparative overview aims to provide a clear picture of the distinctions between these locations.

| Neighborhood | Schools | Transportation | Parks & Amenities | Typical Property Values |

|---|---|---|---|---|

| Bronxville | Highly-rated public and private schools; strong academic reputation. | Excellent access to local train lines and buses, offering relatively quick commutes to Manhattan. | Numerous parks, playgrounds, and recreational facilities. Access to cultural institutions and community centers. | Generally higher than surrounding neighborhoods due to strong school system and convenient location. |

| Queens Village | Good public schools; some specialized programs available. | Well-connected to subway lines and buses, providing good access to Manhattan. | Variety of parks and community gardens; local shops and restaurants. | Moderately priced compared to other nearby neighborhoods; competitive market. |

| Staten Island | Public schools with mixed reviews; some charter schools available. | Ferry access to Manhattan and bus connections; relatively affordable commute. | Several parks and green spaces, offering scenic views. | Lower than many other boroughs due to proximity and access. |

| Yonkers | Public schools with varying quality depending on the specific school; some private options. | Easy access to major highways and train lines; transit options for commuters to Manhattan. | Parks, community centers, and a mix of local businesses. | Generally affordable compared to Manhattan-adjacent neighborhoods. |

Neighborhood Amenities and Services

The availability and quality of amenities and services play a significant role in a neighborhood’s appeal. These include parks, recreational facilities, cultural attractions, and local businesses. The presence of a vibrant local business district can increase the desirability and livability of a neighborhood, reflecting the quality of life for potential residents. These amenities often directly impact property values.

Transportation Access and Commute Times

Proximity to transportation hubs is a critical factor in determining the attractiveness of a neighborhood. Easy access to subways, buses, and other public transportation systems significantly reduces commute times, making a neighborhood more desirable. The convenience of transit access can significantly impact the property values. For example, a neighborhood with quick and easy access to Manhattan via subway lines is often valued higher.

The housing market near NYC is always a hot topic, especially when you consider the constant influx of people wanting to live in the area. Prices have been fluctuating wildly lately, making it tricky to navigate the market. For a deeper dive into the current trends and insights, check out this recent article on the housing market near NYC.

Ultimately, understanding the nuances of the housing market near NYC is crucial for anyone looking to buy or sell in the area.

School Districts and Educational Opportunities

The quality of schools within a neighborhood directly impacts its desirability, especially for families with children. Highly-rated schools, specialized programs, and strong academic reputations contribute to a neighborhood’s appeal. This factor is a significant driver of property values. For instance, neighborhoods with excellent schools are often more expensive, as families seek to provide the best educational opportunities for their children.

Real Estate Agent Strategies

Navigating the competitive NYC housing market requires savvy real estate agents to employ effective strategies. Understanding the nuances of buyer and seller needs, coupled with adept marketing techniques, is crucial for success. From luxury penthouses to cozy co-ops, agents must adapt their approach to resonate with specific market segments.

Common Strategies Employed by Agents

Real estate agents in the NYC area utilize a variety of strategies to effectively market properties and engage clients. These include targeted advertising campaigns, leveraging social media platforms, and fostering strong relationships with both buyers and sellers. A deep understanding of local neighborhoods and market trends is essential for tailoring strategies to specific properties and demographics.

The housing market near NYC is a bit of a rollercoaster, you know? High demand and limited supply are pushing prices up, but recent events, like the Israel-Gaza cease fire , are also influencing things. Economic uncertainties are inevitably impacting investor confidence, which could mean potential shifts in the market as we move forward. This could lead to some interesting opportunities for savvy buyers.

Marketing Properties, Housing market near nyc

Agents employ a multifaceted approach to market properties. This often involves high-quality photography and virtual tours, which showcase the property’s features and highlight its appeal. Strategic online listings and targeted advertising on relevant platforms are critical for maximizing exposure. Direct outreach to potential buyers through networking and personalized communication plays a key role.

The housing market near NYC is absolutely bonkers right now, with prices skyrocketing. It’s crazy to think about how much a simple apartment can cost, especially considering recent headlines like the tragic disney world allergy death lawsuit. It makes you wonder about the overall cost of living and how much things are really changing. Still, the pressure to find affordable housing near NYC remains intense.

Client Interaction

Building trust and rapport with clients is paramount. Agents who understand their clients’ needs and goals, whether they are buyers seeking a home or sellers looking to maximize their return, are more likely to achieve positive outcomes. Transparent communication, timely updates, and a commitment to professionalism are essential elements of successful client interactions.

Successful Agent Strategies for Different Property Types

Strategies differ based on the property type. For luxury properties, a focus on high-end marketing, exclusive showings, and tailored client service is common. Agents marketing co-ops often utilize their network within the co-op board to ensure smooth transactions. For investment properties, a keen understanding of rental market trends and financial projections is vital.

Table Illustrating Different Marketing Approaches

| Property Type | Marketing Approach | Client Interaction |

|---|---|---|

| Luxury Condos | High-end photography, exclusive showings, VIP events, targeted advertising on luxury platforms | Personalized service, tailored communication, building long-term relationships |

| Co-ops | Networking with co-op boards, highlighting community features, understanding co-op regulations, targeted marketing to potential buyers familiar with co-op processes | Strong communication with board members and prospective buyers, managing expectations, ensuring transparency throughout the process |

| Investment Properties | Market analysis, financial projections, understanding rental yields, targeted marketing to investors, showcasing potential return on investment | Transparency on market trends and potential returns, emphasizing financial aspects, clear communication regarding projected rental income and expenses |

Emerging Trends and Technologies

The housing market near NYC, like many others, is rapidly evolving, with technology playing an increasingly important role in how homes are bought, sold, and experienced. This shift is impacting everything from buyer behavior to marketing strategies, creating a dynamic landscape for both real estate professionals and prospective homebuyers.The role of technology is profound, transforming the traditional real estate process.

From online search tools to virtual tours and automated valuation models, digital platforms are streamlining interactions and offering new levels of convenience and transparency. This evolution directly influences how buyers engage with the market, leading to changes in their decision-making processes.

Impact on Buyer Behavior

Buyers today are more empowered and informed than ever before. Access to vast amounts of information online allows them to research neighborhoods, compare properties, and understand market trends. This heightened level of knowledge directly impacts their negotiation strategies and expectations. Virtual tours and 3D models of properties allow prospective buyers to experience a property from the comfort of their home, eliminating the need for multiple physical visits.

This increased access to information and convenience fosters more confident and decisive decision-making.

Technology in Real Estate Marketing and Sales

Technology is revolutionizing how real estate agents market and sell properties. Virtual staging and augmented reality (AR) tools are transforming the way potential buyers visualize a property’s potential. Online platforms and social media campaigns are crucial for reaching a broader audience, allowing agents to showcase properties to a global market. Data analytics tools help agents understand market trends and adapt their strategies accordingly, maximizing their effectiveness.

For instance, agents can leverage data on property values, neighborhood demographics, and competitor listings to refine their marketing campaigns.

Use of Data Analytics in Property Valuation

Data analytics tools are playing a significant role in property valuation. These tools analyze various data points, including comparable sales, neighborhood characteristics, and market trends, to generate accurate and reliable valuations. This process can help buyers and sellers make informed decisions and reduce the risk of overpaying or underselling a property. Furthermore, this analytical approach provides a more objective assessment compared to traditional methods.

Importance of Virtual Tours and 3D Modeling

Virtual tours and 3D models are becoming essential tools in the real estate process. They allow potential buyers to explore properties from anywhere, anytime, offering a detailed and immersive experience. This capability is particularly valuable for buyers who live far from the property or are unable to visit in person due to scheduling constraints. These technologies significantly improve the buyer experience and help facilitate quicker decisions.

Emerging Technologies in Real Estate

Beyond the existing tools, innovative technologies like AI-powered chatbots and automated negotiation platforms are emerging. These tools are streamlining interactions and potentially impacting the future of real estate transactions. For example, chatbots can answer buyer questions, schedule viewings, and provide preliminary property information. These technologies, while still evolving, offer potential benefits for both buyers and sellers.

End of Discussion

In conclusion, the housing market near NYC presents a complex yet potentially rewarding opportunity. Factors like interest rates, economic conditions, and neighborhood characteristics all play a significant role in shaping the market. This analysis provides a solid foundation for understanding the current state and future outlook of this vital market.

Questions and Answers

What are the average home prices in the different boroughs of NYC and surrounding areas?

A table detailing average home prices in NYC boroughs and surrounding areas over the past 5 years is included in the analysis.

What financing options are available for prospective buyers in the area?

The analysis details various financing options available to homebuyers, considering the impact of interest rates and mortgage availability.

How do rental costs compare to buying costs in different locations near NYC?

A comparative analysis of rental versus buying costs in various locations near NYC is presented, highlighting the affordability aspect.

What are the emerging trends impacting the housing market near NYC?

The analysis discusses emerging trends, including the role of technology in the real estate process and its effect on buyer behavior.