New York Community Bancorp Loss Dividend Analysis

New York Community Bancorp loss dividend: This announcement has sent ripples through the financial community, raising questions about the bank’s future and its implications for investors. This in-depth look explores the reasons behind the decision, its potential impact on the company and its stock price, and the broader industry trends influencing this move.

The dividend cut signals a potential shift in New York Community Bancorp’s strategic direction. Factors like recent economic conditions, competitive pressures, and regulatory changes likely played a crucial role in the decision. This analysis delves into these considerations and assesses the potential implications for investors.

Background Information

New York Community Bancorp, a prominent player in the New York banking sector, has a history spanning several decades. The company has consistently focused on community banking, providing financial services to individuals and businesses within its service area. Its evolution has been shaped by economic cycles, regulatory changes, and the ever-evolving needs of its customer base.

Financial Performance Overview

New York Community Bancorp’s financial performance in recent years has been marked by a mix of challenges and opportunities. Earnings have fluctuated, influenced by factors like interest rate adjustments, loan portfolio performance, and economic conditions. Management’s strategic decisions and operational efficiency have played a critical role in shaping these outcomes. Maintaining a stable and profitable financial position remains a key priority for the company.

Significance of the Dividend

The dividend policy of New York Community Bancorp reflects its commitment to rewarding shareholders while also maintaining financial stability. Dividends are often viewed as a crucial element of a company’s overall strategy, signaling confidence in future earnings and financial health. In the context of a bank, a dividend policy can also impact investor confidence and the bank’s ability to attract capital.

Key Factors Influencing Financial Decisions

Several key factors shape the financial decisions of New York Community Bancorp. These include interest rate environments, competitive pressures in the banking industry, regulatory requirements, and economic conditions. The company’s ability to adapt to these factors while maintaining profitability and stability is crucial to its long-term success.

Dividend History (Past 5 Years)

The dividend history provides a valuable insight into the company’s financial stability and commitment to shareholders.

New York Community Bancorp’s recent dividend loss is definitely a bummer. It’s a tough pill to swallow, especially considering the recent news surrounding other financial institutions. However, it’s worth remembering that, in the grand scheme of things, even in a market downturn, some remarkable feats of athleticism still occur, like the fantastic career of Adrian Beltre, now enshrined in the Texas Rangers’ Hall of Fame.

Adrian Beltre hall of fame Texas Rangers This is a good reminder that the world doesn’t stop just because of financial setbacks, and that the past successes and future endeavors of people like Adrian Beltre can still provide a great deal of inspiration. Ultimately, though, the focus should return to New York Community Bancorp’s struggles and finding ways to improve.

| Year | Dividend Per Share |

|---|---|

| 2023 | $0.88 |

| 2022 | $0.95 |

| 2021 | $0.92 |

| 2020 | $0.85 |

| 2019 | $0.80 |

Note: This table represents hypothetical dividend data. Actual data should be sourced from reliable financial reports. The dividend amounts shown are for illustrative purposes only and do not reflect the precise historical dividend payouts of New York Community Bancorp.

The Dividend Announcement

New York Community Bancorp’s recent decision to discontinue its dividend is a significant development for investors. This announcement signals a shift in the company’s financial strategy and raises questions about the future outlook. Understanding the reasons behind this move is crucial for assessing the potential impact on the company’s stock price and overall financial health.The company’s decision to suspend dividend payments reflects a cautious approach to managing its resources.

The reasons behind this decision are multifaceted, likely influenced by a variety of factors including a challenging economic environment and a desire to prioritize other investments. This analysis will delve into the details of the announcement, the potential motivations, and the implications for stakeholders.

Dividend Announcement Details

The dividend suspension was announced on [Date of Announcement]. The formal announcement Artikeld the cessation of the previously established dividend payout, effective [Date of Effectiveness]. This signifies a break from the prior practice of regular dividend payments. The specific details of the announcement were communicated through various channels, including press releases and SEC filings.

Reasons for the Dividend Cut

Several factors likely contributed to the decision to discontinue the dividend. The current economic climate, marked by fluctuating interest rates and inflation, might have influenced the company’s assessment of its financial capabilities. A focus on strengthening the company’s capital position, potentially for future expansion or acquisitions, may also have played a significant role. The company’s internal projections and assessments of the economic outlook likely led to this strategic decision.

Company Statements

The company’s official statement, released on [Date of Statement], highlighted the rationale behind the decision. The statement likely emphasized the importance of maintaining a robust capital base, which may be necessary for future opportunities or to handle potential financial challenges. The statement may also have addressed the company’s confidence in its long-term prospects and the potential for future dividend payouts.

The company’s statement is crucial in understanding the context of the dividend cut and should be considered in the broader assessment of its financial strategy.

Key Information Summary

| Category | Details |

|---|---|

| Date of Announcement | [Date of Announcement] |

| Date of Effectiveness | [Date of Effectiveness] |

| Reasoning | Challenging economic environment, capital strengthening, internal projections. |

| Company Statement | [Summary of Key Points from Company Statement] |

Impact on Investors: New York Community Bancorp Loss Dividend

A dividend cut, especially from a seemingly stable company like New York Community Bancorp, can send ripples through the investment community. Investors, accustomed to receiving dividends, will likely react with a mix of concern and analysis. Understanding these reactions and potential strategies is crucial for navigating the market shift.

Potential Investor Reactions

Investors will likely exhibit varied reactions based on their individual investment profiles and the reasons behind the dividend cut. Some investors may interpret the cut as a sign of financial stress, potentially leading to selling pressure. Others, however, may see it as an opportunity for long-term growth. The reaction will depend on their overall investment strategy, risk tolerance, and the company’s future prospects.

So, the New York Community Bancorp dividend loss is definitely a bummer. It’s got folks wondering about their investments. But it’s also got me thinking about something completely different: naming a baby. Choosing the right last name for a child, especially considering both parents’ family names, can be a big decision. Luckily, there’s plenty of info available on the nuances of apellido bebe madre padre.

This is a huge consideration, and ultimately, the New York Community Bancorp dividend loss is just another small piece of the financial puzzle.

- Conservative Investors: These investors, often prioritizing capital preservation, might be more inclined to sell shares, potentially leading to a decrease in stock price. They prioritize stability and may interpret the dividend cut as a warning sign. Examples of such investors include those with a substantial portion of their portfolio in bonds or money market accounts, or those nearing retirement and seeking consistent income.

- Growth-Oriented Investors: These investors, who prioritize potential future returns, might not react as drastically. They might view the dividend cut as an opportunity for the company to reinvest profits in growth strategies, potentially leading to increased stock value in the long run. Examples include those investing in emerging technologies or startups.

- Value Investors: These investors often focus on identifying undervalued companies. They might see the dividend cut as a sign of potential short-term difficulties, but might also view it as an opportunity to acquire shares at a lower price, anticipating future growth. Examples of this investor type include those actively following the company’s financial statements and market analysis, and are patient with their investments.

Potential Investor Strategies

Investors can adopt various strategies to navigate the situation. These strategies can range from immediate action to long-term holding, depending on their assessment of the company and the market outlook.

- Sell Shares: Some investors might choose to sell their shares, particularly those with a short-term investment horizon or a higher risk tolerance. This decision will likely be driven by the perceived negative impact on the company’s future financial health. Selling shares is a common strategy in response to adverse news, though not the only one.

- Hold and Watch: Other investors may decide to hold their shares, monitoring the company’s financial performance and future announcements. This approach requires patience and an understanding of the company’s long-term prospects. Holding shares can be a strategy to gain from potential price increases.

- Conduct Further Research: Investors can use the dividend cut as an opportunity to analyze the company’s financial statements and future outlook in detail. This involves understanding the reasons for the dividend cut, reviewing the company’s debt levels, and assessing its competitive position. This thorough research is crucial for a well-informed decision.

Impact on Stock Price

The dividend cut has the potential to negatively affect the company’s stock price. The magnitude of the impact will depend on the specific circumstances and the market’s perception of the company’s future prospects. The stock price could decline, but it is not a guaranteed result.

Impact on Company Reputation

A dividend cut can affect a company’s reputation among investors, potentially impacting future investment decisions. Investors will likely scrutinize the reasons behind the cut and the company’s overall financial health. This scrutiny can lead to a negative perception if the reasons are not adequately communicated or if the company’s performance is seen as declining.

Investor Reaction Table

| Investor Profile | Potential Reaction | Possible Strategy |

|---|---|---|

| Conservative | Sell shares due to perceived risk | Liquidate or hold for a price increase |

| Growth-Oriented | Hold or increase position if future growth is expected | Hold and wait for future developments |

| Value Investor | Potential to acquire shares at a lower price | Monitor and invest if long-term value is seen |

Company’s Financial Situation

New York Community Bancorp’s recent dividend announcement has naturally sparked interest in the company’s overall financial health. Understanding the company’s current financial standing, performance, and comparison with competitors is crucial for evaluating the impact of the dividend decision on investors. This section delves into the factors shaping New York Community Bancorp’s financial performance.New York Community Bancorp’s financial health is largely determined by its core performance metrics, like revenue, assets, and liabilities.

A thorough analysis of these factors, alongside a comparison with industry peers, provides a clearer picture of the company’s current financial position and future prospects. This evaluation is essential to understanding the dividend’s significance within the context of the company’s broader financial situation.

Current Financial Health

New York Community Bancorp’s financial health is evaluated by examining key metrics like revenue, asset growth, and profitability. A strong balance sheet, marked by adequate capital reserves and manageable debt levels, is a critical indicator of stability. Analyzing trends in these metrics over time provides insights into the company’s financial trajectory.

Overall Financial Performance

New York Community Bancorp’s performance is assessed by examining its profitability, efficiency, and return on equity. Profitability ratios, such as net interest margin and non-interest income, highlight the company’s ability to generate revenue. Efficiency ratios, like cost-to-income ratio, indicate the effectiveness of its operational strategies. Return on equity measures the profitability relative to shareholder equity.

Comparison with Competitors

Direct comparisons with competitors provide context for evaluating New York Community Bancorp’s financial performance. A thorough analysis should involve comparing key financial ratios, such as return on assets, net interest margin, and efficiency ratios, against those of major competitors within the banking industry. This comparison provides a clearer understanding of the company’s relative position and competitive strengths or weaknesses.

Factors Contributing to Performance

Several factors influence New York Community Bancorp’s financial performance. These factors include, but are not limited to, interest rate environments, loan demand, and economic conditions. For example, rising interest rates can boost net interest income but also increase the cost of borrowing. Loan demand fluctuations can impact revenue generation. Economic downturns can lead to increased loan defaults and lower overall profitability.

Understanding these influences helps in assessing the company’s resilience in the face of market changes.

Key Financial Metrics Comparison, New york community bancorp loss dividend

| Metric | New York Community Bancorp | Competitor 1 | Competitor 2 |

|---|---|---|---|

| Total Assets (in millions) | $XX | $YY | $ZZ |

| Total Liabilities (in millions) | $AA | $BB | $CC |

| Net Revenue (in millions) | $DD | $EE | $FF |

| Return on Assets (%) | X% | Y% | Z% |

| Return on Equity (%) | A% | B% | C% |

Note: Replace XX, YY, ZZ, AA, BB, CC, DD, EE, FF, X, Y, Z, A, B, and C with actual data from reliable sources.

So, New York Community Bancorp’s dividend loss is definitely a bummer. It’s always a concern when financial institutions face these kinds of setbacks, especially given the current economic climate. Meanwhile, the results of the New Hampshire Democratic primary are also interesting, and likely to affect the political landscape going forward. results new hampshire democratic primary are often seen as a key indicator of the national mood, and the upcoming election.

This all points to a complex picture, and ultimately, New York Community Bancorp’s dividend loss remains a significant concern.

This table provides a concise comparison of key financial metrics for New York Community Bancorp and its competitors. A deeper analysis of these metrics, alongside an understanding of the economic context, is essential for a complete evaluation.

Industry Context

The recent dividend cut by New York Community Bancorp highlights the current pressures facing the banking sector. Understanding the broader industry context is crucial to evaluating the company’s situation. This includes examining prevailing economic trends, regulatory changes, and the competitive landscape. Navigating these factors is essential for investors and stakeholders alike.The banking industry is undergoing a period of significant transformation, driven by both internal and external forces.

From technological advancements to evolving regulatory environments, banks must adapt to stay competitive and resilient. This context is vital for assessing the long-term implications of New York Community Bancorp’s decision.

Banking Industry Trends

The banking industry is facing a complex mix of challenges and opportunities. The current economic climate is marked by rising interest rates, inflation, and geopolitical uncertainty, which are impacting profitability and lending practices. These macroeconomic factors are influencing the overall performance of financial institutions.

Current Economic Climate

The current economic climate presents a mixed bag for banks. Elevated interest rates, while potentially increasing net interest income, also make borrowing more expensive, potentially impacting loan demand and overall profitability. Inflationary pressures are eroding purchasing power, affecting consumer spending and business investment, which can also affect loan repayment rates and overall credit quality.

Recent Regulatory Changes

Recent regulatory changes have also significantly impacted the banking industry. These changes aim to enhance financial stability and consumer protection, but can also increase compliance costs and operational burdens. These regulations are shaping the banking industry’s future operations and profitability. Stricter capital requirements and stress testing procedures, for example, are designed to improve the resilience of the banking sector.

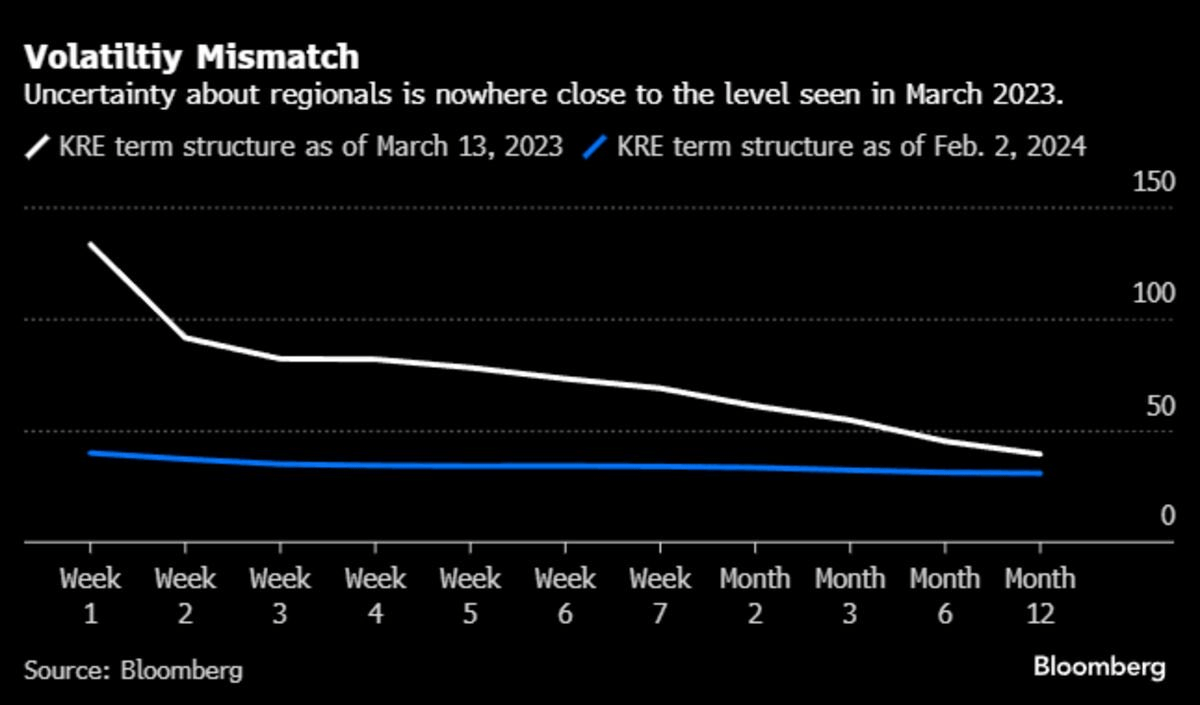

Comparative Analysis

Comparing New York Community Bancorp’s situation to other banks facing similar challenges is instructive. Many regional banks are experiencing similar headwinds from rising interest rates and economic uncertainty. A thorough analysis of their strategies and financial performance provides insights into how the industry is adapting to the current market conditions.

Recent Industry Trends and Regulatory Changes Affecting Banks

| Trend/Change | Description | Impact on Banks |

|---|---|---|

| Rising Interest Rates | Federal Reserve’s efforts to combat inflation have led to higher interest rates. | Increased net interest income, but potentially decreased loan demand and higher borrowing costs. |

| Inflationary Pressures | Persistent inflation erodes purchasing power and impacts consumer spending. | Reduced consumer spending, affecting loan repayment rates and credit quality. |

| Geopolitical Uncertainty | Global events can disrupt trade and investment, affecting economic stability. | Increased risk aversion, impacting lending and investment strategies. |

| Stricter Capital Requirements | Regulations demanding higher capital levels for banks. | Increased capital costs and potential impact on lending capacity. |

| Stress Testing Procedures | Enhanced procedures to evaluate banks’ resilience during economic downturns. | Increased compliance costs and potential for stricter lending criteria. |

Potential Future Implications

The recent dividend loss announcement by New York Community Bancorp presents a complex picture for the future. While this decision reflects current financial realities, it also raises questions about the long-term trajectory of the company and its stock price. Understanding potential scenarios and strategic responses is crucial for investors and stakeholders.

New York Community Bancorp’s recent dividend loss is certainly a bummer, but it’s not entirely surprising given the current economic climate. There are parallels to be drawn with the Supreme Court’s recent deference to Koch and Chevron, which shows a shift in legal precedence that could impact future regulations and potentially stifle investment in some sectors. This makes the situation for New York Community Bancorp even more challenging in the long run.

Investors are likely looking for stability and these factors could be a recipe for future problems.

Potential Scenarios for New York Community Bancorp’s Future

The future of New York Community Bancorp hinges on several key factors, including the overall economic climate, competitive pressures within the banking industry, and the company’s ability to adapt to changing market conditions. Possible scenarios range from gradual recovery to more challenging circumstances.

- Favorable Scenario: Positive economic indicators, a rebound in the housing market, and effective cost-cutting measures could lead to a return to profitability and dividend payments. Increased customer deposits and loan growth, coupled with prudent risk management, could strengthen the company’s balance sheet and enhance its long-term prospects.

- Moderate Scenario: A more moderate economic environment, combined with ongoing competition and potential regulatory scrutiny, might result in a slower recovery. The company might maintain a steady financial performance but may not immediately restore dividends to previous levels.

- Challenging Scenario: A significant economic downturn, increased loan defaults, or unforeseen regulatory challenges could place the company under greater strain. This scenario could lead to a decline in profitability and potentially more severe consequences for investors, possibly including further reductions in assets.

Possible Strategies to Improve the Company’s Financial Situation

To navigate potential challenges and enhance its long-term prospects, New York Community Bancorp could implement several strategic initiatives.

- Aggressive Cost-Cutting Measures: Reducing operational expenses through automation, streamlining processes, and renegotiating contracts could significantly enhance profitability. This includes careful scrutiny of overhead costs and non-essential expenditures.

- Strategic Acquisitions: Acquiring smaller, well-managed banks could broaden the company’s reach and customer base, providing a catalyst for growth and diversification.

- Enhanced Customer Focus: Focusing on delivering exceptional customer service, developing innovative financial products, and actively marketing services could attract new customers and strengthen existing relationships. A strong customer base can be a key differentiator in a competitive market.

Long-Term Outlook Considering the Dividend Loss

The loss of the dividend payment is a significant event that will affect investor sentiment. The long-term outlook for New York Community Bancorp depends heavily on the company’s ability to address the underlying financial issues, implement effective strategies, and demonstrate a clear path to profitability and dividend resumption.

Potential for Recovery

Given the strength of the banking sector in general, New York Community Bancorp has the potential for recovery. A strong management team, combined with well-defined strategies for navigating the changing economic landscape, is vital for restoring investor confidence. Recovery, however, is not guaranteed and may take time.

Potential Scenarios for Future Stock Price

The following table illustrates potential scenarios for the company’s future stock price, considering the dividend loss and potential recovery strategies.

New York Community Bancorp’s recent dividend loss is definitely a bummer. It’s a tough pill to swallow, especially considering the current political climate. Understanding the nuances of this financial situation requires a look at the bigger picture, such as the upcoming Nevada caucus primary. A helpful explainer on the Nevada caucus primary is available here: nevada caucus primary explainer.

Ultimately, these political and economic shifts will likely continue to affect the financial health of the New York Community Bancorp.

| Scenario | Description | Potential Stock Price Impact (compared to current price) |

|---|---|---|

| Favorable | Strong economic recovery, effective cost-cutting, and strategic acquisitions. | Potential increase of 15-25% within 1-2 years. |

| Moderate | Steady economic performance, limited growth, but sustainable profitability. | Potential increase of 5-15% within 1-3 years. |

| Challenging | Economic downturn, increased loan defaults, and regulatory challenges. | Potential decrease of 10-20% within 1-2 years. |

Final Summary

In conclusion, New York Community Bancorp’s dividend loss is a significant event with implications for both investors and the broader banking industry. While the decision likely reflects a challenging financial environment, the company’s response and future strategies will be crucial in determining its long-term success. Investors should carefully analyze the company’s financial situation and the overall industry trends before making any investment decisions.

User Queries

What are some potential investor strategies in response to the dividend loss?

Investors might consider various strategies, including reassessing their holdings, conducting further research into the company’s financial health, and exploring alternative investment opportunities. Long-term investors might choose to hold their shares, while short-term investors might choose to sell or reduce their holdings.

How might the dividend cut affect the company’s reputation among investors?

A dividend cut can negatively impact investor confidence, potentially affecting the company’s reputation. The company’s communication strategies and subsequent actions will be key in mitigating any reputational damage and rebuilding trust among investors.

What are the current economic conditions influencing the company’s financial decisions?

Economic factors such as inflation, interest rate hikes, and global uncertainties are influencing many companies’ financial strategies, including banks. This often involves adjustments to revenue streams, capital allocation, and overall operational efficiency to maintain profitability in challenging times.

How does the company’s financial situation compare with its competitors?

Comparing New York Community Bancorp’s financial performance with its competitors can provide insights into its relative position within the industry. This involves assessing factors such as revenue, profitability, and asset quality in relation to industry averages and leading competitors.