IRS Tax Filing Free Online Your Guide

IRS tax filing free online opens up a world of possibilities for taxpayers, offering a straightforward and convenient way to handle their tax obligations. Whether you’re a seasoned tax filer or a first-timer, understanding the process and the various options available is crucial. This guide delves into the intricacies of free online filing, exploring eligibility requirements, different services, the filing process, security, support, common errors, and more.

Navigating the complexities of tax season can be daunting. Free online filing services simplify the process, making it accessible to everyone. From the initial steps to the final submission, this resource provides a comprehensive overview, ensuring a smooth and successful tax filing experience.

Introduction to Free Online IRS Tax Filing

Free online IRS tax filing is a convenient and accessible way for taxpayers to prepare and submit their tax returns electronically. This service eliminates the need for paper forms and traditional tax preparation methods, offering a streamlined process for individuals and families to fulfill their tax obligations. It’s a significant time-saver, especially for those who may not have the expertise or time to manually complete tax forms.This method is particularly beneficial for taxpayers who prefer digital interactions and seek efficiency in handling their tax responsibilities.

It’s a valuable resource for those who may be unfamiliar with complex tax regulations, as the software can often guide them through the process. The ease of use, coupled with potential cost savings, makes it an attractive option for many.

Various Scenarios for Taxpayers

Free online filing services cater to a wide range of taxpayers, from simple returns to more complex ones. Individuals with straightforward financial situations, such as those with only one job and limited deductions, can benefit greatly from this service. This also applies to students or self-employed individuals with limited deductions or income.

Benefits and Advantages of Online Filing

The advantages of using free online filing options extend beyond just convenience. The primary benefit is the significant time savings compared to traditional methods. Filing electronically eliminates the need for manual calculations, form completion, and mailing, which often translates to considerable time savings. Moreover, the accuracy of tax preparation can be improved as the software often checks for errors and inconsistencies.

This reduces the chance of errors and potential penalties.

Different Types of Free Online Filing Services

Several different types of free online filing services are available, each with its own set of features and capabilities. Some services are offered by the IRS directly, while others are provided by third-party tax preparation software companies. Each platform has varying levels of complexity in their software, catering to different levels of tax expertise and needs. A key factor to consider is the software’s capability to handle various tax situations.

For instance, some software might excel in handling simple returns, while others may provide support for complex situations like self-employment income or multiple properties.

Eligibility and Requirements

Free online IRS tax filing services are a valuable resource for taxpayers, particularly those with limited financial resources or technical expertise. Understanding the eligibility criteria ensures that you can utilize these services effectively and avoid potential complications. These services aim to simplify the tax filing process, promoting accessibility for all qualified individuals.Accessing these services is contingent upon meeting specific requirements.

These requirements, often based on income and other factors, help the IRS target resources effectively to those who benefit most from them. Knowing these guidelines helps taxpayers determine their eligibility and avoid unnecessary delays or complications during the filing process.

Income Limitations

The IRS offers free online filing services to taxpayers who meet specific income guidelines. These income limitations are designed to ensure that those who need assistance the most can access the service.

- Generally, the income limits are tied to the IRS’s Free File program. These limits vary depending on filing status (single, married filing jointly, etc.) and the specific service provider.

- Taxpayers should consult the Free File Fillable Forms website for the most up-to-date information on income limits.

- These limits are usually expressed in terms of adjusted gross income (AGI). AGI is a measure of a taxpayer’s income after certain deductions and adjustments are made.

Specific Documentation Requirements

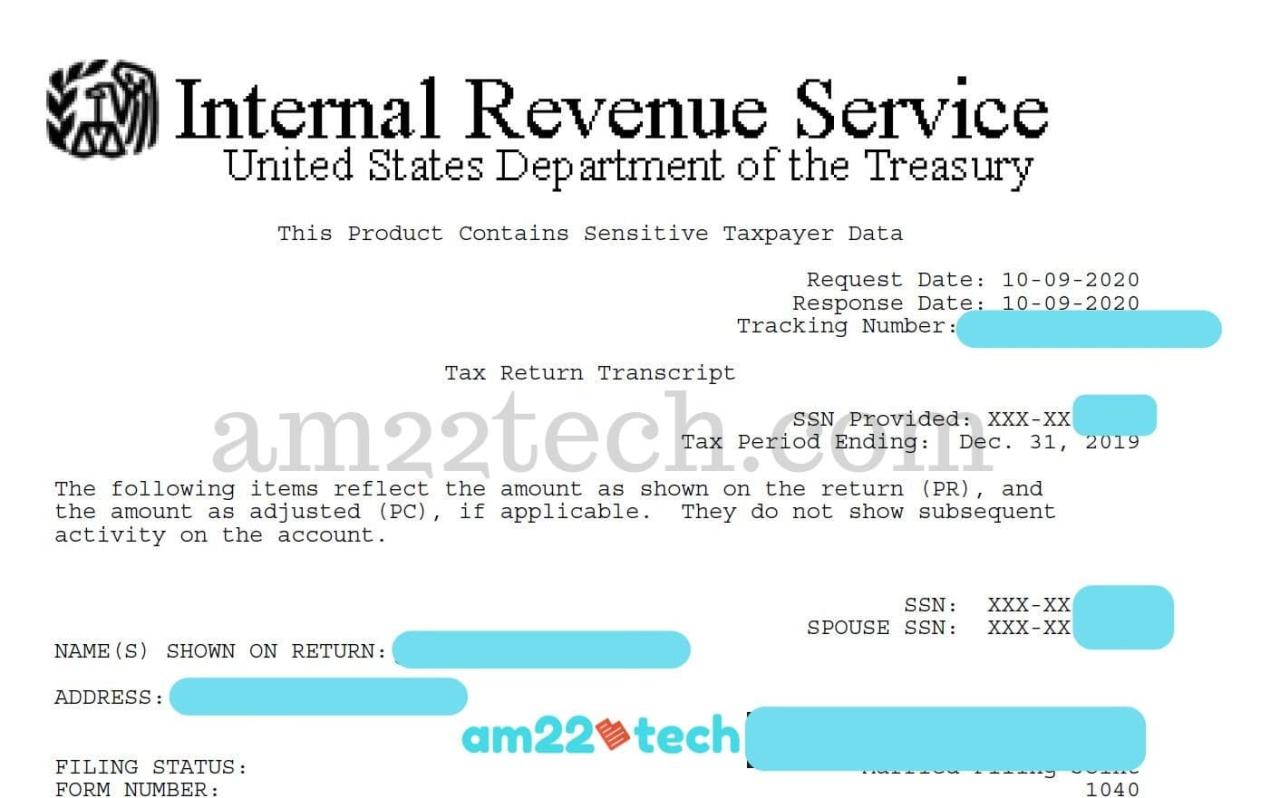

The specific documents required for free online filing vary depending on the situation and the tax preparation software used. Usually, you will need to provide the same basic documentation as you would with a paid tax preparer, but the specific forms may vary depending on the specific program.

- Social Security numbers (SSN) for all individuals on the return.

- Taxpayer identification numbers (TIN) for dependents or other individuals with income.

- Proof of income, such as pay stubs, W-2 forms, or 1099 forms.

- Bank account information for direct deposit of refunds.

- Documentation of any deductions or credits claimed, like those for dependents, education expenses, or charitable contributions.

Qualifying and Non-Qualifying Situations

Understanding the eligibility criteria helps you make informed decisions about using free online filing services.

- Qualifying situations: A taxpayer with a low-to-moderate income, who needs help filing their tax return and who has the necessary documentation to complete the return, can often use these free services. For example, a single individual with a verifiable income of under $73,000 annually may be eligible for many free file programs.

- Non-qualifying situations: If your income is significantly higher than the established limits, or if you are unable to provide the required documentation, you may not qualify. Complex tax situations, such as those involving foreign income or investments, may not be best suited to free online filing services. Consider consulting a paid tax professional if your tax situation is complicated.

Comparing Free Filing Options

Navigating the world of free IRS tax filing options can feel overwhelming. Different services cater to various needs and complexities. Understanding the strengths and weaknesses of each platform is crucial for selecting the best tool for your specific tax situation. This comparison will help you make an informed decision.Choosing the right free online tax filing service depends on factors such as your income level, filing status, and the complexity of your tax situation.

Some services are better suited for simple returns, while others offer more advanced features for those with intricate financial situations. By understanding the capabilities of each service, you can select the best fit for your tax needs.

Free File Fillable Forms

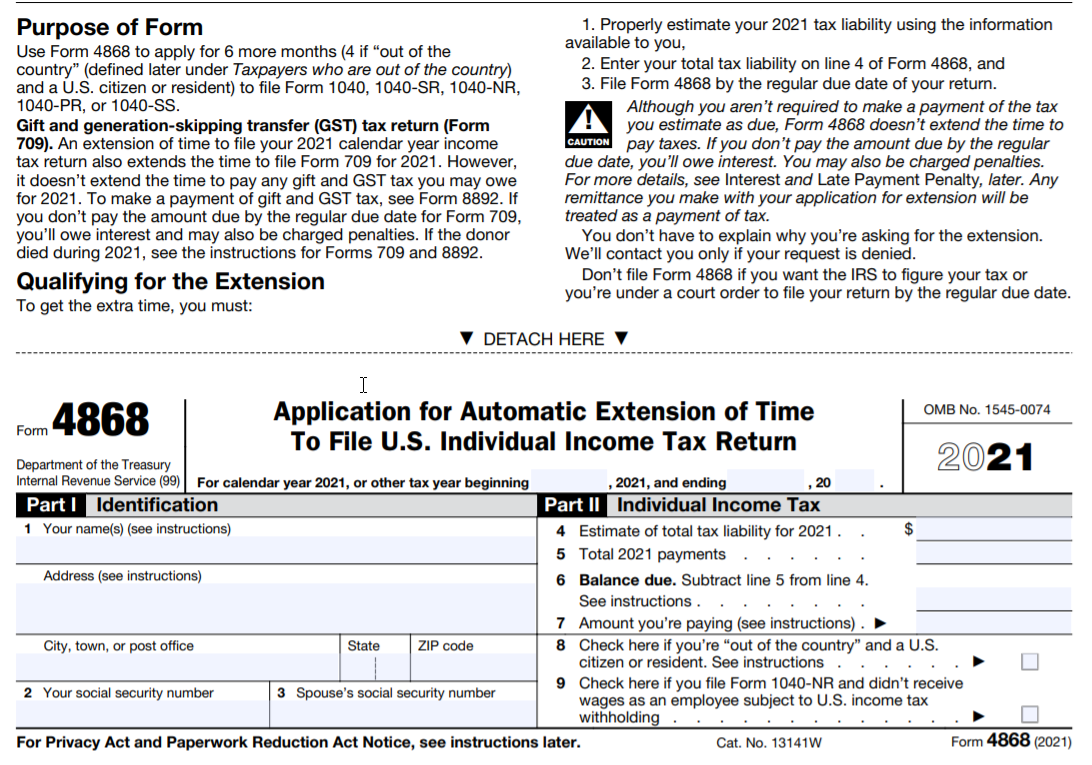

The IRS offers free fillable forms as a straightforward option for those with uncomplicated tax situations. This method involves downloading tax forms, filling them out manually, and then electronically submitting them to the IRS. This option is best for those who prefer a hands-on approach and are confident in their ability to accurately complete the forms.

Filing your IRS taxes online for free is a great option for many, but recent court decisions, like the Koch Chevron deference supreme court ruling, highlight the complexities of the legal landscape that can affect how these services are offered and maintained. Fortunately, free online IRS tax filing options are still widely available and can save significant time and effort compared to traditional methods.

Free File Software Providers

Many reputable tax software companies offer free tax filing services through partnerships with the IRS. These services provide pre-filled forms and intuitive guidance through the filing process. This option is beneficial for users who need assistance navigating complex tax situations or who prefer a guided approach.

Filing your IRS taxes online for free is a great way to save time and effort. It’s super helpful, especially when you’re thinking about all the things you need to do for your taxes. Speaking of saving time and effort, did you know that Adrian Beltre, a legendary Texas Ranger, is now a Hall of Famer? Adrian Beltre hall of fame Texas Rangers is definitely a notable accomplishment! Regardless of whether you’re a baseball fan or not, this recognition deserves a mention, and it highlights how dedication and hard work in sports can lead to amazing achievements.

Now back to taxes, I’m sure it’s a relief to know that free online filing options are available for the upcoming tax season!

Comparison Table

| Feature | Free File Fillable Forms | Free File Software Providers |

|---|---|---|

| Security Features | The IRS ensures the security of the forms. Users should maintain their own security protocols, including using strong passwords and secure internet connections. | Security features vary among providers, with some offering enhanced security measures such as encryption and multi-factor authentication. |

| Support Options | Limited support is available through IRS resources and potentially the software company. | Software providers typically offer various support channels, including FAQs, online help, and phone support. |

| Filing Timeframes | Filing time depends on the user’s ability to accurately complete the forms. | Filing time is generally quicker due to the automated nature of the software. |

| Complexity of Tax Situations | Suitable for simple tax returns. | Better suited for various levels of tax complexity. |

| User Experience | Requires manual input and careful attention to detail. | Generally more user-friendly with guidance and automated tools. |

Features and Functionalities

Free File Fillable Forms provide basic functionalities, enabling users to directly input their information into the downloaded forms. On the other hand, Free File Software Providers offer more advanced features, such as calculating tax liability, suggesting deductions, and generating personalized tax forms.

Pros and Cons

- Free File Fillable Forms: Pros: Simple, straightforward, and completely free. Cons: Requires meticulous attention to detail, potentially time-consuming, and limited support.

- Free File Software Providers: Pros: Guided assistance, faster filing, more advanced functionalities. Cons: May have limited free options or require a paid version for advanced features.

Filing Process Overview

Navigating the IRS’s free online tax filing system can feel daunting, but it’s actually quite straightforward. Breaking down the process into manageable steps makes the entire experience less intimidating. Understanding the required information at each stage will help you complete your return efficiently and accurately. This guide provides a clear roadmap for successful free online tax filing.

Account Creation

Setting up your account is the initial step. This involves providing personal information and creating a secure login. Accurate data entry is crucial for avoiding errors later. The IRS’s system is designed to verify your identity and ensure the security of your information.

- Gathering necessary information: You’ll need your Social Security number, name, address, and date of birth. Also, gather your previous year’s tax return documents (if available) and any relevant financial records, such as W-2 forms, 1099 forms, and other income documentation.

- Creating a user account: The IRS portal will guide you through creating an account, typically requiring a username and password, and potentially a security question. Follow the on-screen prompts carefully to avoid any hiccups in account creation.

- Verifying your identity: This step may involve confirming your identity using information from your tax return or other documentation. Be prepared to provide the requested verification details.

Data Entry

Once your account is set up, you’ll need to enter your financial information. This usually involves providing details about your income, deductions, and credits. Carefully review each field and double-check the accuracy of your entries.

Filing your IRS taxes for free online is super convenient, but sometimes it’s hard to find the right resources. Thinking about the horrific realities of the Holocaust, like the tragic story of lovers in Auschwitz, Keren Blankfeld and József Debreczeni, found in the cold crematorium, this heartbreaking news piece reminds us of the importance of taking the time to complete your taxes properly.

Luckily, there are many helpful online tools to assist with your tax filing needs.

- Income details: Enter the details of all sources of income. This includes wages, salaries, tips, self-employment income, and any other income reported to the IRS. Include relevant documents, like W-2s and 1099s, to verify the accuracy of your income entries.

- Deductions and credits: The IRS provides information about available deductions and credits, such as the standard deduction, itemized deductions, and various tax credits. You can claim these based on your specific circumstances and relevant supporting documentation.

- Reviewing and double-checking: Before submitting your return, thoroughly review all entered data. Carefully scrutinize each section for any potential errors. If you’re unsure about any part, consult the IRS website or seek professional advice.

Submission, Irs tax filing free online

Submitting your tax return is the final step in the process. After reviewing and confirming all information, you’ll submit your return for processing. Be sure to keep a copy of your return for your records.

- Reviewing your return: Carefully review the final version of your return to ensure accuracy before submission. Pay close attention to any warnings or error messages displayed.

- Submitting your return: Once you’re satisfied with the accuracy of your return, submit it electronically. Keep a copy for your records.

- Receiving confirmation: You’ll receive a confirmation message once your return is submitted. This message typically includes a unique tracking number for your return.

Security and Privacy Considerations: Irs Tax Filing Free Online

Filing your taxes online involves entrusting sensitive personal information to third-party services. Therefore, understanding the security measures in place is crucial for a smooth and worry-free experience. This section delves into the security protocols employed by free online tax filing systems, ensuring your data remains protected.Taxpayers’ financial information is inherently sensitive. Free online tax filing platforms recognize this, and their security protocols are designed to protect your data throughout the entire process.

This includes measures to prevent unauthorized access and maintain the confidentiality of your personal and financial details.

Figuring out your IRS tax filing online for free is super helpful, right? But, what about those important decisions after the tax filing? Like choosing a baby’s name or, perhaps, the family’s last name? Knowing how to choose a baby’s last name, apellido bebe madre padre , can be a really interesting and significant part of the whole process.

Once you’ve settled on that, you can get back to those free IRS tax filing options with ease.

Security Measures Employed

Free online tax filing platforms employ various security measures to protect taxpayer information. These measures are designed to prevent unauthorized access and maintain the confidentiality of sensitive data. These include robust encryption protocols, secure server infrastructure, and multi-factor authentication.

Data Protection During Filing

Data protection during the tax filing process is paramount. The security of your information is maintained through various techniques, including secure socket layer (SSL) encryption, which safeguards your data during transmission between your computer and the tax filing platform. Additionally, data is often stored on secure servers with restricted access, further protecting it from unauthorized access.

Privacy Policies of Online Filing Services

Understanding the privacy policies of online tax filing services is essential. Reviewing these policies allows you to understand how your information will be used, stored, and protected. Reputable services will Artikel their data handling practices, including data retention periods, data sharing protocols, and how they comply with relevant privacy regulations like the GDPR or CCPA. For instance, a privacy policy might state that your information will be used solely for tax preparation purposes and not shared with third parties without your explicit consent.

Verifying Platform Security

Verifying the security of an online tax filing platform is a crucial step. Look for indicators of secure practices, such as the presence of an SSL certificate, which can be verified by looking for the padlock icon in your browser’s address bar. Another indicator is the platform’s adherence to industry best practices and compliance with relevant regulations. Reviews from reputable sources can also provide valuable insight into a platform’s security record.

Additionally, look for clear and concise privacy policies that detail how your data is handled and protected. For example, the platform may provide a detailed explanation of its data encryption protocols, outlining the encryption methods used to protect your data.

Support and Assistance

Navigating the complexities of tax filing, even with free online services, can sometimes be challenging. Having readily available support is crucial for ensuring accuracy and a smooth experience. This section details the support options available for free online IRS tax filing services, helping you feel confident and informed throughout the process.

Support Channels Overview

Free online tax filing services often provide multiple avenues for assistance. Understanding these options can save you valuable time and frustration. Knowing how to reach out for help is an important part of the process.

Frequently Asked Questions (FAQs)

A comprehensive FAQ section is a valuable resource. It addresses common issues and provides quick answers to frequently asked questions. These FAQs are usually readily accessible on the service’s website, typically organized by topic or issue type. Using the search function is also beneficial for finding specific answers.

Online Resources and Help Articles

Beyond FAQs, online resources often include detailed help articles, tutorials, and video guides. These resources delve deeper into specific topics, offering step-by-step instructions and explanations. Searching for specific s or phrases can help locate the most relevant articles quickly.

Phone Support

Phone support provides direct interaction with a support representative. This can be beneficial for complex issues or when a visual demonstration is needed. Phone support is usually available during specific hours, and representatives are trained to address a wide range of technical and procedural questions.

Contacting Support Personnel

Contacting support personnel is straightforward. Most services provide contact information, including phone numbers and email addresses, on their website. Following the provided contact methods usually results in a prompt response.

Filing your IRS taxes for free online is a great option, especially if you’re on a budget. While the New Hampshire Democratic primary results are certainly interesting to follow, results new hampshire democratic primary don’t affect your tax obligations. Knowing the options for free online filing can really simplify things and save you time when tax season rolls around.

Support Availability Table

| Support Channel | Availability | Description |

|---|---|---|

| FAQs | 24/7 | Accessible anytime; answers common questions |

| Online Resources/Help Articles | 24/7 | Detailed explanations and tutorials |

| Phone Support | Specific hours (often weekdays) | Direct interaction with support representatives |

Common Errors and Troubleshooting

Navigating the complexities of online tax filing can sometimes lead to frustrating errors. Understanding potential pitfalls and knowing how to troubleshoot them can save you valuable time and stress. This section details common errors encountered during free online IRS tax filing and provides practical solutions.

Common Errors in Free Online Tax Filing

Knowing the potential pitfalls in free online tax filing can help you avoid costly mistakes and delays. By understanding common errors, you can be better prepared to address them effectively.

- Incorrect Information Entry: Carefully double-checking all entered information, such as social security numbers, addresses, and income details, is crucial. Typos or incorrect data can lead to rejection or delays in processing. Re-entering data with meticulous attention to detail is often the solution.

- Missing or Incorrect Supporting Documents: Ensure all necessary documents, like W-2 forms, 1099s, and receipts, are available and accurately uploaded. Review the requirements for each form to avoid rejection. If needed, obtain missing documents promptly. Contacting the relevant issuing agencies can often resolve this issue.

- System Errors During Filing: Technical glitches, internet connectivity issues, or software bugs can sometimes disrupt the filing process. Try restarting the browser, clearing the cache, and checking your internet connection. If the error persists, contact the tax preparation software provider for support.

- Incompatibility Issues with Software/Platform: Different browsers, operating systems, or outdated software can cause compatibility problems. Try using a supported browser, updating the software to the latest version, or checking for known compatibility issues. Some online platforms may provide specific compatibility guidelines.

- Incorrect Tax Form Selection: Choosing the wrong tax form or using the wrong tax bracket can lead to inaccurate calculations. Ensure that the form selected matches your filing status and income. Refer to the IRS website for clarification on form selection and tax brackets. This may involve reviewing and selecting the appropriate tax form based on your specific situation.

- Problems with the IRS Online System: Occasionally, the IRS online system experiences downtime or other technical issues. Checking the IRS website for system status updates is essential. If the error persists, try filing at a different time or contact the IRS directly.

Troubleshooting Steps for Common Errors

Addressing errors promptly is key to a smooth tax filing experience. This section Artikels steps to effectively resolve common issues.

- Verify Information Accuracy: Thoroughly review all entered information for accuracy. Double-checking data prevents errors that could delay processing or result in penalties. Check for typos and verify all numbers, including social security numbers, addresses, and income amounts.

- Download and Verify Documents: Download and review all required documents before uploading them to the online platform. Ensuring the correct documents are included and that they are properly formatted can save potential errors.

- Check Internet Connectivity: Ensure a stable and reliable internet connection is maintained throughout the filing process. Restarting your browser or device and checking for network problems can resolve temporary connectivity issues.

- Update Software and Browsers: Keep your software and browsers updated to the latest versions. This often addresses compatibility issues and security vulnerabilities.

- Review IRS Guidelines: Consult the IRS website for detailed information on tax forms, filing requirements, and applicable tax brackets. Using the correct form and tax bracket ensures accuracy and avoids potential errors.

- Contact Support or the IRS: If the problem persists after following these steps, contact the tax preparation software provider or the IRS for further assistance. Provide detailed information about the error encountered to facilitate resolution.

Tax Form and Information Accuracy

Filing your taxes accurately is paramount to a smooth and stress-free experience. Mistakes, even seemingly minor ones, can lead to delays, audits, and even penalties. Understanding the importance of accuracy and implementing strategies to ensure correct information is crucial for a successful tax filing.Accuracy in tax forms is essential because the IRS uses the information you provide to calculate your tax liability and refund.

Incorrect information can result in an incorrect tax bill or a delayed or denied refund.

Importance of Accurate Data Entry

Accurate data entry is critical to avoid errors. This is a critical component of a successful tax filing, as even a seemingly small error can have significant repercussions. Using accurate information minimizes the risk of errors.

Consequences of Inaccurate Information

Submitting inaccurate information can have serious consequences. The IRS may issue penalties, interest charges, or even initiate an audit. A simple mistake in a form can result in a substantial financial burden. For example, a misreported deduction could lead to a tax bill that is higher than it should be. Similarly, incorrectly reported income might lead to penalties and interest.

Steps to Ensure Accuracy During Online Filing

Ensuring accuracy during online filing requires careful attention to detail and a systematic approach. Reviewing all information before submission is essential. Double-checking is key to preventing costly mistakes.

- Thorough Review: Carefully review every field on the tax form, ensuring all data is accurate and complete. Verify the accuracy of income, deductions, credits, and other relevant information.

- Data Verification: Compare the information entered with supporting documents, such as W-2 forms, 1099 forms, and receipts for deductions. Match the figures against your records to confirm their accuracy.

- Cross-checking: Cross-check the information entered in different sections of the form to ensure consistency. If a discrepancy exists, thoroughly investigate the source of the error to correct it before submitting.

- Use of Tools: Utilize the IRS’s online tools, if available, to cross-reference data or identify potential issues.

Verifying Data Entry and Cross-checking Information

Verifying data entry and cross-checking information is essential to minimize errors. This process involves meticulous attention to detail.

- Source Documentation: Refer to original documents, such as pay stubs, receipts, and investment statements, to verify the accuracy of the information entered on the tax form. This is critical to ensure you don’t enter wrong figures.

- Reconciliation: Reconcile your entered information with your bank statements, investment records, and other financial documents. Ensure consistency in the reported data.

- Comparison with Previous Years: Compare the current year’s information with your previous tax returns to identify any inconsistencies or discrepancies. This can help prevent errors that arise from forgetting or overlooking some details.

- Seeking Professional Assistance: If you’re uncertain about any aspect of your tax return, consult a tax professional for guidance. Seeking professional help can help you avoid mistakes and potential penalties.

Illustrative Scenarios and Examples

Navigating the world of tax filing can feel daunting, especially with the various scenarios and forms involved. This section provides clear examples to demystify the process, highlighting the steps for different filing statuses and the specific tax forms applicable to each. Understanding these examples will empower you to confidently complete your return.

Single Filer Scenario

This scenario covers individuals who are unmarried and not claimed as a dependent on another person’s return. The required forms depend on the sources of income and deductions.

- Income Sources: Wages from employment, interest income from savings accounts, and possibly capital gains from investments are common sources. Accurate reporting of these incomes is crucial for calculating the correct tax liability.

- Deductions: Standard deduction or itemized deductions, such as medical expenses, student loan interest, and charitable contributions, can significantly reduce your tax burden. Be sure to meticulously document these expenses for accurate deduction claims.

- Tax Forms: Form 1040, Schedule 1 (for additional income and adjustments to income), Schedule A (for itemized deductions), and possibly Form 8880 (for education credits) are common forms.

- Example: Sarah, a single individual, earned $50,000 in wages, $500 in interest income, and had $1,500 in itemized deductions (charitable contributions). She would use Form 1040, Schedule 1 to report her income, Schedule A to list her itemized deductions, and use the appropriate tax tables for her filing status to determine her tax liability.

Married Filing Jointly Scenario

For married couples filing jointly, the combined income and deductions are reported on one return.

- Income Sources: Wages from both spouses, rental income, dividends, and other sources of income are all reported together.

- Deductions: Standard deduction or itemized deductions, such as mortgage interest, property taxes, and medical expenses, can reduce the couple’s tax liability.

- Tax Forms: Form 1040, Schedule 1 (for additional income and adjustments to income), Schedule A (for itemized deductions), and possibly Schedule SE (for self-employment tax) are used.

- Example: David and Emily, married and filing jointly, reported $80,000 in combined wages, $1,000 in interest income, and had $3,000 in itemized deductions. They would use Form 1040, Schedule 1 to report their income, Schedule A to list their itemized deductions, and the tax tables for their filing status to determine their tax liability.

Head of Household Scenario

This scenario applies to individuals who are not married but have a qualifying dependent living with them.

- Income Sources: Similar to single filers, income sources can include wages, interest, and dividends.

- Deductions: Standard deduction or itemized deductions can be claimed, as in other scenarios.

- Tax Forms: Form 1040, Schedule 1, Schedule A, and possibly other schedules based on specific income sources or deductions.

- Example: Mark, the head of household, earned $65,000 in wages, $200 in interest income, and had $2,000 in itemized deductions. He would use Form 1040, Schedule 1 to report his income, Schedule A to list his itemized deductions, and the tax tables for his filing status to determine his tax liability.

Table of Scenarios and Required Tax Forms

| Filing Status | Primary Tax Form | Additional Forms (Examples) |

|---|---|---|

| Single | Form 1040 | Schedule 1, Schedule A, Form 8880 |

| Married Filing Jointly | Form 1040 | Schedule 1, Schedule A, Schedule SE |

| Head of Household | Form 1040 | Schedule 1, Schedule A, potentially others |

Tools and Resources for Filing

Navigating the IRS tax system can feel overwhelming, but thankfully, numerous tools and resources are available to simplify the process, especially for those utilizing free online filing services. These resources range from pre-filled forms to interactive calculators, assisting users in accurately completing their returns.This section will delve into the helpful tools and resources offered by the IRS and third-party providers that can aid in your tax preparation.

These resources are designed to make the entire process more efficient and less daunting, helping you file your return correctly and on time.

Available Tax Preparation Tools

The IRS website provides a wealth of tools for tax preparation, including interactive tax calculators and pre-filled forms. These tools can significantly reduce the time and effort needed to complete your tax return. They are designed to guide you through the process, ensuring accuracy and reducing the chance of errors.

- Interactive Tax Calculators: These calculators help you determine various tax credits and deductions you may be eligible for. They often consider factors like income, dependents, and specific deductions, providing estimated tax liability. For instance, a calculator might estimate the Earned Income Tax Credit based on your income and family size. Another example might be a calculator to determine the child tax credit, taking into account the child’s age and other pertinent information.

- Pre-filled Forms: The IRS offers pre-filled tax forms based on your prior year’s tax return. This significantly streamlines the process, minimizing manual data entry. This feature is extremely helpful for users who have not experienced any major life changes, like a significant change in income or number of dependents. These pre-filled forms are designed to save you time and reduce the risk of errors.

- Tax Topic Articles: Comprehensive articles cover a vast array of tax topics, from deductions to credits, providing clear and concise explanations. This resource is invaluable for clarifying specific tax situations or for understanding the rules related to particular deductions. These articles often contain examples to illustrate the points made.

Accessing Tools and Resources

Accessing these tools is straightforward and usually involves navigating to the appropriate section of the IRS website. Instructions are generally clear and easy to follow, making it simple to locate the resources you need.

- IRS Website Navigation: The IRS website is organized logically, with dedicated sections for various tax tools and forms. Using the search bar or navigating through menus allows for easy access to specific resources.

- Free Online Filing Services: Many free online filing services integrate with IRS tools, providing seamless access to these resources. These services typically offer a user-friendly interface, making it easy to find and use these tools during the tax preparation process.

Further Information and Links

For more in-depth information and further resources, exploring the IRS website and related online guides is highly recommended. These additional resources can provide detailed explanations and support.

The IRS website is a comprehensive source of information, providing detailed explanations of various tax topics.

- IRS Website: The IRS website ([insert IRS website address here]) is a primary resource for detailed information on tax forms, publications, and interactive tools. This is a crucial reference for anyone preparing their tax return.

- Online Tax Preparation Software: Many third-party tax preparation software companies provide access to their own resources and support materials, aiding in understanding tax laws and completing forms.

Examples of Helpful Tools

Many tax preparation tools are readily available, assisting in the process of completing tax returns. These tools provide helpful guidance and ensure accurate calculations.

- Tax Counseling for the Elderly (TCE): This service offers free tax assistance to seniors, leveraging IRS resources and tools to help them file their returns.

- Volunteer Income Tax Assistance (VITA): VITA provides free tax preparation services to low-to-moderate-income taxpayers, using resources from the IRS and other relevant entities to assist in filing.

Conclusive Thoughts

In conclusion, free online IRS tax filing offers a valuable alternative to traditional methods. This guide has explored the key aspects of this process, highlighting the benefits, potential challenges, and essential considerations. Remember to carefully review the eligibility criteria, compare available services, and prioritize security throughout the process. By understanding the intricacies of free online filing, you can confidently and efficiently complete your tax obligations.

Quick FAQs

How do I know if I qualify for free online IRS tax filing?

Eligibility criteria vary depending on the specific service. Often, income limitations and filing status play a role. Check the specific requirements of the service you’re considering.

What if I encounter an error during the filing process?

Many services provide comprehensive error messages and troubleshooting steps. Refer to the service’s help resources or contact support for assistance.

Are my personal and financial details secure when using free online filing services?

Reputable services employ robust security measures to protect sensitive information. Look for platforms with strong encryption and clear privacy policies.

What forms are typically used for free online tax filing?

Most free online filing services support common tax forms. However, some may require additional documentation. Consult the service’s guidelines for specific forms and requirements.